What can we expect from the EURUSD after the ECB meeting?

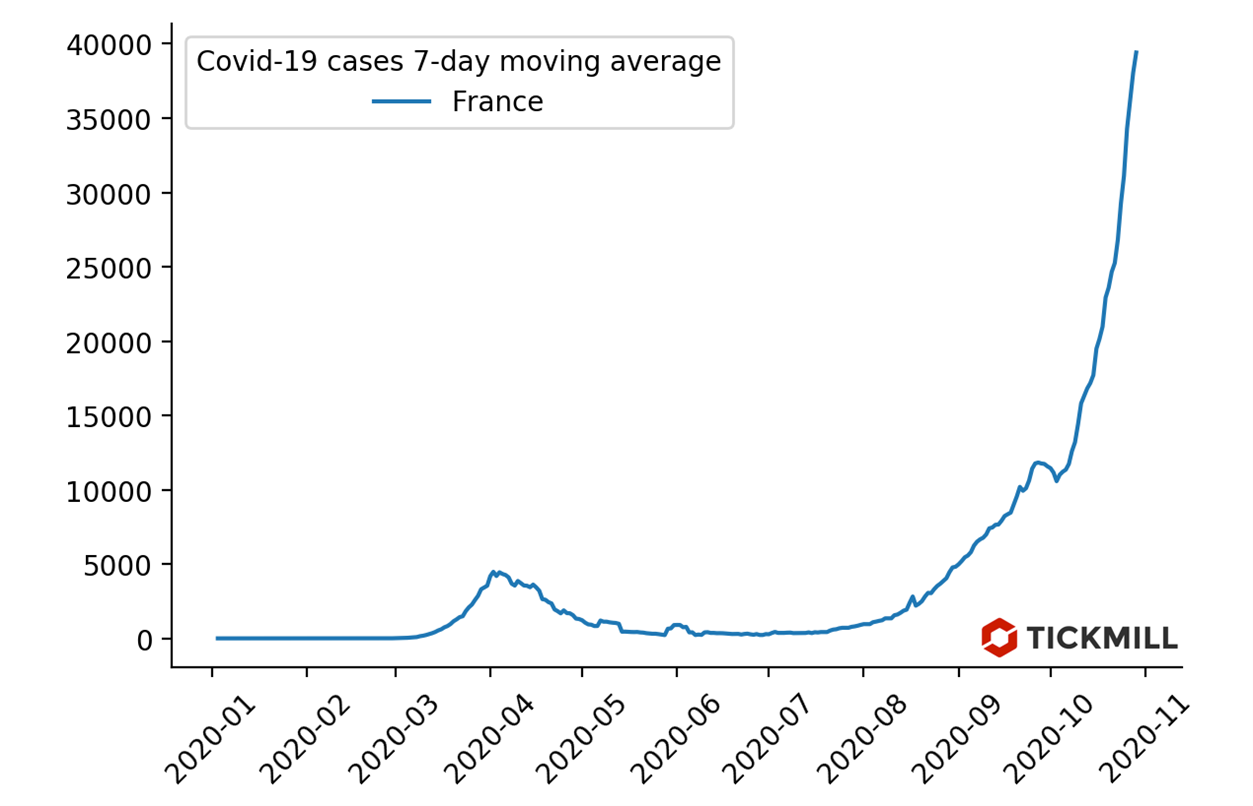

As expected, EURUSD crashed after the ECB meeting on Thursday, as policymakers almost openly stated that the central bank will continue to ease credit conditions in December. The only question is what policy instruments will be involved (depo rate cut, increase in QE, expansion of TLTRO or increased asset-purchases within the PEPP). The coronavirus impacts began without warning, causing the ECB to act almost preemptively:

All members of the ECB governing council unanimously supported the need for intervention in December. Recent tightening of social restrictions in Europe threaten to plunge the economy into another recession (this becomes the baseline scenario now!).

ECB President Lagarde announced that all instruments will undergo recalibration. In fact, this means that in December a mix of a rate cut, an increase in QE, etc. can be announced. Amid a pause in the actions of other central banks, yesterday's announcement by Lagarde is a very hard blow for the euro. Common currency was sold much faster than expected.

