Will FOMC Send USD/RUB Down?

Good day!

The Federal Reserve meeting is about to happen tonight, and investors worldwide are eagerly waiting what will come out of it. This is mostly because Fed might decide to either cut interest rates or hint on it. At that, Chair of the Federal Reserve Jerome Powell is expected to focus on telling about strong US economy. Well, we shall wait and see what’s going to happen next. In the meanwhile, let’s check what the currency pairs are currently up to.

The Russian currency is slowly approaching the support level of 63.65 therefore it is quite likely for this asset to jump from this level. Should Russian ruble gets stronger, it can also break the level, yet it is a second possible option. Although many things can happen tonight and define the future of Russian ruble:

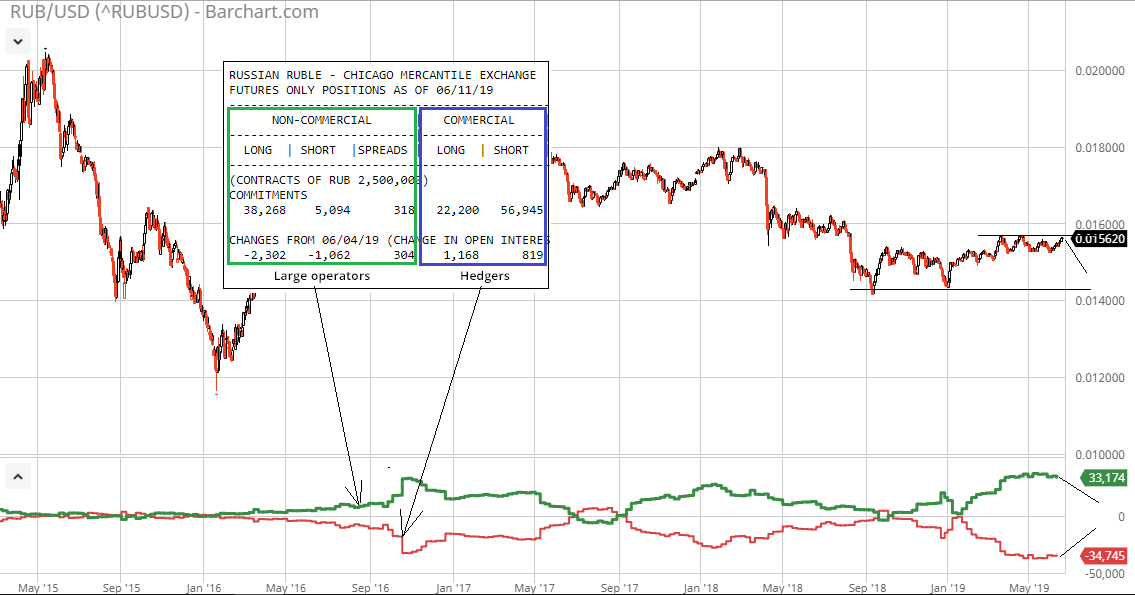

Based on the reports provided by COT CFTC, large operators go long on Russian ruble compared to the past years therefore they can quickly shorten their positions and make ruble drop. Currently, large operators were holding the same positions, remaining in a sort of positional range. In this case, everything can quickly and unexpectedly change:

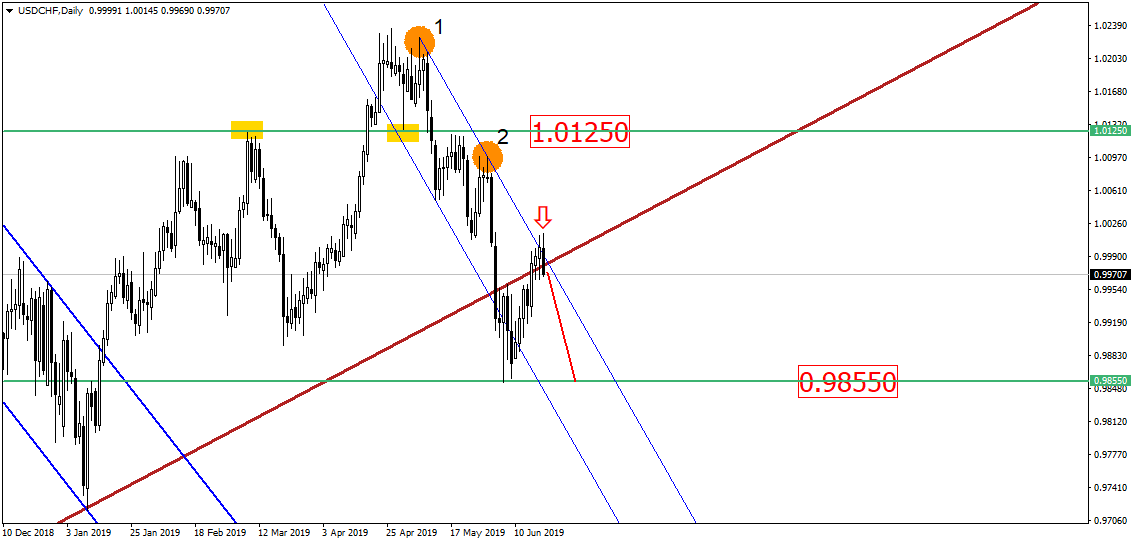

Swiss franc got back to the broken uptrend and local downtrend and is now trying to pull back away from it, forming a bearish engulfing. Here we should wait for the trading day to close and engulfing to completely form. Therefore, we assume that the currency pair should drop for now:

Cross rate of the currency pair EUR/CHF approached the lower boundary of the weeks long range therefore here two things can happen. The first option is that the pair might jump, and this is what has already happened many times in a row. Here we should wait for the reversal candlestick patterns to form as they will signify whether the rates are about to jump. The asset can also break the boundary, but we don’t know how likely this breakout is to happen. We should wait and see what tonight will bring us:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.