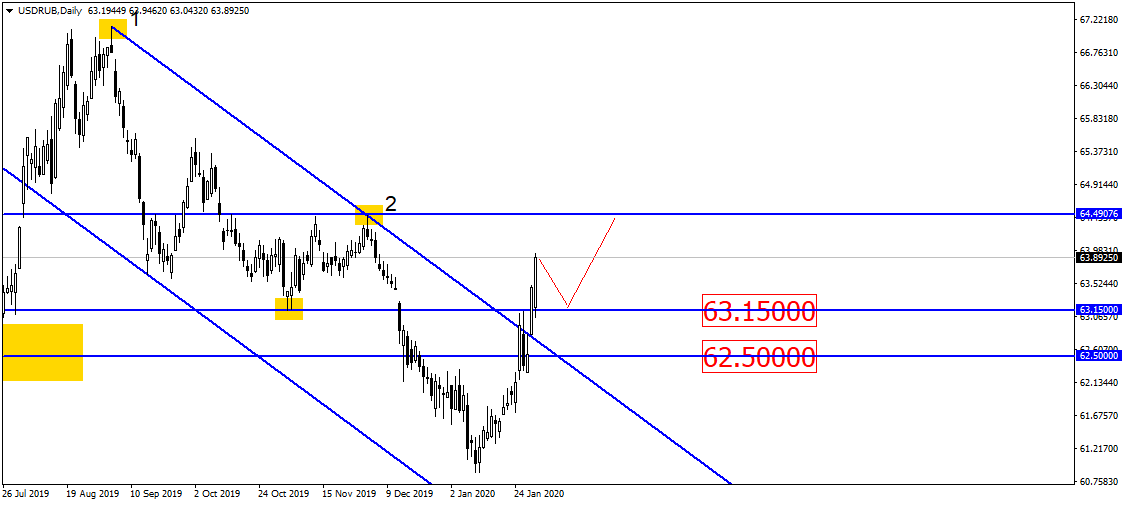

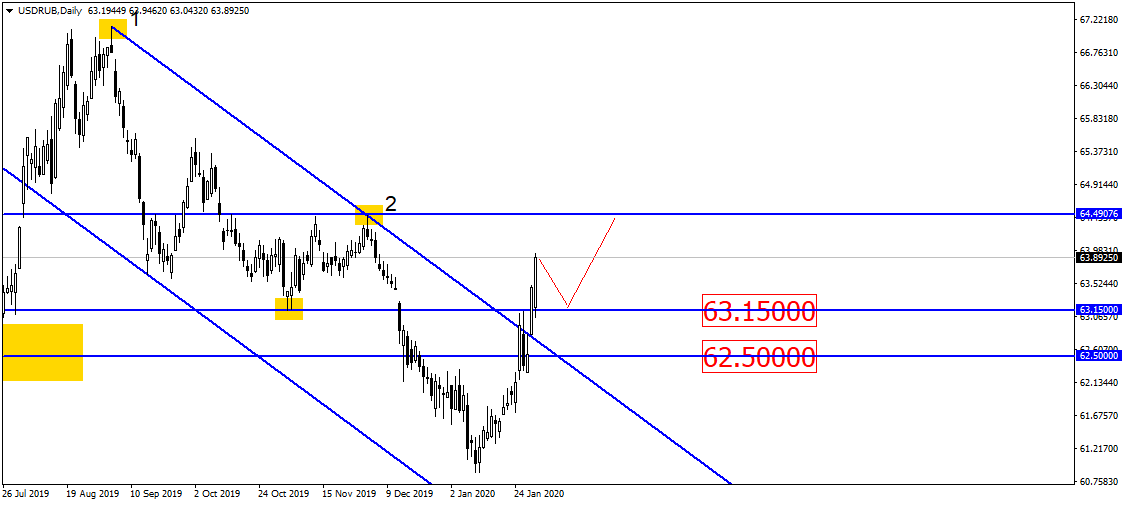

USD/RUB: Potential Jump Ahead?

Good day!

