Chart of the Day AUDUSD

Chart of the Day AUDUSD

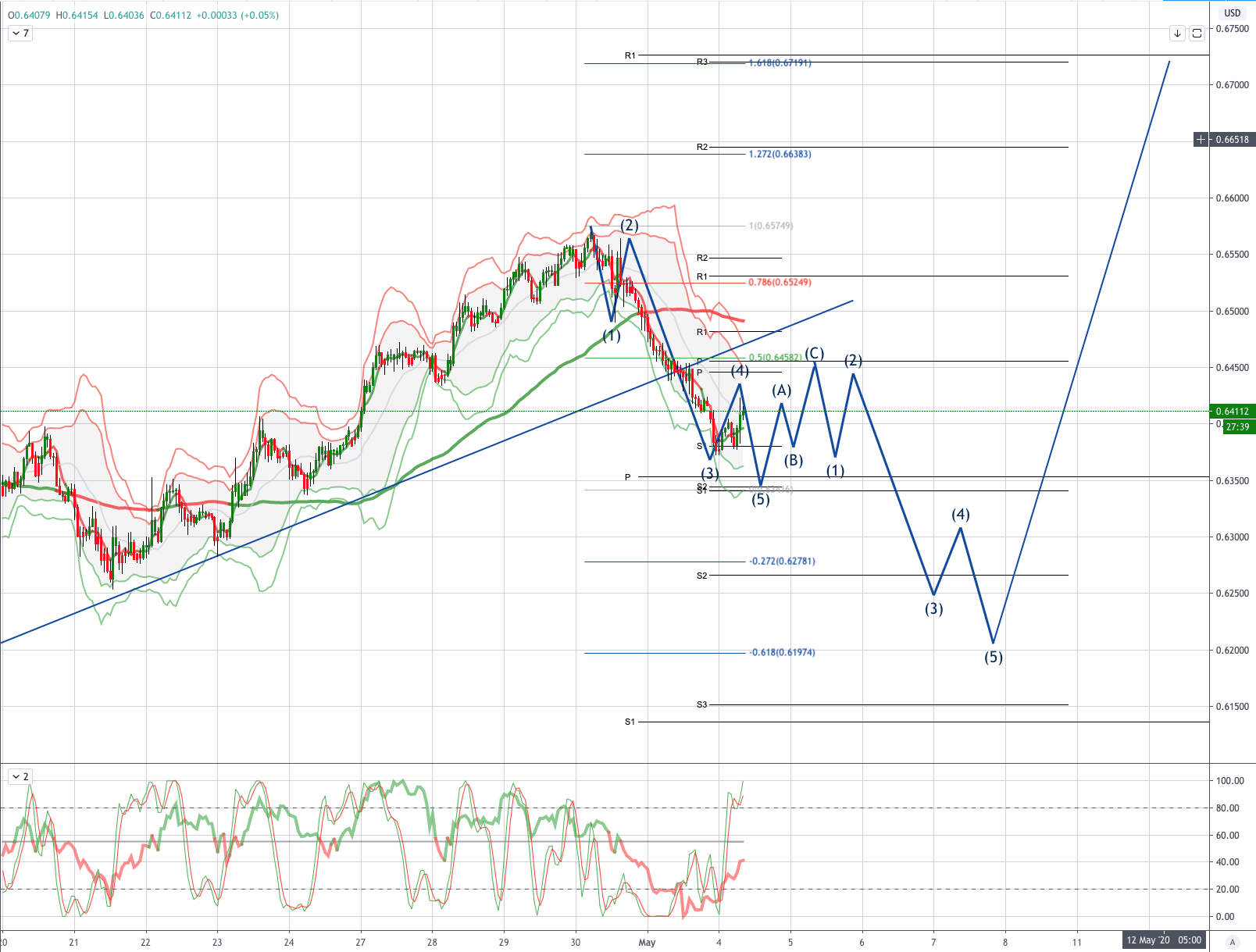

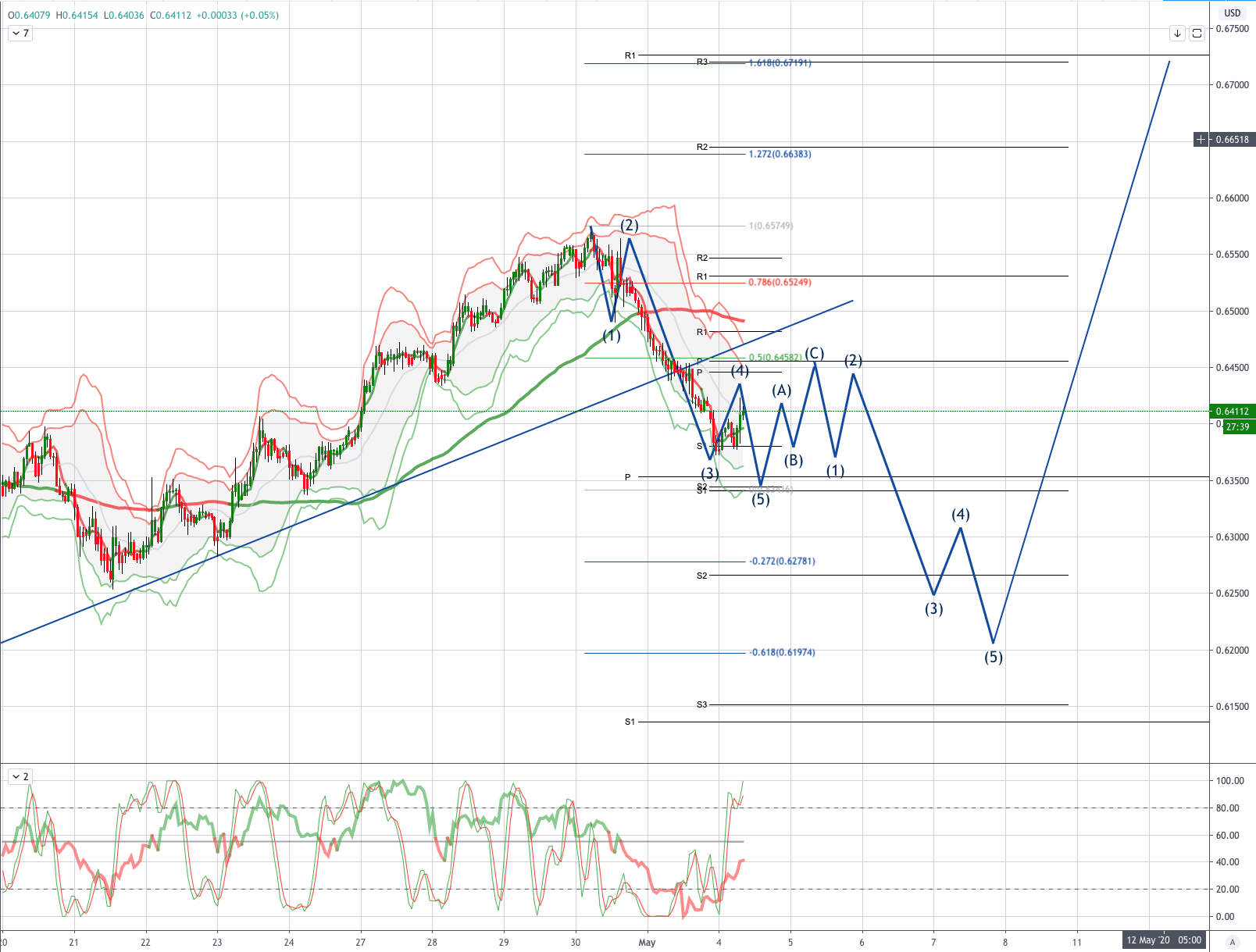

AUDUSD Bearish - Probable Price Path

Global risk appetite is likely to start on the back foot today on news that North and South Korean troops exchanged fire at the DMZ whilst US Secretary of State Michael Pompeo accused China saying that there is “enormous evidence” the Covid-19 started in a Wuhan facility and president Trump is weighing a Chinese stock ban for $50b of federal savings. The S&P500 retreated 2.8% on Friday amid a relatively grim earnings picture from Amazon.com, Apple and Exxon Mobil which pushed the S&P to its second straight weekly loss after rallying 12.7% in April. VIX rose to 37. Meanwhile UST bonds gained with the 10-year bond yield down to 0.61%. The 3-month LIBOR eased further to 0.55613% while LIBOR-OIS narrowed to 51bps. Elsewhere, India extended its nationwide lockdown for two weeks from 4 May.

