USDJPY Soars on Japanese PM News

JPY Plunges

USDJPY is turning sharply higher today following news overnight of Takaichi’s election as the next Japanese PM, and first female leader there. Takaichi in power is being seen as a bearish driver for JPY given her support for fiscal expansion and a likely return to the Abenomics which has dominated the Japanese economic agenda over the last decade. News of her selection as leader of the LDP last month saw JPY rocked lower as traders moved to price in a les hawkish BOJ in line with the view that she would ultimately become the Japanese PM.

Uncertainty Over Takaichi

The question for traders now is whether this expectation is likely to be fulfilled or not. Japanese headlines refer to a plan finalised by Takaichi this week to appoint Satsuki Katayama as finance minister. Katayama is well known for her support for a stronger Yen, casting some uncertainty over the view that Takaichi will necessarily drive JPY lower. Traders will now be watching to see some concrete moves from Takaichi with a view to gauging the likely direction of JPY in coming months.

US/China Trade

USDJPY is also rallying this week amidst an uptick in USD. A softening of rhetoric from the US over China is raising optimism that Trump’s hard line threats are merely a bluff. Traders now wait to hear how scheduled US/Chinese negotiations this week progress. Any positive headlines should furtehr boost USDPY near-term, weakening safe-haven demand for JPY while driving USD higher.

Technical Views

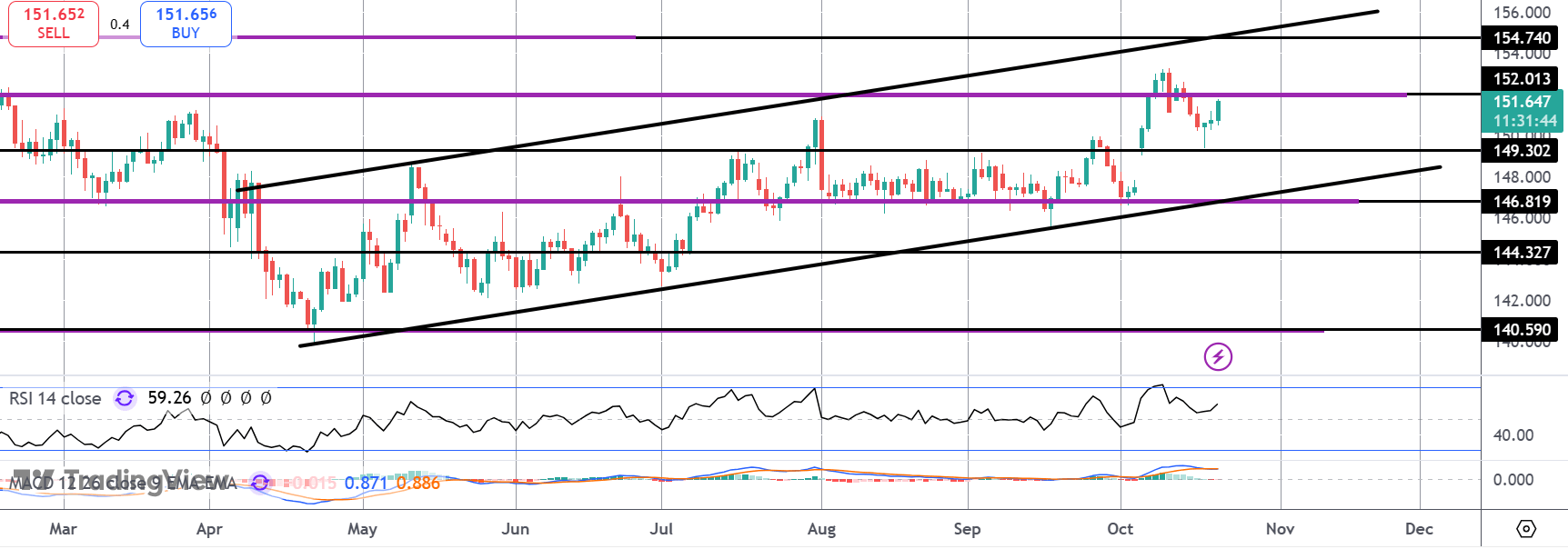

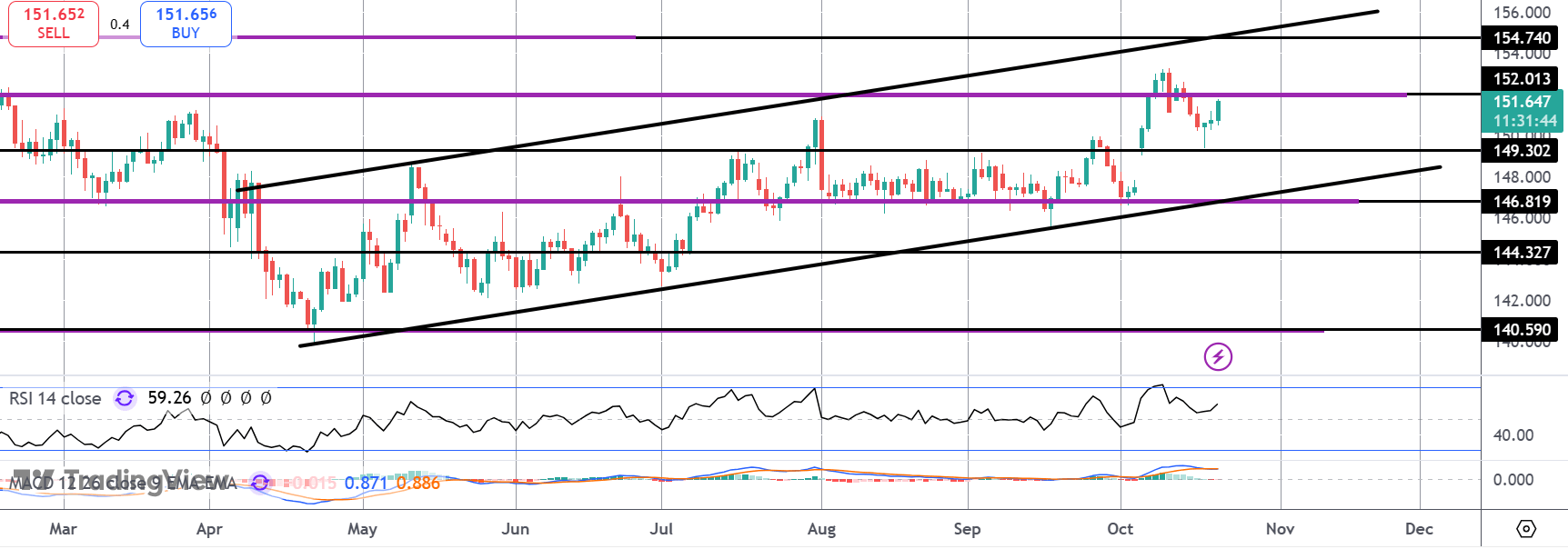

USDJPY

The correction lower in USDJPY found strong support into the 149.30 level with price bouncing sharply, now testing the 152 level. With momentum studies turning higher, focus is on a fresh breakout towards the 154.74 level next. The bullish view holds while price stays above the 149.30 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.