Chart of the Day EURUSD

Chart of the Day EURUSD

EURUSD - Probable Price Path

News of more US states re-opening for business led Wall Street higher, with the S&P500 adding 0.9% overnight led by healthcare (Pfizer) and energy stocks (Chevron Corp) as Brent topped $30 per barrel for the first time since 15 April, whereas Disney reported a 37% fall in 2Q operating income amid the Covid-19 outbreak and Airbnb will cut 25% of its workforce. Meanwhile, UST bonds ended mixed with the 10-year bond yield at 0.66% amid the T-bill deluge (more than $1.5t since start of April). The 3- month LIBOR eased again to 0.474% (lowest since December 2015) and LIBOR-OIS narrowed to 43bps. The US is considering the extension of some China tariff exclusions.

Germany’s constitutional court outlined some red flags with regards to the ECB’s existing asset purchase programmes and directed that the ECB could continue but needed to carry out a “proportionality assessment” within the next three months. This will need to show that the ECB is buying government bonds consistent with the “capital key” (reflecting each country’s share in population and GDP) and isn’t straying into monetary financing of governments. The ruling sets the scene for a legal challenge against the ECB’s new €750b pandemic emergency purchase programme, which has even looser limits than previous asset purchase programmes. It doesn’t change the fact that euro area governments need to show some unity and step up with a fiscal recovery plan to support the economy, taking the pressure off ECB policy.

