US Economy Shows Resilience as Inflation Pressures Mount

The United States economy continues to impress skeptics, as robust consumer spending and tight jobs market remain two key driving forces behind persistently high inflation. With this trend, it is increasingly likely that the Federal Reserve hawks will gain influence. If the ongoing debt ceiling issue is resolved favorably and the upcoming job numbers on Friday indicate strength, it becomes more probable that there will be an interest rate hike in June.

The April report on personal income and spending in the United States surpassed expectations in various aspects. Incomes rose by the anticipated 0.4% month-on-month, with wages and salaries experiencing a 0.5% increase. Meanwhile, spending rose by 0.8% month-on-month, surpassing the consensus of 0.5% and with an upward revision for March. As a result, real consumer spending stood at 0.5% month-on-month, exceeding the anticipated 0.3%. These developments will inevitably lead to an upward adjustment of second-quarter GDP projections, as consumer spending accounts for two-thirds of economic activity as measured by GDP.

Now turning to the matter of inflation, the core Personal Consumption Expenditures (PCE) deflator increased by 0.4% or 4.7% instead of the expected 0.3% or 4.6%. This upward movement will undoubtedly strengthen the arguments of Federal Reserve hawks like James Bullard and Neel Kashkari, who advocate for tighter policies to ensure a timely return to the 2% inflation target. Although there is a risk of a significant slowdown in inflation during the second half of the year, it gets harder to maintain the belief that the Federal Reserve will demonstrate the patience required to refrain from raising interest rates, particularly if spending remains robust. Therefore, if the debt ceiling issue is resolved positively and next Friday's job numbers reach approximately 200K, the likelihood of a 25 basis point rate hike in June would be quite high.

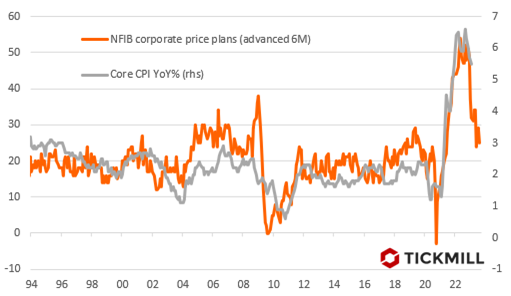

Nevertheless, a turning point is on the horizon that will eventually lead to a substantial shift in Federal Reserve policy. The reason is declining firms price power as has been indicated in the NFIB corporate price plans data. The downward momentum is evident

The challenge lies in the lack of confidence that the Federal Reserve will wait for this outcome. It is still possible that there will be an excessive tightening of monetary policy combined with significantly stricter lending standards that will restrict credit flow, ultimately pushing the economy into a potentially painful recession. Consequently, this scenario will fuel the narrative of a future interest rate cut.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.