The Russian ruble made an expected move at the end of last week, approaching the 65.00 level. So far, the 63.15 support level remains for the Russian ruble for a while. Getting back to this level, the asset can jump again:

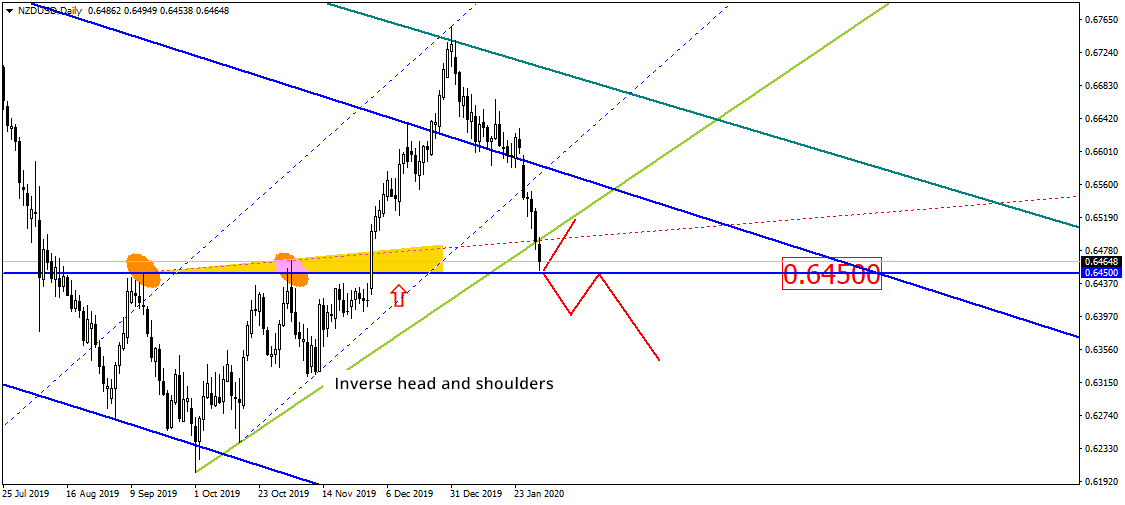

New Zealand dollar approached a very important supporting level of 0.6450. This level also serves as the broken neckline of an inverse head and shoulders pattern. In principle, the currency pair is likely to jump however, we should wait for the candlestick patterns to form as they will confirm the potential pullback. The level could also get broken down so, let’s wait and see what’s going to happen next:

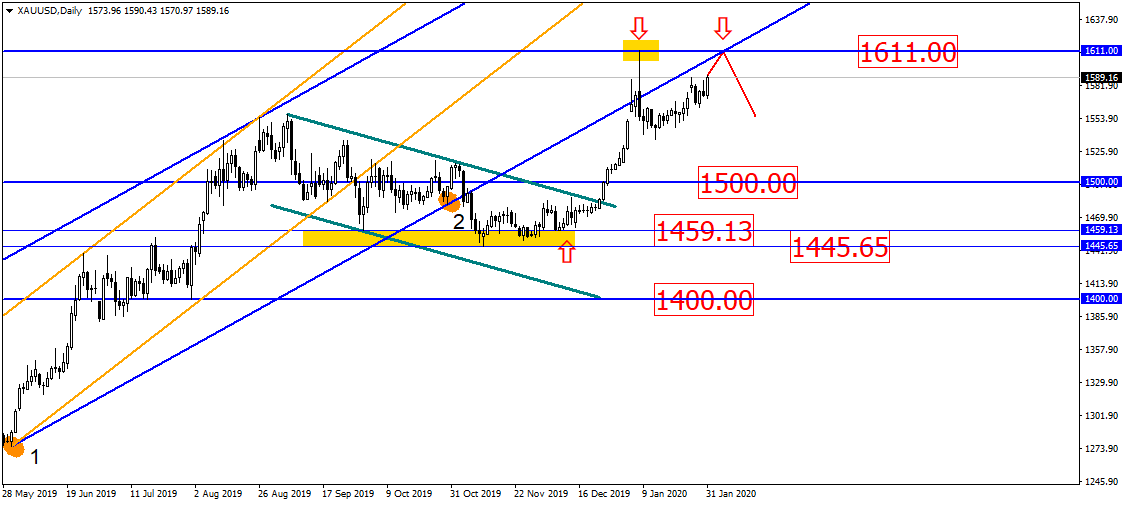

Gold decided to test the tail of the falling candlestick. Asset’s price is approaching the 1611.00 level, where the broken uptrend lies. At the crossing point of this level the uptrend asset’s price is most likely to drop and form the peak:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.