All Hail The RSI

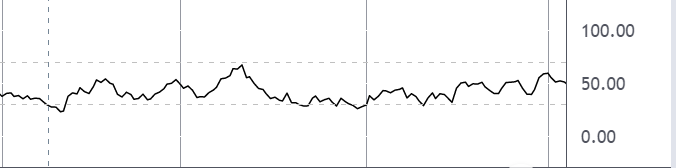

The Relative Strength Index continues to be one of the most popular technical indicators. The RSI, which is a momentum indicator (measuring the strength of prices moves) is used by beginner and professional traders alike and is renowned for its simple and effective signals. The indicator (shown below) essentially consists of a 14 period line which oscillates in a 0 – 100 range. There are two default thresholds plotted on the indicator ate 30 and 70. In its simplest form, when the 14 period line hits the bottom threshold, momentum is classed as oversold and the market is vulnerable to a reversal higher. When the indicator hits the upper threshold, momentum is classed as overbought and is vulnerable to a reversal lower.

Basic RSI Method

Typically, the way that traders will use this indicator is to look to trade reversals as the indicator hits either the upper or lower threshold. This is a great strategy and is particularly useful when combined with some basic support and resistance analysis e.g looking to sell overbought signals as price hits resistance or looking to buy oversold readings as price hits support. This type of method works particularly well in range bound markets where price is rotating between two support and resistance regions.

However, the RSI can also be incredibly useful in trending markets. Interestingly, many new traders often struggle to use RSI in trending markets, but this is typically because they look to use the same technique applied in ranging markets. However, when a trend is flowing, we need to slightly adjust the way we use the indicator and, in doing so, we can then unlock great trading opportunities.

In the image above we can see the market selling off a double top formation. When price breaks through the neckline of the double top, the bear trend is in full swing. Now, typically traders would look to buy oversold RSI readings. However, because the market is trending, doing this will simply cause you to suffer many losing trades. Alternatively, looking to trade with the trend and looking to sell overbought readings will prove difficult seeing as the market rarely corrects strongly enough (during the middle of a trend) to allow for this. So, this is where we adapt our technique.

Advanced RSI Method

So, this is where we adapt our technique. Knowing that 0-50 on the RSI indicates bearish momentum and that 50-100 indicates bullish momentum, instead of looking for the indicator to move all the way up to the overbought level, in a bearish trend like this we can wait for the indicator to rise above the 50 level (you’ll have to plot this in yourself) and then sell as it crosses back below. These mini corrections can offer fantastic entries into fast moving markets and are only typically used by advanced RSI traders, meaning that you will be identifying plenty of unique entry points.

Give It A Go

So, now you know a better way to use the indicator, try it out! and feel free to let us know how you get on in the comments section. The great thing about this method is that it can be used on all timeframes and for any instrument meaning it should suit all types of traders from scalpers through to set and forget traders.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.