Chart of the Day USDCHF

Chart of the Day USDCHF

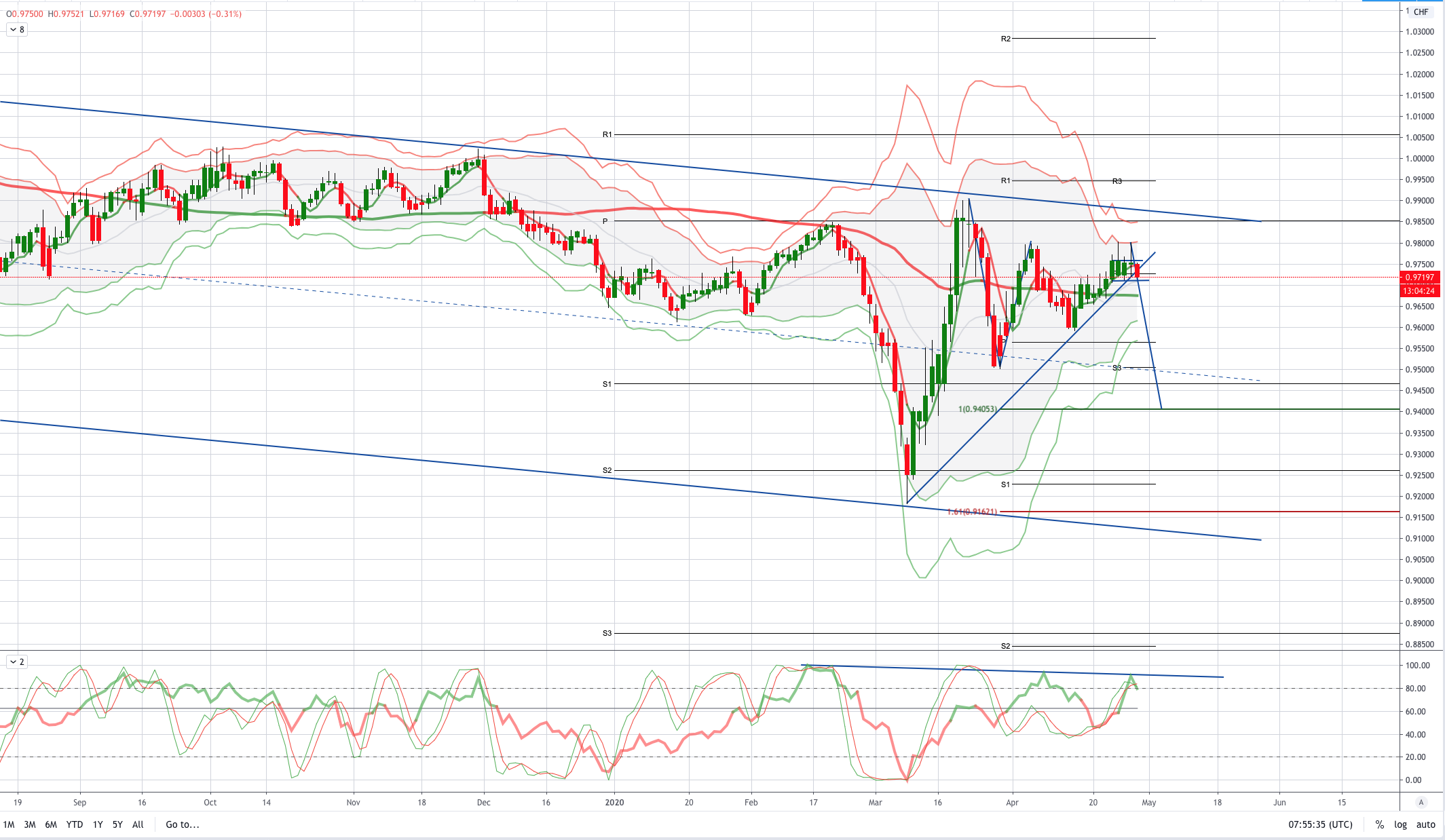

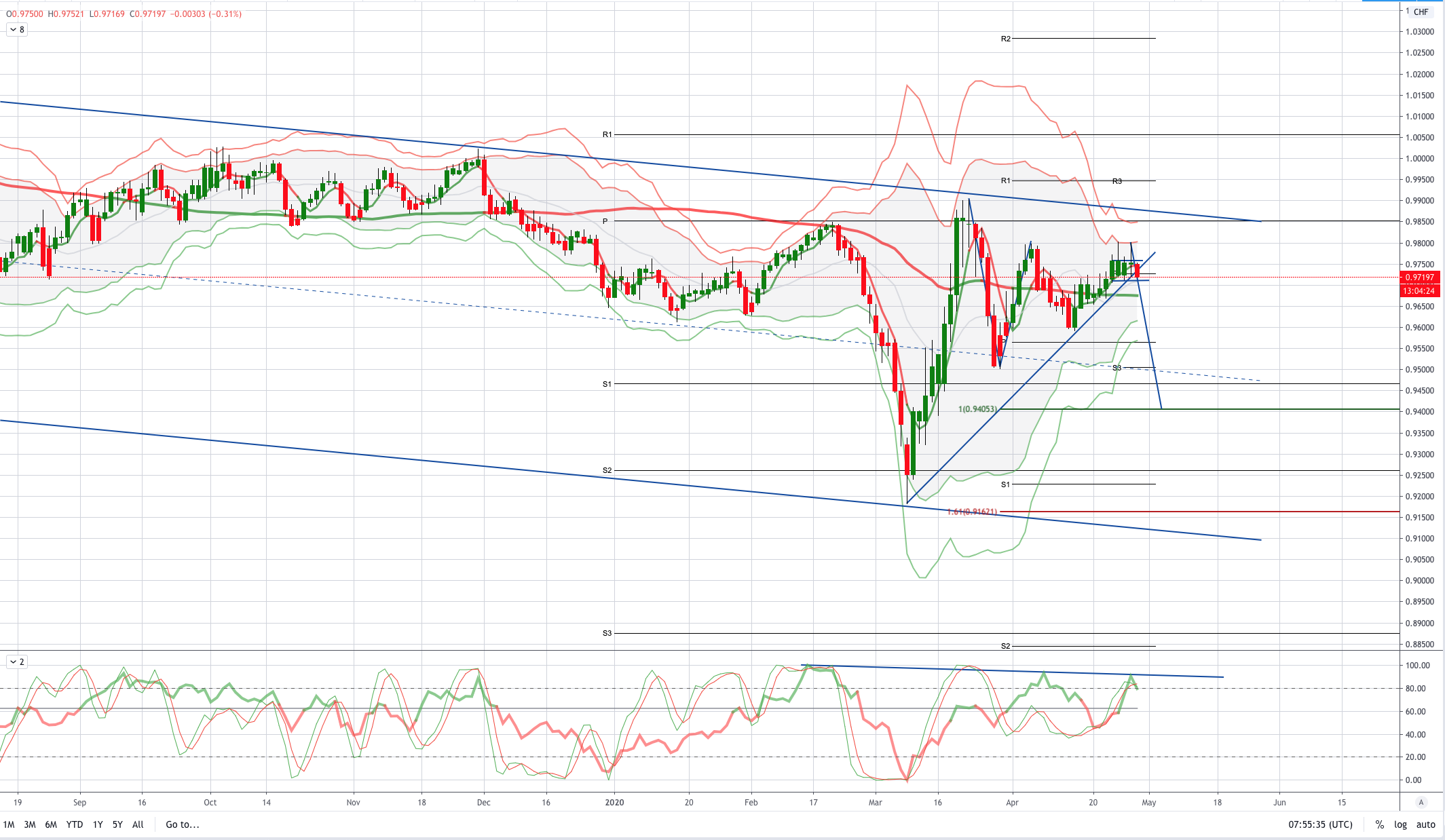

USDCHF Bearish - Probable Price Path

Global risk appetite wavered yesterday with Wall Street surrendering early gains to close lower. Covid-19 infections crossed 1 million cases in the US, and President Trump has signed an executive order to require meat-processing plants to stay open. US earnings picture was also mixed – Alphabet beat with $33.71b but warned that March ads slowed, while Starbucks’s same-store sales fell 10% globally (China: -50%) but tips 90% of stores to re-open by June, and Caterpillar and PepsiCo refrained from giving any 2020 guidance. The S&P500 fell 0.5% with VIX up to 34, while UST bonds rallied and the 10-year bond yield fell to 0.61%. The 3- month LIBOR eased further to 0.7601% while LIBOR-OIS narrowed to 69bps.

Note Swiss-franc bears hope a mooted delay in publishing the U.S. Treasury's semi-annual currency report stretches for many weeks. That would reduce the risk of the Swiss National Bank facing fresh U.S. heat over its currency policy – heat which could re-inflate the CHF. The franc rose in value after the U.S. added Switzerland to a list of countries whose currency practices it finds worrisome when it published its most recent report, on Jan. 13 (the publication of that report had itself been delayed). On Monday, two sources at Taiwan's central bank told Reuters that the next report would also be delayed (the reports are normally released every April and October) .That news helped lift EURCHF away from 1.0500. SNB FX intervention (selling CHF) helped keep EURCHF above 1.0500 last week and the week before, when it plumbed a 57-month low of 1.0509 (EBS). The cross extended north to a four-week high of 1.0610 on Tuesday.

From a technical and trading perspective, the USDCHF has made a couple of attempts to take out stops above the .9800 handle and failed twice. On a closing basis the pair has repeatedly failed at the .9758 level. Today’s reversal is eroding the trendline support from the year to date lows, as such bearish exposure should be rewarded on a breach of the.9700 handle, initially targeting a move back to test .9600 a failure for buyers to defend this level will open a move back to test the .9500 level, through here opens the primary equality objective sighted at .9400. Only a close through .9758 would negate the bearish thesis.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!