Upside Surprise in NFP will Likely Trigger Rebound in Oversold USD

Another batch of US macroeconomic data pointed to an easing in inflation pressures while the consumer spending index (Core PCE) rose by 0.2% in October against the forecast of 0.3%. US equities rose after the report, dollar dipped while Treasury bond yields retreated even lower, to the lowest level since early October. After the speech of Fed chairman Powell on Wednesday, markets started to price in a dovish pivot in the Fed policy, which is likely to be marked by a modest, by recent standards, rate hike of 50 basis points in December. In this regard, a strong Payrolls report can cause only a moderate correction of these expectations while weaker-than-expected prints of Payrolls and wages will only strengthen the chances of a dovish outcome of the December meeting.

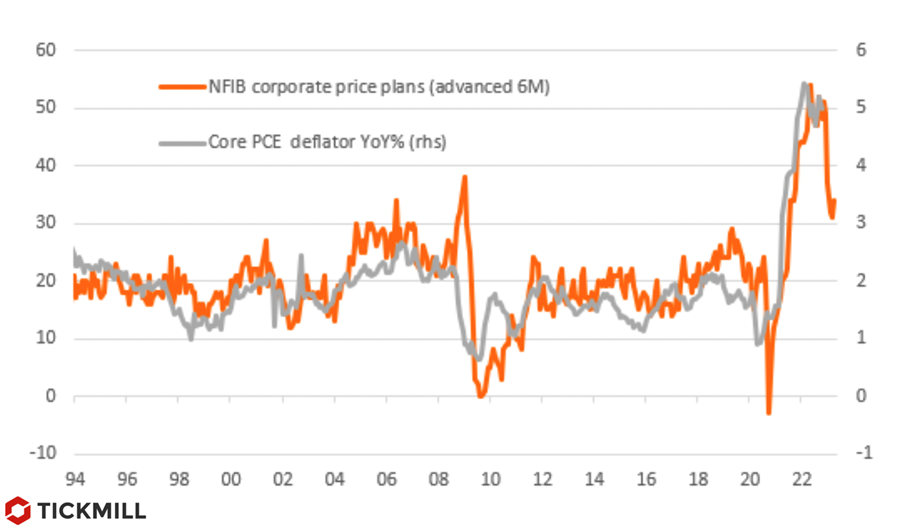

Almost all major indicators of inflation pressure in the US economy - CPI, PPI, Core PCE, housing prices started to trend lower in October. There are more signs of persistence in wage growth, especially in the services sector, and today’s report will help to clarify if this persistence has finally started to ease. One of the important leading indicators of inflation - the plans of firms to increase prices signaled in October that the downward trend in inflation is likely to continue. The NFIB report showed that the share of firms planning to raise prices in the next three months has dropped sharply from 50+ to 32%. Changes in the pricing plans of firms often precede, with some lag, a similar change in consumer inflation rate:

The growth rate of economic activity in the US beat expectations and didn’t show signs of easing along with inflation, as it usually happens during the onset of a downturn. Consumer spending rose 0.5% in real terms in October, the strongest monthly gain since January. Black Friday and Cyber Monday sales volumes were also strong, meaning that quarterly consumer spending growth could be 4% year-on-year in Q3. In the absence of a strong positive surprise in the NFP today, the market is likely to take a stronger view that there will be a 50bp rate hike in December. Another 50 bp will follow in February and the Fed will most likely stop there. With US CEO confidence at its lowest level ever, and with the US real estate market starting to cool, there is no reason to expect further policy tightening.

Markets are approaching the NFP report today with dollar oversold and there is little room for the dollar to fall on the soft report. On the contrary, a strong report, in particular Payrolls beat, may correct expectations for the December FOMC meeting and may be a catalyst for a moderate greenback upside correction. The dollar index is trading just below the 200-day SMA and the 105 round support level, having corrected by 50% if we take the beginning of the year as the starting point. This is a good level to enter long positions, only a catalyst is needed, so the reaction to today's report is likely to be asymmetric. If wages break above the 0.3% MoM consensus and job growth exceeds 200K, this may trigger some powerful bullish momentum in USD with DXY rising from 104.50 to 105.50-106 level:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.