Chart of The Day Nikkei225

Chart of The Day Nikkei225

Nikkei225 Year Treasury Note Probable Price Path & Potential Reversal Zone

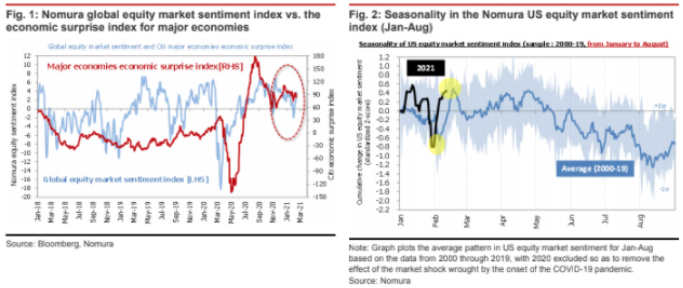

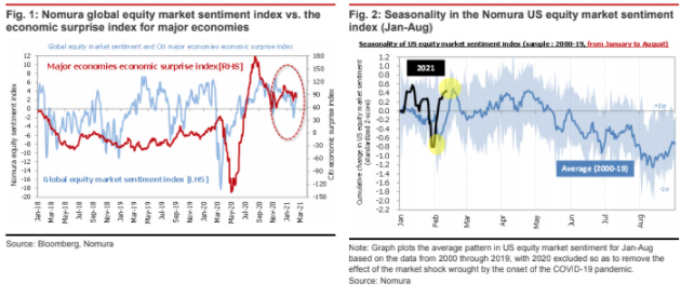

Nomura’s Quant Insight desk issued an interesting note last week highlighting two potentially significant seasonal patterns that could be the catalyst for a near term correction in equity markets

“Nomura Quants Insight

Seasonal selling of equities starting next week is a risk to consider Two overlapping seasonal patterns; key thresholds for CTAs’ long positions in US & Japanese equities Global equity markets are treading water. We think some caution is warranted, as the period from the middle of next week through the end of February tends to bring a round of technical position-trimming.

Some quick-moving investors have established short positions in Japanese and European equities as hedges, but they do not seem to be expecting any major change in fundamentals.

We think that equities could conceivably fall to as low as 3,725 for the S&P 500 and 28,150 for the Nikkei 225 between now and the end of February, but we ultimately expect any dip in the market to be brief and shallow”

Nomura’s note is timely given the technical and trading perspective that is developing in the market. It is noteworthy that the Nikkei225 is poised to test a pivotal intersection of potential trend resistance. We have a potential reversal zone from 30845 to 31210, this area represents the weekly and monthly R3 pivot points and it also represents the intersection between two projected ascending trendline resistance. Counter trend players should be on watch for bearish reversal patterns in this zone especially given the additional confirmation of momentum divergence that is currently developing. Initial downside objectives will be the interim ascending trendline support sited at 29000 a breach here would open a test of the primary trendline support sited at 2700

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!