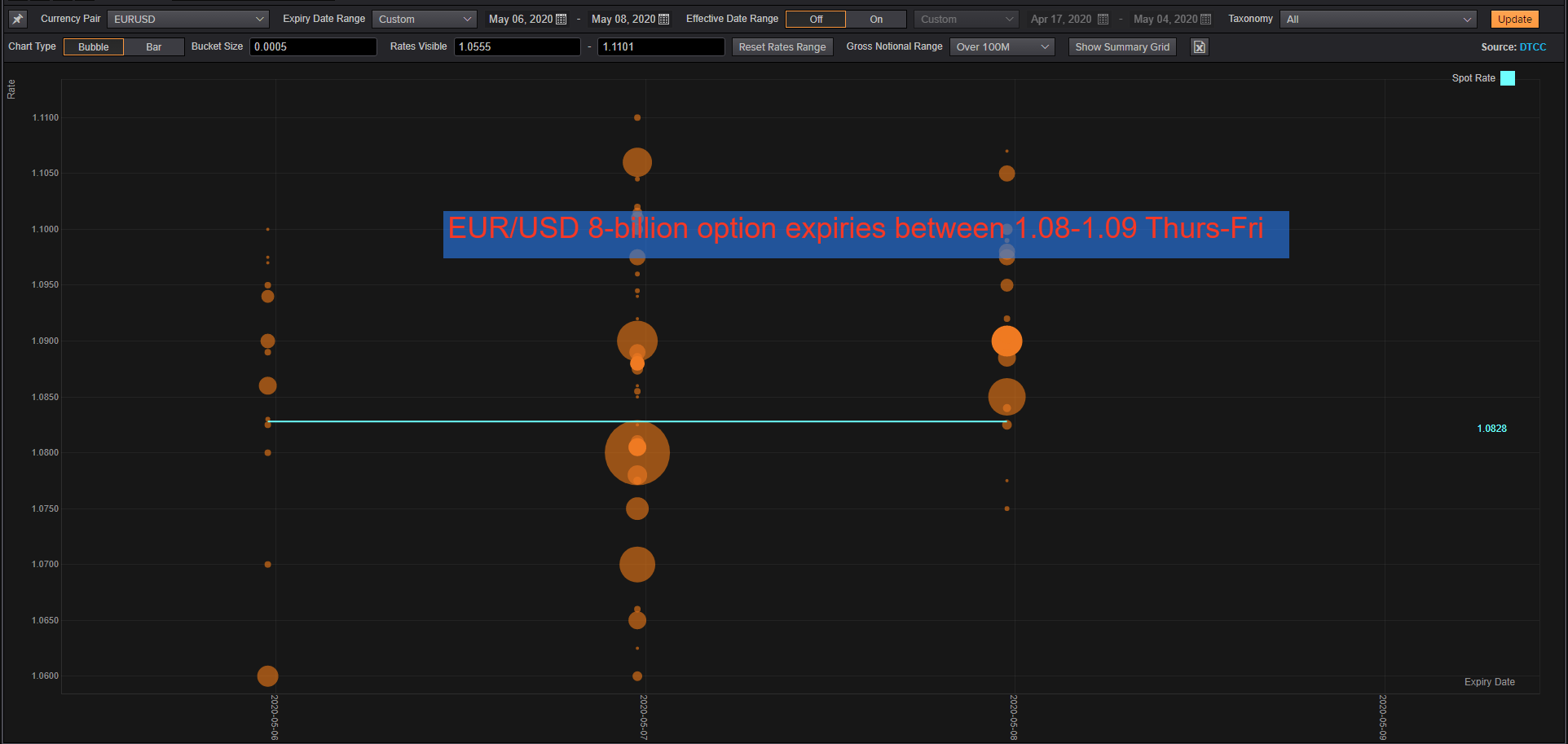

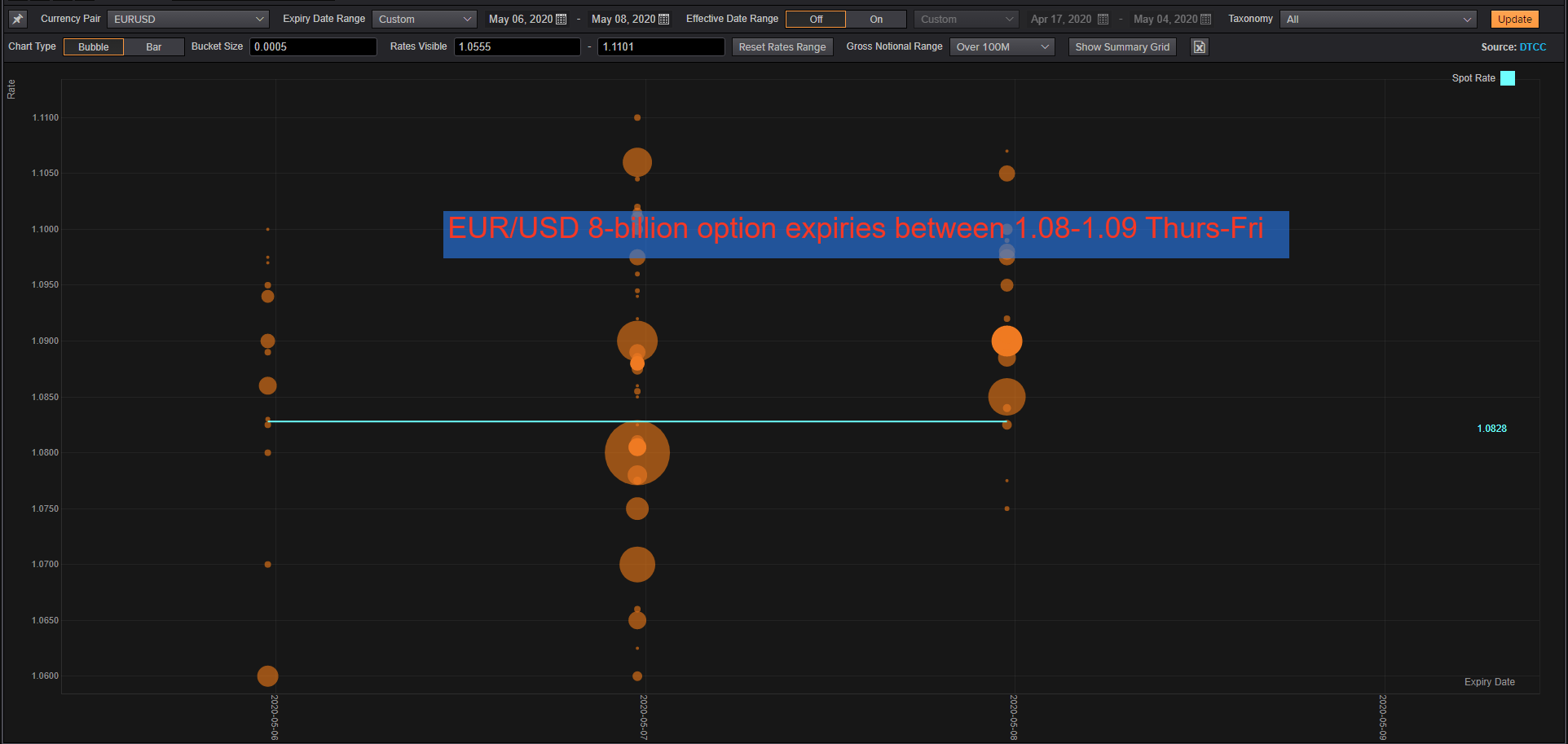

DTCC data shows massive EUR 5-billion EURUSD option expiries Thursday. They are evenly split between 1.0800-10, and 1.0875-1.0900 Expiry is 10-am NY cut Thursday. On Friday 1-bln 1.0850, 2-bln 1.0885-1.0910 Without a renewed catalyst - expiries can help define 1.08-1.09 range.

From a technical and trading perspective, the EURUSD continues to trade within the contracting triangle, the resolution of this pattern will offer some significant trading opportunities. If EURUSD bulls can defend the 1.0750 and print a key reversal pattern from the triangle support then bullish exposure should be rewarded initially targeting triangle resistance at 1.0980 enroute to an ultimate upside objective of 1.1233. A failure to defend the triangle support will see bearish exposure rewarded as bears target the interim equality and prior cycle lows at 1.0630, through here and 1.03 becomes the primary downside equality objective

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!