USDJPY Capped by Hawkish BOJ Meeting

BOJ Holds Rates

The September BOJ meeting overnight threw up some surprises with the bank seen taking a more hawkish tone than many were expecting. While rates were held unchanged as expected, two dissenting votes in favour of further tightening revealed growing hawkish dissent within the bank. These dissenting voters were seen voicing concern that the bank’s price stability target had been met, with risks now seen to the upside. The BOJ did note in its statement that inflation expectations had risen recently, reflecting these upside risks. Additionally, the announcement that the bank will begin unloading holdings of ETFs and J-REITs was also seen as a further hawkish development.

Bullish JPY Outlook

The reaction in USDJPY has been muted today given the strength we’re seeing in USD. However, if USD falls foul of any downside data surprises near-term, the pair is vulnerable to a sharp drop lower as bullish JPY sentiment is given room to shine. Near-term, though, while USD continues higher, the pair looks likely to continue within the recent choppy range which has framed recent action. Looking ahead, if the BOJ hikes rates in October while the Fed commits further to its new easing cycle, this should create room for USDJPY to start pushing lower.

Technical Views

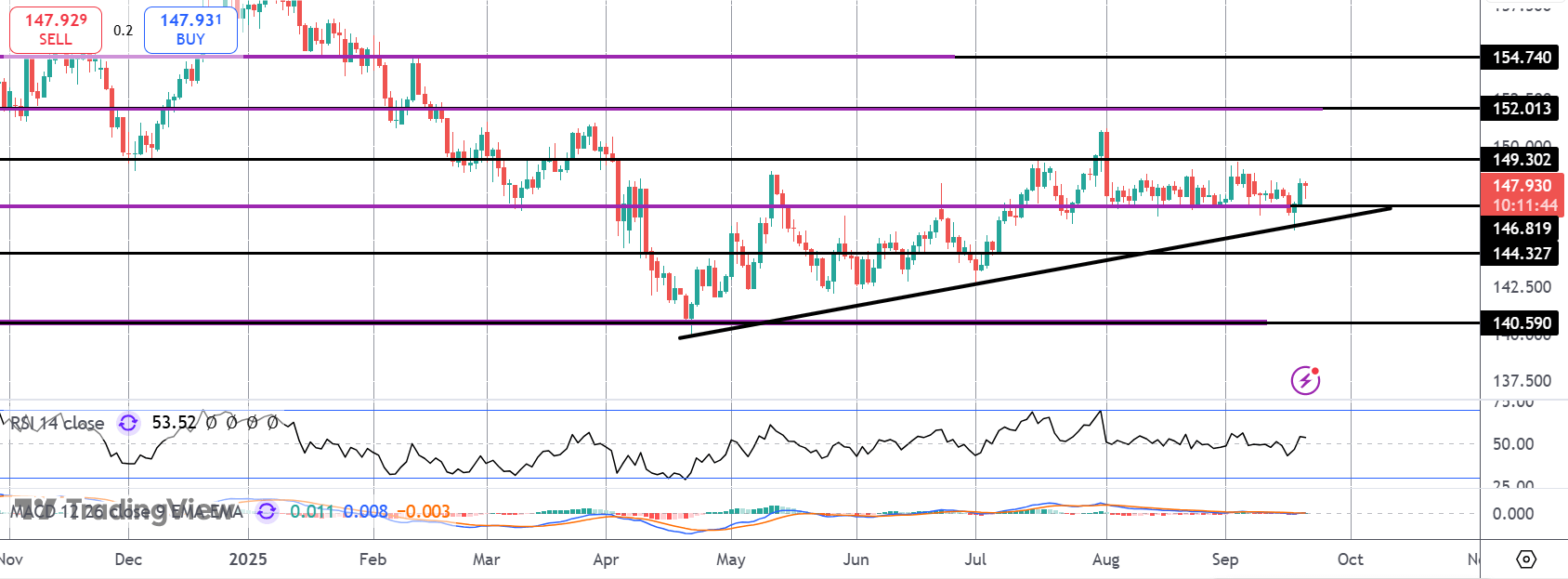

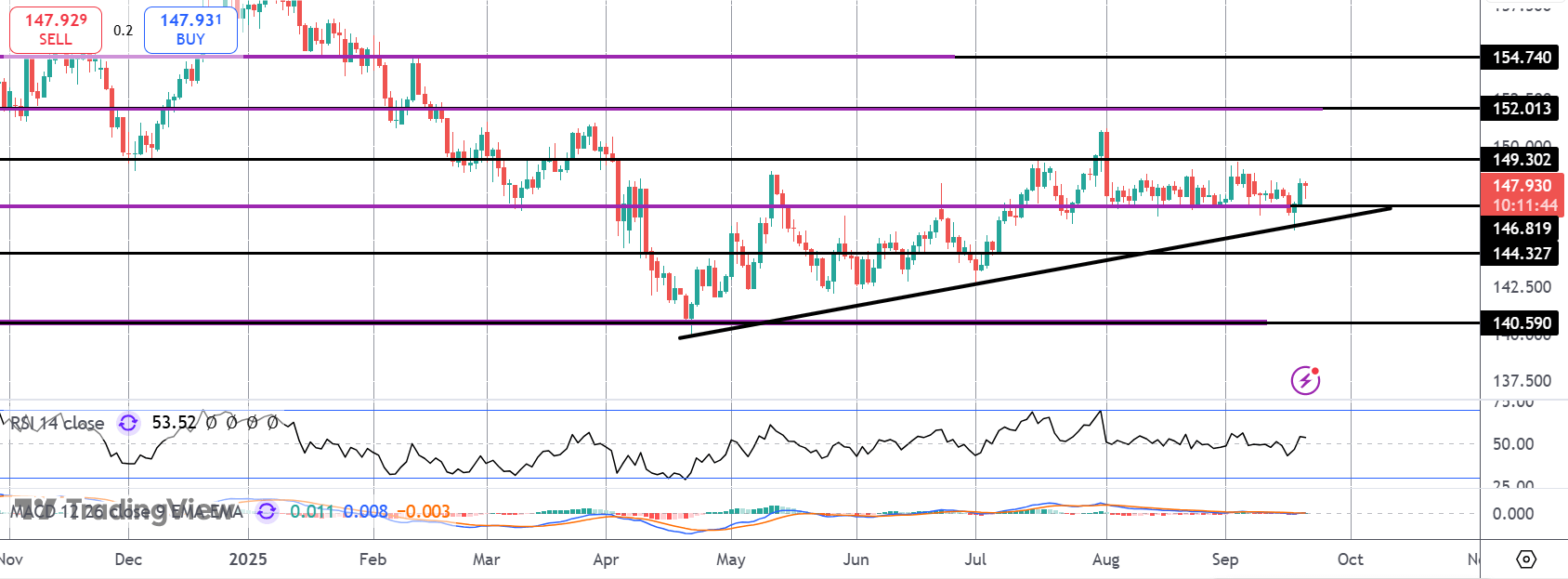

USDJPY

For now, USDJPY remains above the bull trend line off YTD lows and above the 146.81 support. While this area holds as support focus is on an eventual breakout above the 149.30 resistance with 152 the higher bull target to note. To the downside, 144.32 will be the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.