USD Reaps the Rewards of Vaccination in the US

Marine traffic resumed in Suez Canal reducing uncertainty in the markets, with the USD firming its position while long-dated Treasuries sell-off gained momentum ahead of Biden's presentation of infrastructure spending plan. Oil clang to recent gains ahead of the OPEC meeting.

On Thursday, OPEC will decide whether to extend current output cuts after May 1. At the last meeting, OPEC took it by surprise leaving productions cuts unchanged, which, however, played a cruel joke: the market regarded this as a signal of concern about demand outlook. Prices jumped up, but unwound gains quickly, ironically, OPEC concerns about demand were later justified – the third wave of covid came in Europe, lockdowns were extended and eroding demand forecasts.

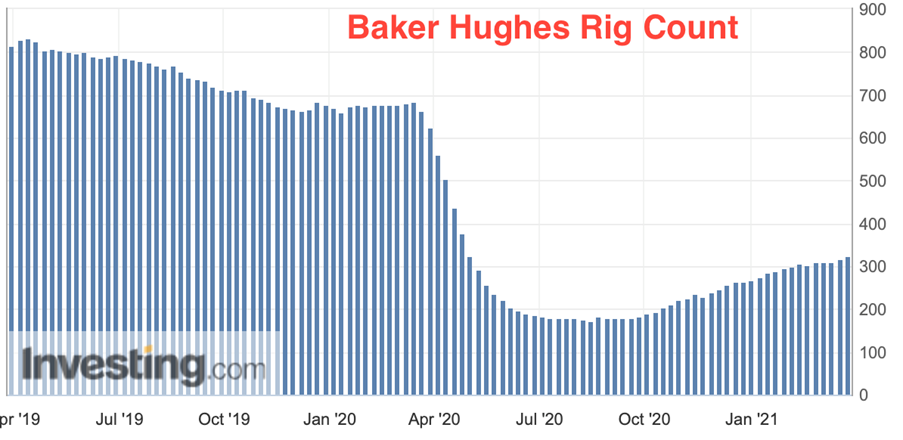

After OPEC’s decision at the last meeting, expectations of aggressive lifting of restrictions were shifted to May. After oil prices tumbled in March and covid situation worsened, this outcome became much less certain and expectation surfaced that OPEC may again decide to extend output cuts in May. By the way, expectations of a dovish OPEC move could be the key driver in recent price rebound. In my opinion, the chances of such an outcome are minimal, since in its last monthly report, OPEC revised its forecasts for demand growth in the third and fourth quarters upward, the situation with covid Europe is painful for the market, but not so critical as to prolong the restrictions. US production is recovering slowly, with low temperatures in late February further pushing the recovery back, as evidenced by drilling activity and the dynamics of commercial oil reserves:

The number of active drilling rigs in the United States is less than half of the same period last year.

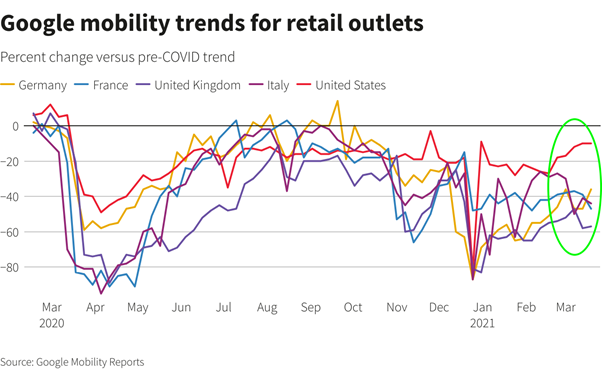

The chances of extension of USD corrective rally appear to be rising as metrics of consumer mobility indicate that the US is beginning to outpace the EU and the UK in recovery. For example, here is the level of consumer visits to retail outlets compared to the pre-crisis level by country. The United States began to stand out noticeably in early March:

Other mobility metrics, such as restaurant visits and air travel, also show that the US is removing restrictions faster. Improved economic prospects relative to other countries justify investment flows, which in turn affect foreign exchange flows.

Over the next few weeks, there is a risk that USD index as part of its rebound trend, will touch 94 points, the highest level since November in 2020:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.