Are Fiat Currencies Losing Battle Against Gold?

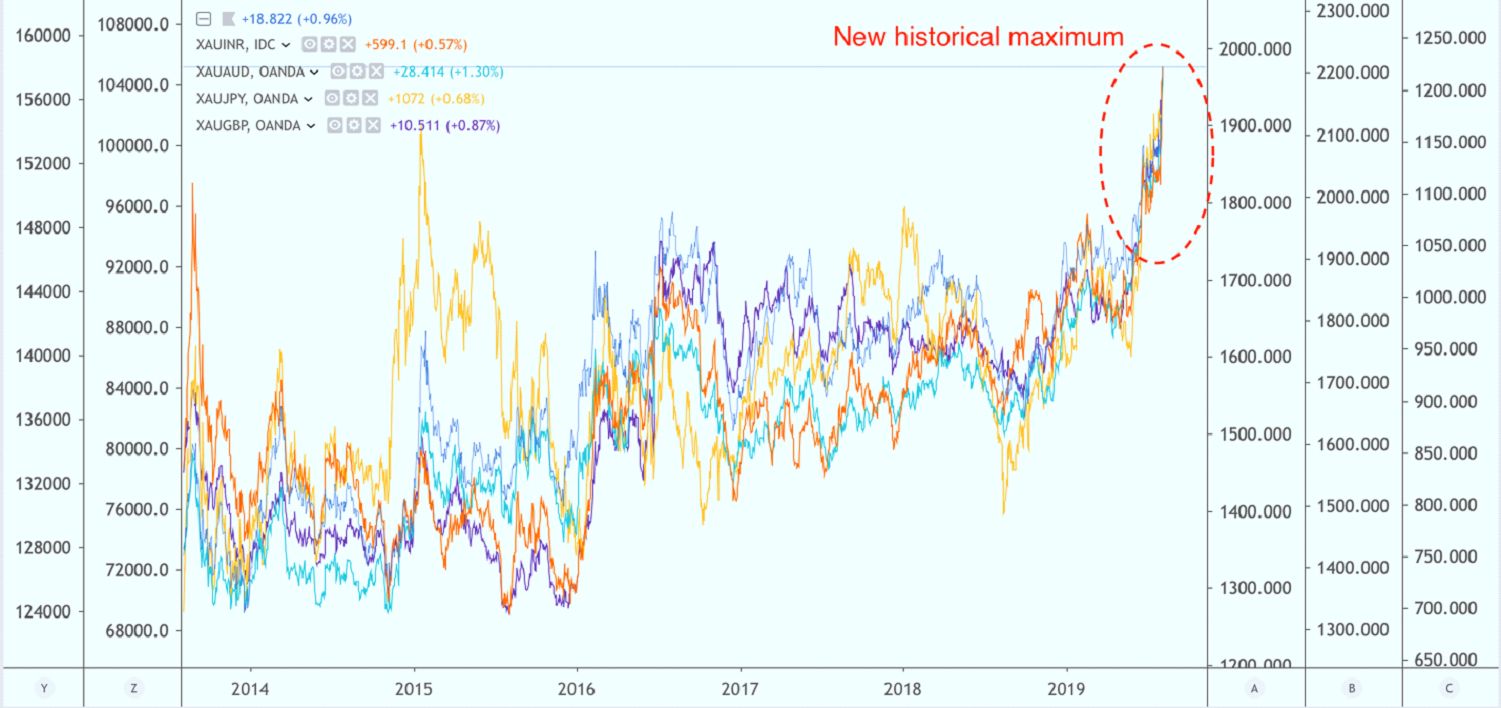

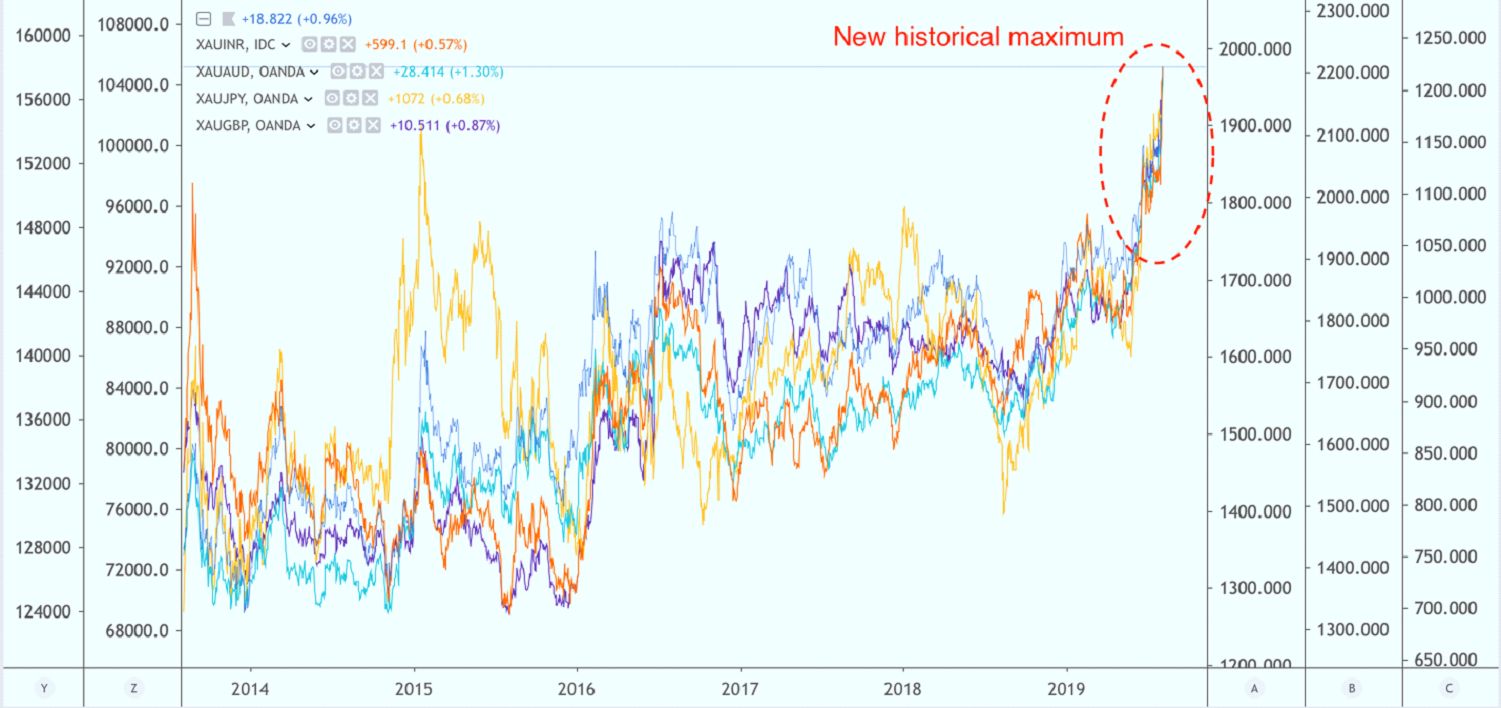

Rapid rise of the gold price this week was somewhat particular as the yellow metal renewed historical peaks against a number of fiat currencies:

Since the beginning of August, the price of gold in GBP, AUD, JPY, CAD, INR, ZAR (and many other) has jumped 6%, which speaks of “overwhelming distrust” in the fixed income market (both EM and developed) and continuing increase of risks associated with trade tensions. The global debt worth $15 trillion offers negative real yield although recently this figure was only $13 trillion. Expectations of lower opportunity costs (short-term real interest rates) are now working in favour of gold buyers:

Gold futures broke through $1,500 per troy ounce for the first time since 2013 after PBOC set USDCNY reference rate slightly above expectations (6.9996) sparking more concerns about the pressure on Yuan from panic capital outflows. The bank is still trying to defend the level of 7 yuan per dollar asking state-owned banks to cut short-term dollar market liquidity in the market to curb shorting of Yuan.

The last episode gold rally is not an isolated event, but part of a longer-term trend. Yellow metal has risen 17% since last December, after a fall in the stock market forced the Fed to press the pause button. Britain’s delayed exit from the EU boosted XAUGBP rate by 25% in 2.5 months. There are wake-up calls gradually appearing in the incoming US economic data - the ISM manufacturing activity index declined to 51.2 points in July, construction spending also fell 1.3% despite expectations for a seasonal surge. Applications for unemployment benefits rose by 8K to 215K at the end of July.

World Council data showed that in the first six months of 2019, central banks bought gold for a record $ 15.7 billion, continuing to diversify their portfolio and move away from the dollar. Poland, China and Russia bought up 374 tons in the first half, which also became a record. The ECB also emphasised the change in attitude towards gold, annulling the 1999 “Gold Central Banks agreement” as global banks turned from sellers to net buyers.

Of the short-term drivers that will determine the pricing of gold in the near future, we can highlight only the news background related to Trump tariffs. This factor now precedes other components in the "equation" of gold price, such as short-term interest rates, inflation expectations, the general risk appetite of investors. There is a risk to be late responding to the latter catalysts buying or selling gold. The price is now approaching strong resistance level while Trump is likely to take a break before a new attempt to “verbally raise stakes”, so further purchases of gold may require patience.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.