Chart of the Day US500 (S&P500)

Chart of the Day US500 (S&P500)

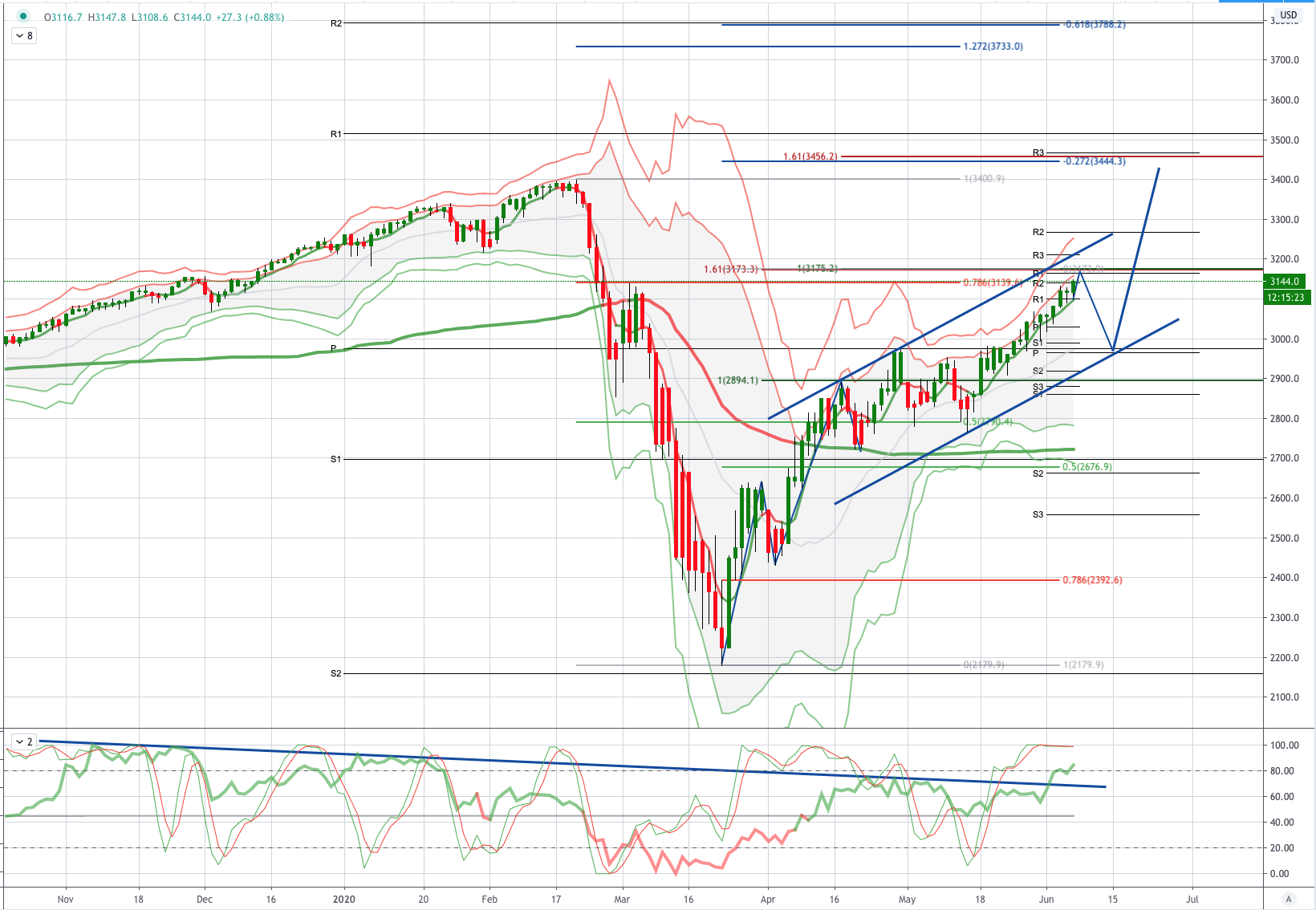

US500 (S&P500) Pivotal 3140/75 test - Probable Price Path

The ECB delivers with a bigger-than-expected EUR600b addition to its emergency bond purchase program and also extended the duration till at least end 2021. ECB chief Lagarde warned of an “unprecedented contraction” and that “the improvement has so far been tepid” so “action had to be taken”, but sidestepped the issue of whether to include junk rated debt in its purchases. Nevertheless, Italian bond yields fell on the upside surprise. The ECB slashed its 2020 growth forecast down to -8.7% before seeing a 5.2% rebound in 2021, whereas inflation will only average 1.3% by 2022.

Over in the US, the S&P500 slipped for the first time in five sessions by 0.34% with declines led by real estate and utilities even though US initial jobless claims fell from 2.13m the previous week to 1.88m to bring the four-week average to 22.4m. VIX climbed to 25.81 while UST bonds bear-steepened again with the 10-year yield up 7bps to 0.82%. The 3-month LIBOR eased to 0.31763%.

This afternoon’s monthly US labour market report due at 1.30pm will be the focus for today. Last month’s April figures showed nonfarm payrolls plunging by 20.5 million and the unemployment rate jumping up to 14.7%. A further deterioration in the labour market is expected in May, but less severely than in April. Look for nonfarm payrolls to have fallen by 10 million, while the consensus median prediction is for a 7.5 million decline. Anticipate the unemployment rate to rise again to 20% (consensus: 19.1%), which would be the highest level since the Great Depression. The risk to this payrolls forecast is probably skewed to a smaller decline after the ADP on Wednesday reported a fall in private payrolls of ‘just’ 2.8 million in May, much less than anticipated. Nevertheless, while the ADP mirrored the official figures in April, it remains to be seen whether it will do so again in May. In particular, the weekly initial jobless claims data point to a large increase in newly unemployed (although less than in April) while survey evidence points to weak hiring. Overall, broader evidence suggests payrolls may have fallen more than the ADP report suggests

From a technical and trading perspective, price is testing the pivotal 3140/75 potential reversal zone (PRZ), bears will be watching for supply in this area to play for a correction to the surge higher from the March lows. This PRZ represents the 78.6% retracement of the entire pandemic decline and the 1.61 Fibonacci extension of the initial structure high and low printed in early April, it also represents the three equal legs higher from the March lows. A close back below the near term volume weighted average price at 3100 should see bearish exposure rewarded initially targeting a test of projected ascending trendline support sighted at 3000. A close through 3200 negates the corrective thesis and suggest a continued grind higher to retest all time highs

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!