BoJ Urged to Review Monetary Policy – What are the implications for the Yen?

The Bank of Japan has lost sight of its duty as a central bank. The IMF urged the Japanese Central Bank to pay close attention to the weak spots of its policy, specifically the stability of the banking sector, with a greater emphasis on the purchase of short-dated bonds as part of the yield curve control program.

The Central Bank of Japan maintains a long-term interest rate of 0% and a short-term interest rate at 0.1% through the purchase of bonds on the open market. Doing so it tries to boost credit activity and influence expected inflation.

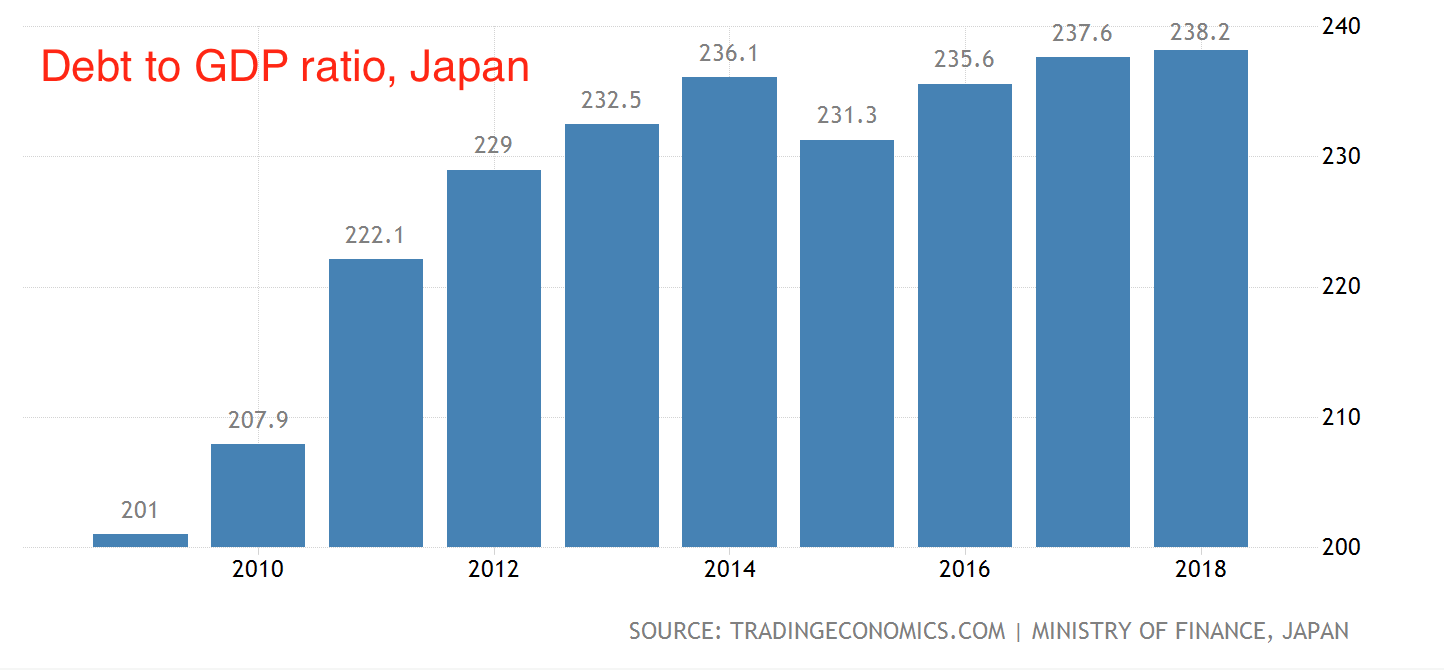

Fiscal policy can effectively complement the actions of the Central Bank in protecting against external risks, the global lender said, providing an implicit recommendation that the government can break the ceiling in borrowings, the level of which has been floating since 2014 at about 237% of GDP.

The rhetoric that there is an untapped potential in creating demand by a government (through fiscal spending) has become more frequent lately. This should be taken as a concrete hint about the depletion of the interest rate channel in stimulating economic activity, primarily in EU and Japan, where low rates were largely ineffective at pursuing price stability.

At the meeting in October, the Bank of Japan said that the likelihood of loss of momentum in achieving price stability has stopped rising, but the probability itself worries officials. The Central Bank confirmed the continued enormous participation in the market of various assets: JGB purchase volumes remained unchanged at 80 trillion yen per year, ETF purchase volumes (essentially stock market purchases) at 6 trillion yen per year, and securities trusts in real estate at 9 trillion yen per year. According to the head of the bank Haruhiko Kuroda, an increase in the supply of long-term government bonds can solve the issue of an excessive decrease in long-term rates due to QE, which again implies an increase in government debt.

The IMF suggests replacing the inflation target with the inflation target range, pointing to the pressure of technological innovation, which is a serious obstacle to inflation growth in the long run. As you know, a series of failures of the central bank in terms of announcing forecasts - inability to achieve them, leads to a loss of public confidence in the policy, which further reduces the sensitivity of expectations to the efforts of the Central Bank. At the same time, increased supply of credit to the economy reduces the risk premia, which creates a dangerous imbalance - the hunt for yield, including in foreign assets. The Central Bank thus eliminates the positive long-term effect in the form of a devaluation of the yen, since during a period of risk aversion, capital returns to Japan creating increased demand for it.

The next meeting of the Bank of Japan is scheduled for December 18, which promises a change in policy settings in accordance with IMF recommendations.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.