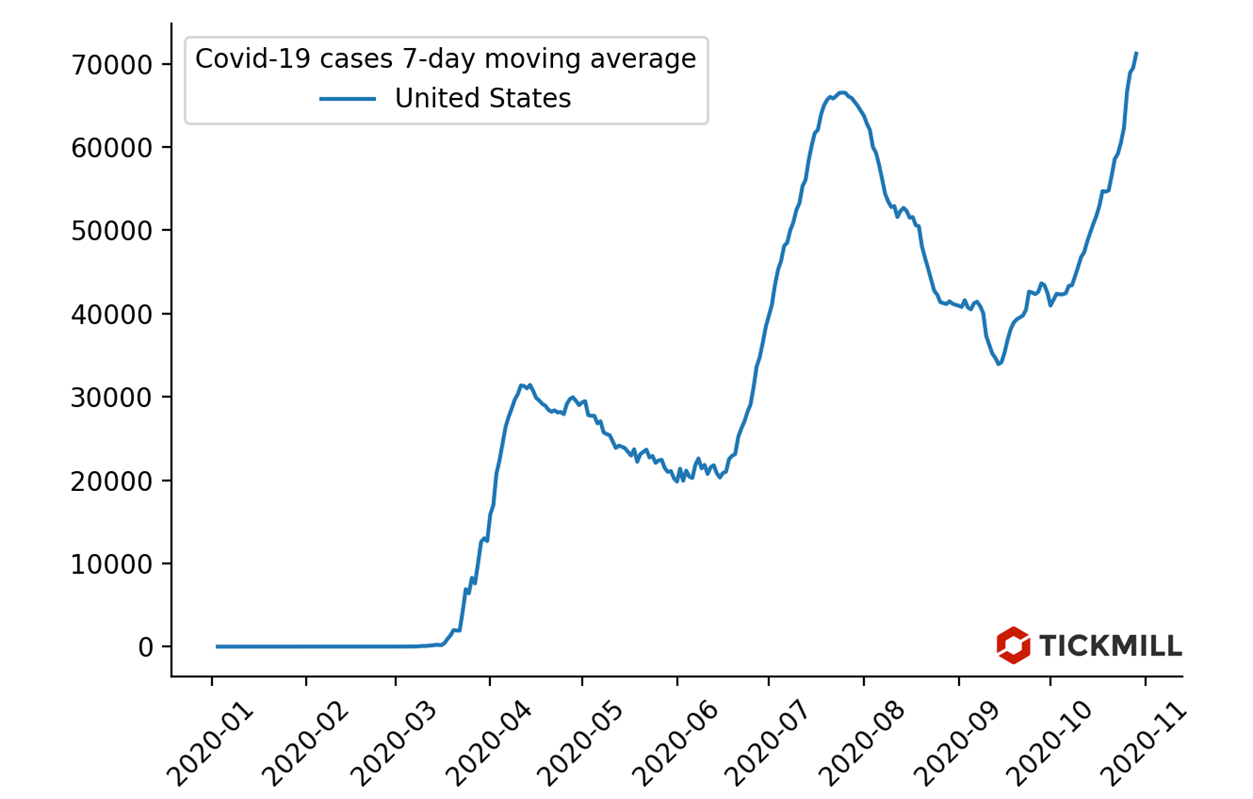

As a result, a noticeable imbalance of statements in favor of the ECB is formed in the central bank policy environment. The virus activity in the US has not yet forced the Fed to announce similar easing of credit conditions, which could balance the pressure on the euro in EURUSD. Also, judging from the dynamics of the disease in the United States, no urgent statements by the Fed are expected:

The United States has already “visited” the ~ 70K daily case zone in July, so I think that the US is quite away from the critical point of depletion of healthcare reserves. Therefore, there is no need to impose tougher curbs or introduce lockdowns. This means that there is no need for the Fed to rush to ease monetary policy. Hence, the Central Bank policy imbalance will linger for some time which should be properly priced in the Euro.

I expect that the pressure on the euro will continue in November and most likely we will see a breakthrough of the September low in EURUSD (1.161) after the elections.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.