Upcoming Fed meeting: Being contrarian has good reason

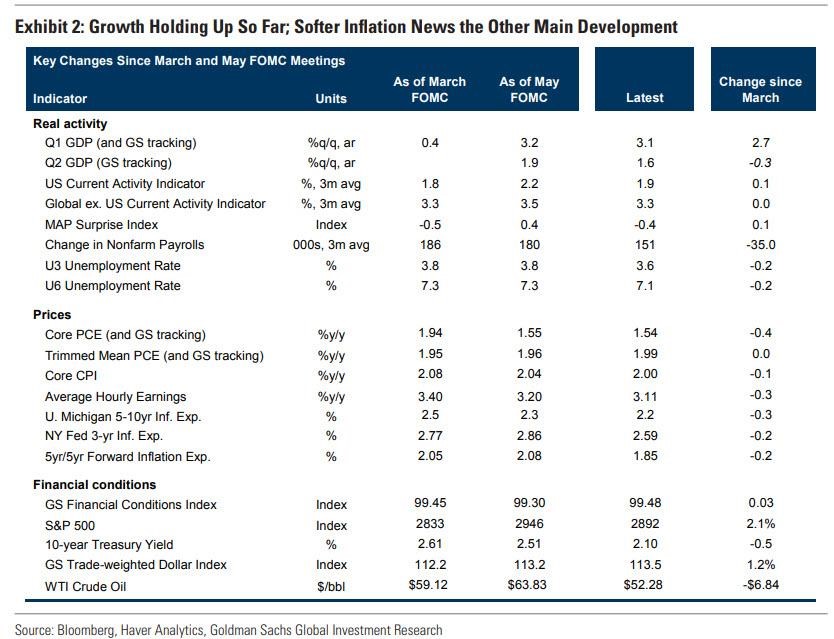

Since the March Fed meeting, there have been no significant changes in the US economy to justify the current expectations of three rate cuts until February 2020 (the most likely outcome). The rebel in the forecasts, disturbing the dovish consensus, became Goldman Sachs, pointing to price stability in the stock market, unemployment lingering at a 50-year low, unchanged forecasts for growth in aggregate demand and US GDP, as well as elimination of the key factor of concerns - the tariff front with Mexico. After the retail sales release (control group + 0.5%, revision of the April figure), Atlanta Fed raised its forecast for economic growth to 2.1%, Goldman Sachs itself - to 1.6% in the second quarter. Acknowledging the potential Fed’s bias in favour of soft stance, Goldman notes that it will not sufficiently satisfy the markets that have aggressively priced in rate cuts recently.

Joining the Goldman camp now looks like an especially attractive opportunity, given the strong market bias in the expectations of a global U-turn in the Fed policy, which is supported by the assumption of synchronous actions of global Central Banks following yesterday's ECB surrender. Draghi pointed out on Tuesday the potential willingness to continue moving rates into negative territory, putting even more pressure on commercial European banks. Accordingly, it is possible to speak of an unequivocal reaction of the markets in the form of a pullback, mainly in the fixed income market, if the Fed disappoints. For the dollar, this will mean strengthening positions against the euro, the Australian dollar and possibly the British pound. In the context of a bonds vs. stocks trade-off, this will mean the convergence of the S&P 500 valuation and the yield on 10-year Treasury bonds, between which there is now a strong gap:

The Fed's policy in response to the development of the trade war between the US and China, at the moment, should rather be driven than led. Strong pressure on the US economy is priced in as a result of the expectations of a protracted standoff between US and China, at the same time the latest news (yesterday's telephone conversations between Trump and Xi, news about the “extended meeting”) increase the chances of a reverse outcome. In such a situation, the signals on the reduction of rates will be premature, since then the Fed have to revert monetary easing hints and this is fraught with costs, in particular market volatility (and a blow to the reputation). Preserving the room for maneuver should be considered now as the Fed's preference for predictable policy. Then the conceptual basis of the Fed’s guidance will have to be based on the principle “a reduction in the rate may be warranted if the US and China cannot get out of the trade impasse”.

Much attention will be focused on the wording in the regulator's communiqué, namely, preserving / throwing emphasis on “patience”, which has been a kind of Fed mantra since January. If the wording is excluded from the statement, it will move the development of the expectation of the July rate cut.

Touching QT now would also be unwise, although Citi believes that such a turnaround would be an inexpensive option to hint about the completion of a bias in tightening policy. However, it should be remembered that rates are the active policy tool, and in the third quarter, the reduction in the balance of assets will come to a natural end.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.