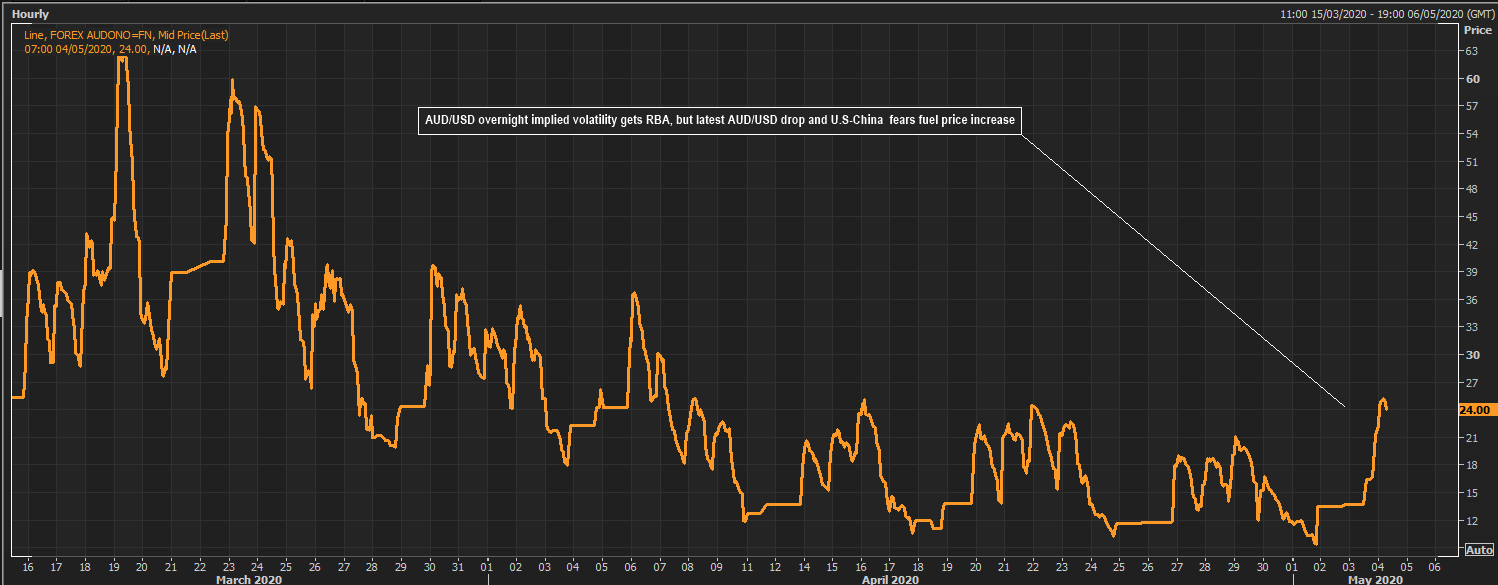

Overnight (Tues 10-am New York cut) AUD/USD options get RBA rate decision Implied volatility high since early April at 24.0 vs average 18.0 last week Premium/break-even for vanilla straddle now 64 vs 48 pips either direction. However, raised US-China tensions fuelled volatility risk Friday with the benchmark one month implied vol 3.0 above last week's crisis low, now 14.25 This suggests that U.S-China tensions are a bigger threat to AUD volatility than RBA. RBA expected unchanged, more focus will be on the quarterly fiscal statement Friday

From a technical and trading perspective, the AUDUSD chart has now flipped bearish premised on the closing breach of the near term volume weighted average price. On the intraday charts we can identify a potentially bearish impulse leg lower. With this price structure in play bearish exposure should be rewarded on a move back towards .6460 in preparation for another leg lower to complete a broader corrective cycle towards the .6200 area. A move back through .6550 would negate the bearish thesis and suggest a continuation of the uptrend targeting .6700 the primary upside objective.

From a technical and trading perspective, the AUDUSD chart has now flipped bearish premised on the closing breach of the near term volume weighted average price. On the intraday charts we can identify a potentially bearish impulse leg lower. With this price structure in play bearish exposure should be rewarded on a move back towards .6460 in preparation for another leg lower to complete a broader corrective cycle towards the .6200 area. A move back through .6550 would negate the bearish thesis and suggest a continuation of the uptrend targeting .6700 the primary upside objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!