US GDP Falls Short of Expectations and Inflation Rises: A Closer Look at the Numbers

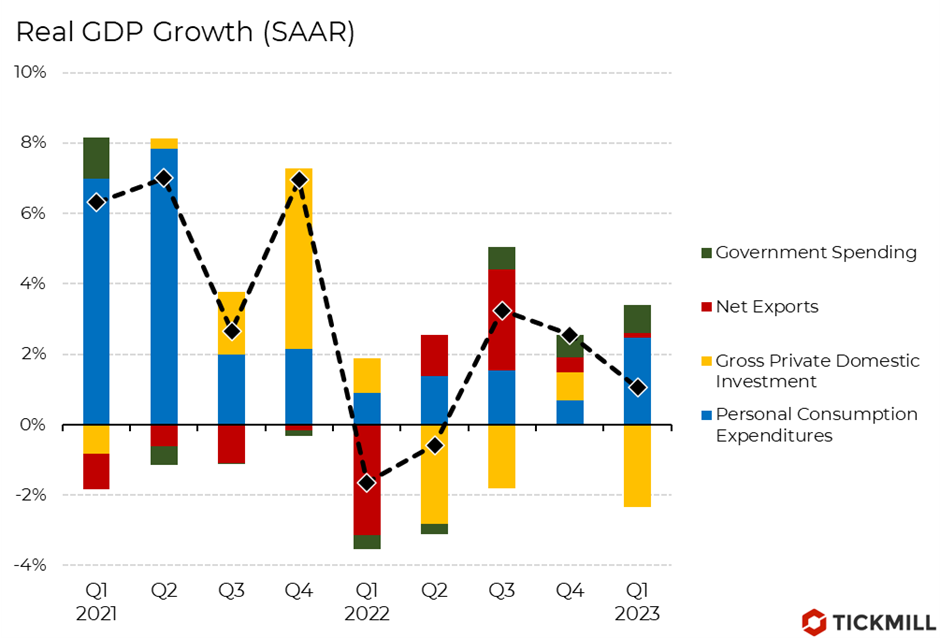

The risk appetite in global markets came under pressure while safe-haven demand increased after the US GDP and inflation data on Friday. For the first quarter, the US GDP posted a big "bearish" surprise, rising by only 1.1% compared to the forecast of 1.9%. Looking at the GDP separately for the four main components (consumption, investment, government purchases, and net exports), it is evident that it was the investment component that dragged down the headline reading while consumption and government purchases maintained a good positive momentum:

In annual terms, consumption grew by 3.7%, with a strong jump in January when unusually warm weather stimulated early activity rebound after December. Government purchases increased by 4.7% in annual terms, and net exports added 0.11% to the annual GDP growth rate.

Nevertheless, the weakness of the main indicator was hidden in downside momentum of investments (21% of GDP). It consists of three main components: investments in fixed assets, firm inventories, and households' residential investments. While firm investments in fixed assets grew by 0.7% (quite weakly), investments in housing decreased by 4.2%. In quarterly terms, this indicator has been decreasing for 8 consecutive quarters due to pressure from mortgage rates combined with sticky high housing prices that accelerated during the period of low rates after the pandemic. Firms also reduced their inventories in the first quarter (which is considered negative investment), which took away 2.26 percentage points from the GDP growth rate.

As for inflation, the core GDP deflator (one of the inflation metrics) increased by 4.9% on an annual basis, up from 4.4% in the previous quarter and above the consensus of 4.7%. Along with disappointment over the GDP data, the market was forced to reprice the risks of the Federal Reserve's monetary policy tightening in light of hawkish inflation data today. The rise in Core PCE exceeded expectations - 4.6% versus the forecasted 4.5%. The February figure was revised upward to 4.7%. Monthly inflation was in line with expectations at 0.3%.

In the next quarter, consumption is likely to make a less significant contribution to GDP, given recent consumer trends (decline in retail sales). Weak investments suggest a reduction in corporate optimism about the short-term prospects of the US economy. CEO surveys of US companies and the NFIB small business index indicate preparations for a downturn and recession, which will further depress hiring and investment in capital goods.

The consensus for Q2 GDP growth is shifting closer to 0, and the actions of the Fed, which is forced to fight inflation, will likely bring the onset of a recession in the US economy closer. Also, we cannot underestimate the possibility of new banking shocks, which could lead to a sharp tightening of credit conditions and further hit economic activity.

The dollar received a boost today due to increased demand for the US currency as a safe haven asset. Looking at the EURUSD pair, it can be seen that the price is consolidating around the lower boundary of the uptrend channel, which can be seen as a signal that the uptrend may be petering out and closer to the Fed meeting, there may be a break downward:

Eurusd chart

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.