USD Looks for April US Retail Sales Rebound to Resume Downtrend

The dollar ceded ground on Friday, as one of the main drivers of the recent strengthening - the correction in the US equities, gained momentum. Recall that the US equity market returns have significant negative correlation with USD index returns and it seems that this correlation played out again. US equities rebounded on Thursday, which brought noticeable relief given that the SPX was in danger of falling below the psychologically important 4000 points. On Friday, Asian indices rebounded noticeably, futures for US stock indices, European markets were beating back losses.

The dollar is likely to continue to move towards support at 90.25, with today’s US retail sales report as a primary catalyst of the move. Retail consumption above the 1% forecast is likely to alleviate concerns about the impact of the weak April NFP on income and consumer optimism, allowing weak job growth to be attributed to non-critical effects such as a temporary shortage of low-skilled labor due to high benefits and benefits, seasonal adjustments etc.:

Next week's DXY targets reside at the February low of 89.65, but given the rate of decline (RSI approaching extreme downside values), a pullback to 90.50 is likely to follow before the move towards the target resumes.

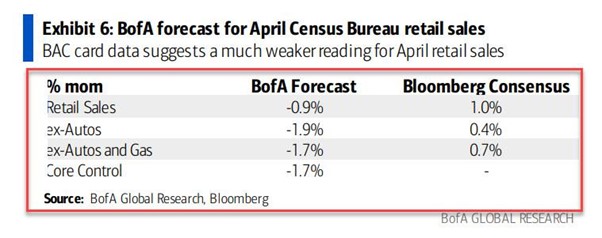

A negative surprise in April US retail sales is predicted by BoFA, which for the past three months has been fairly accurate in predicting retail sales dynamics based on data on spending from customer cards. According to the bank's forecast, retail sales in April will disappoint the market, showing a decrease of 0.9% compared to the previous month:

In this case, further downside in equities will likely prevail and USD will likely extend its current rebound. In addition, it will be tougher to expect inflation surge on weak consumption picture and US Treasuries will likely seen inflows on eased inflation expectations.

Yesterday's data on unemployment benefits in the US further eased market discomfort caused by dramatic miss in April NFP. Falling claims held back development of downbeat expectations regarding employment in the United States. Initial claims fell to new past-pandemic lows, indicating that the US labor market continues to recover.

The dynamics of production prices in the US in April did not come as a surprise given that the bar to surprise the market was high after the April release of the US CPI. The underlying PPI beat the forecast and amounted to 4.1%. Elevated CPI print can be also partially attributed to the low base effects, which arose due to weak inflation readings in April and May last year. The measurement of inflation in annual terms in April and May 2021, as a result, may be distorted.

The release of an important protocol on the last meeting of the ECB is also expected today. The report is likely to clarify the reaction function of the ECB to possible acceleration of inflation and is expected to have a mildly positive impact on the euro as the EU economy emerges from recession and the CB rhetoric should focus on discussing the exit from stimulus. In particular, the details on the main anti-crisis program - PEPP, will most likely allow the European currency to strengthen, as the chances are high that the ECB may hint in the report on some dovish tweak in PEPP purchases.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.