What to Expect From Today’s Non-Farm Payrolls Report?

No positive surprise is expected from the NFP report, besides there is little hope that job gains in December will come in line the very modest forecast. Congress approved the new support measures after a period when labor market statistics were collected, so they will not be reflected in the December NFP. Most of the stimulus from the previous package had fizzled out by that time, which makes it highly likely that we will see a negative surprise in the official labor market data as well.

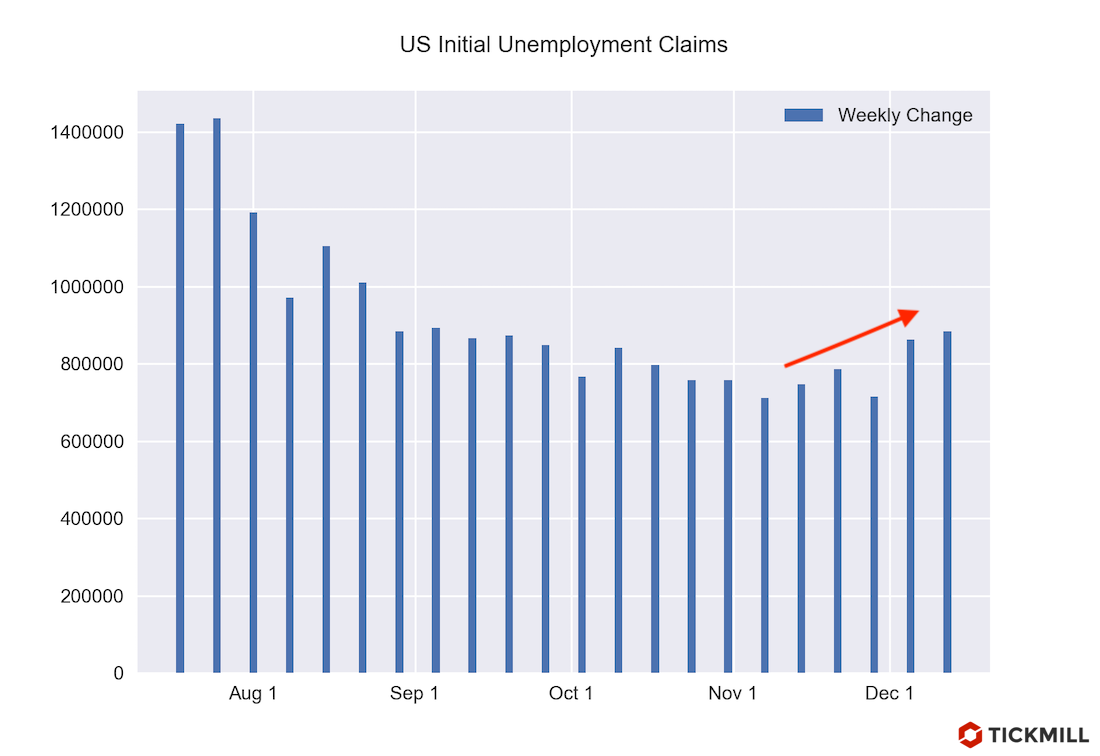

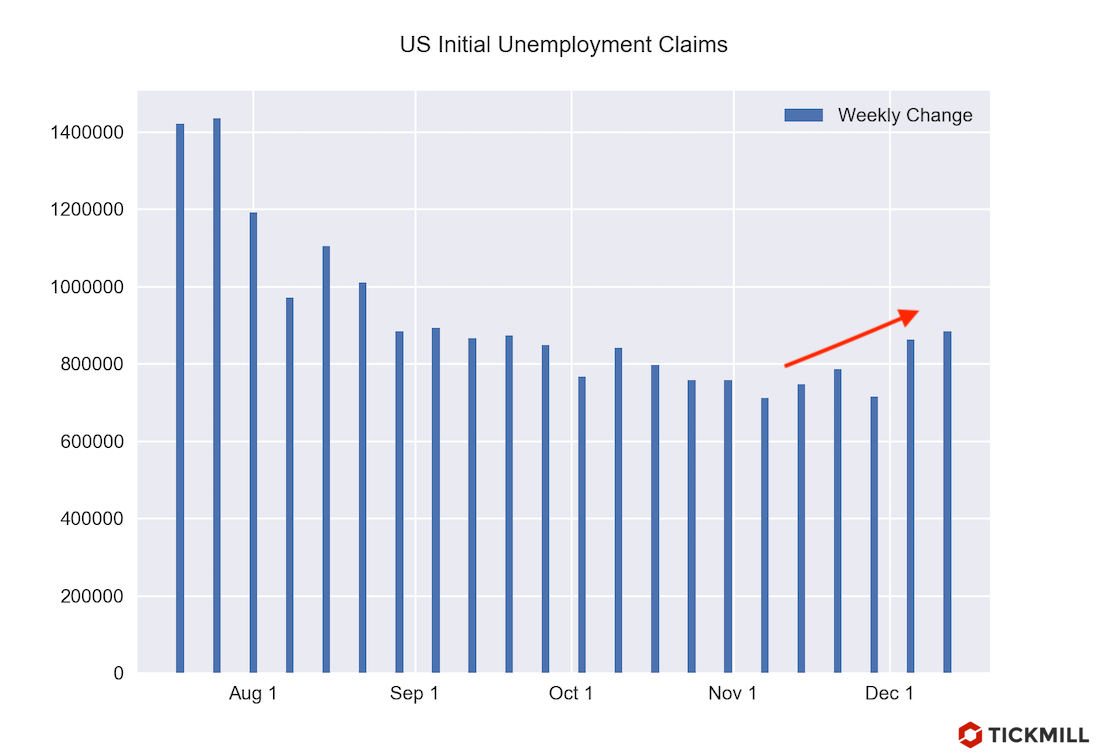

Various employment indicators that came out over the past month surprised to the downside more often than to the upside. One of the most important from them is initial unemployment claims which picked up in December:

Although continuing claims extended their welcomed downward trend in December, this did not have a positive effect on employment as it was mostly caused by expiration of corresponding unemployment programs, after which continuing to stay on benefits made little sense for unemployed.

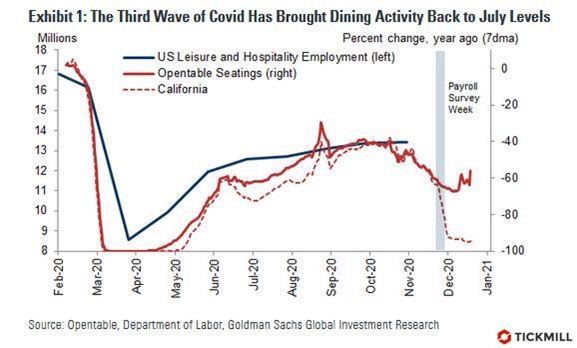

The number of pandemic payments also increased in December, reflecting the negative impact of the pandemic on the economy. The ADP report indicated a 123K reduction in the number of jobs versus + 88K expectations. The largest number of layoffs occurred in services sector. The impact of the pandemic on services industry is shown in the following chart from Goldman:

From the chart above it can be seen that dining activity fell to July levels (-60% from pre-crisis levels). This will most likely be followed by corresponding decline in the level of employment in the sector.

Manufacturing sector and services sector moved in opposite direction in generating new jobs, the employment component of ISM PMIs showed: in services sector, the employment index fell from 51.5 to 48.2 points while in manufacturing sector, the index rose from 48.4 to 51.5 points.

Challenger's data showed that the number of planned layoffs rose 48% in December compared with November.

All major indicators on the labor market, as we can see, point to a negative surprise today.

In its pessimistic forecast, Goldman said it expects a 50K job cut in December, after 245K in November and 610K in October. This is significantly lower than the + 150K consensus. If the forecast is confirmed, we are likely to see a positive reaction in gold and Treasury yields, as this will further increase the chances that Democrats will offer markets a new stimulus package, which the market perceives as a strong pro-inflationary factor. The whole reaction to the NFP, in my opinion, boils down to this simple idea.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.