USD Extends Rebound as Markets Get Confident about Fed Hawkish Shift

Following a technical retreat last Friday, the USD renewed its strength on Monday. The US Dollar Index (DXY), which measures the Greenback’s performance against a basket of six major currencies, climbed near the 108.20 mark. This turnaround came as several Fed officials hinted that the pace of future rate cuts might be more moderate than previously envisaged.

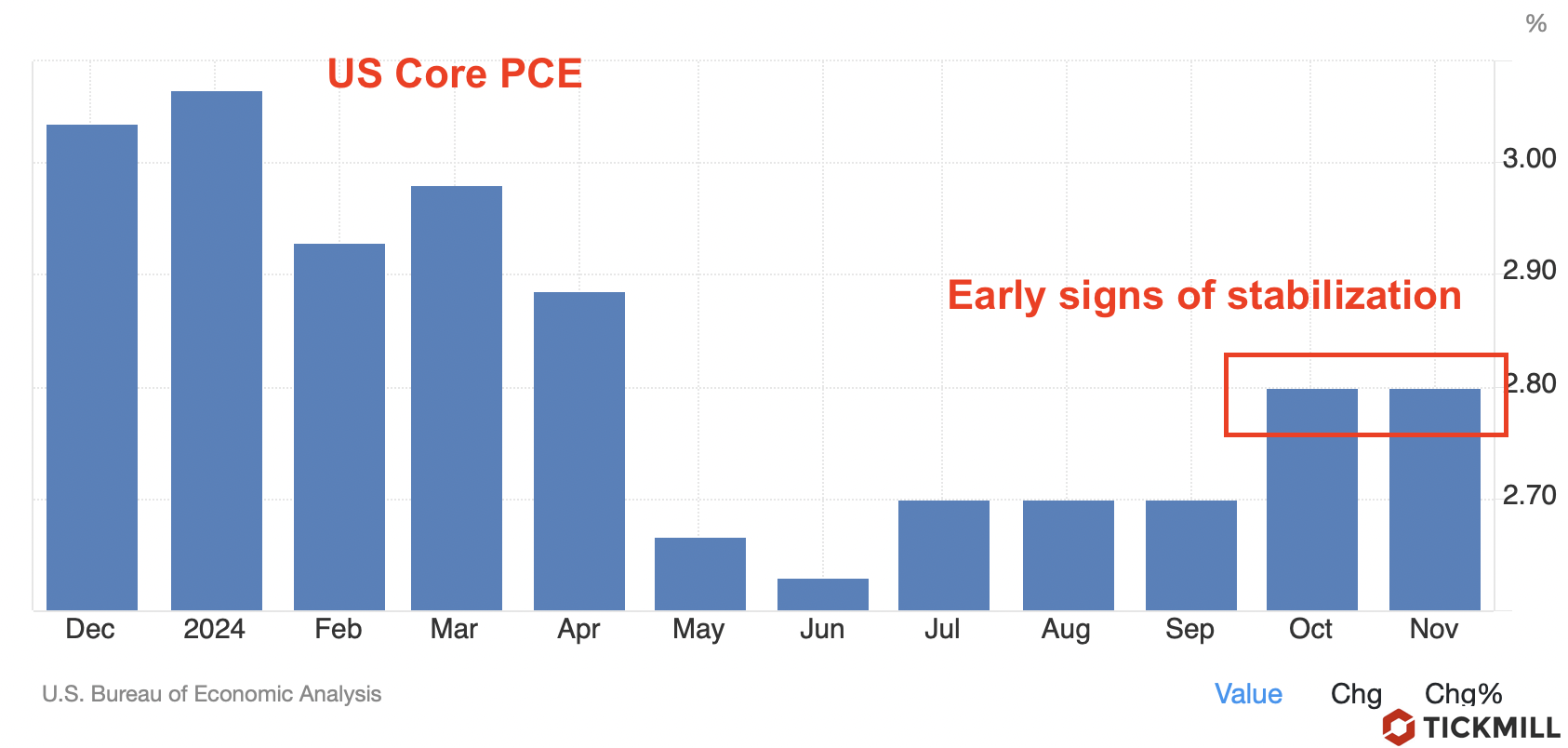

An important, albeit short-term, catalyst behind Friday’s USD decline was the publication of less-than-anticipated increase in the consumer price level measured by PCE Fed’s preferred measure of inflation. Headline and core PCE each edged up just 0.1% month-on-month, while core PCE year-on-year came in at 2.8% rather than the projected 2.9%:

Cleveland Fed President Beth Hammack, known for casting the lone vote to keep rates steady in last Wednesday’s meeting, reiterated on Friday that she would prefer holding rates at current levels until there is stronger evidence that inflation continues heading toward the 2% target.

Chicago Fed President Austan Goolsbee signaled that uncertainty surrounding the incoming administration’s economic policies led him to scale back his expectations for 2025 interest-rate reductions. Where he once projected a full percentage point of cuts, he now foresees a more modest decrease.

The Euro experienced downward pressure during Monday’s European session, pulling EUR/USD below the 1.04 threshold as the US Dollar regained ground:

The move reflects ongoing speculation about future ECB policy changes, coupled with the stronger USD. The ECB President Christine Lagarde struck a relatively dovish tone in an interview published Monday, suggesting confidence that eurozone inflation is nearing a level where policymakers can state it has been sustainably brought close to the ECB’s 2% medium-term target.

The British Pound saw another wave of decline against king USD, with market participants weighing an increase in dovish BoE rate-cut forecasts for next year:

Market expectations now tilt toward a cumulative 53 basis points of reductions in 2025, compared to 46 basis points before last week’s BoE policy meeting. This sentiment grew after three of nine Monetary Policy Committee (MPC) members voted for a 25-basis-point rate cut, surpassing many observers’ expectations that only one member might adopt a more dovish stance. The 6-3 split has fueled speculation of a more accommodative policy path, yet these wagers remain in line with the Fed’s outlook and still fewer than potential cuts anticipated from the ECB—factors that could, paradoxically, support the Pound in the medium term.

Looking further ahead, some private sector analysts take a more aggressive view. For instance, economists at Deutsche Bank foresee four BoE rate cuts in the coming year—one in the first half and three more in the latter part. Although this stands out as a more bearish projection than consensus estimates, it underscores that diverging interest-rate paths among central banks will remain a crucial driver of currency markets going into 2024 and beyond.

In the near term, investors will be keeping an eye on the US Durable Goods Orders report for November, scheduled for release on Tuesday. Analysts anticipate a 0.4% decline, a reversal from October’s 0.3% increase. Given the Fed’s evolving stance, a weaker-than-expected print could stir fresh doubts about the strength of the US economy and reignite debates over just how many rate cuts will materialize next year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.