Copper Traders Watching Trump & Xi

Copper Remains Weak For Now

Copper prices remain down from recent highs as traders wait cautiously for further updates on the US/China trade story. Following fresh threats from Trump last week against China, risk markets tumbled with copper futures sinking around 9% from the month’s highs. The market has been steadily recovering higher after the seismic decline seen in early summer. However, the recovery could now be in peril if the US and China return to all out trade war on the back of the 90-day truce which had been agreed between the two economic superpowers.

Trump/Xi In Focus

Looking ahead, focus now will be on whether we see any fresh discussion/negotiation between the two sides. Trump and Xi were scheduled to meet around the end of the month on the side of the Korean APEC summit. With the 90-day truce window due to expire on Nov 10th, a meeting in that timeframe could spare markets the impact of a return to tariffs. On the back of recent threats from Trump, if the truce isn’t extended or a deal isn’t done by that time, US tariffs on Chinese goods are due to rise to 145% with China set to retaliate aggressively. In this scenario, copper prices are vulnerable to another heavy move lower as broader risk appetite evaporates.

Bullish View

However, if rhetoric turns less hostile and the two leaders do meet, this should help copper price stabilise near-term with prices set to rise if the current tariff suspension window is extended. Clearly the best-case scenario for bulls would be the agreement of a trade deal which would see copper prices sharply higher amidst a broad rally in risk assets.

Technical Views

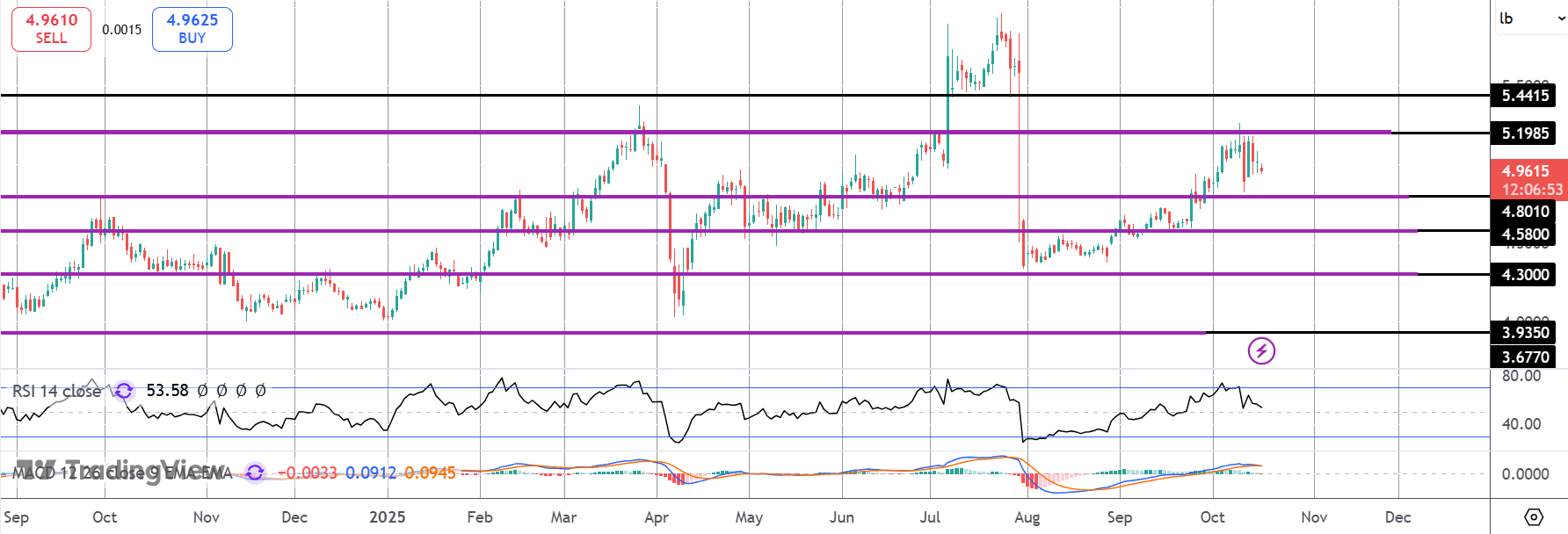

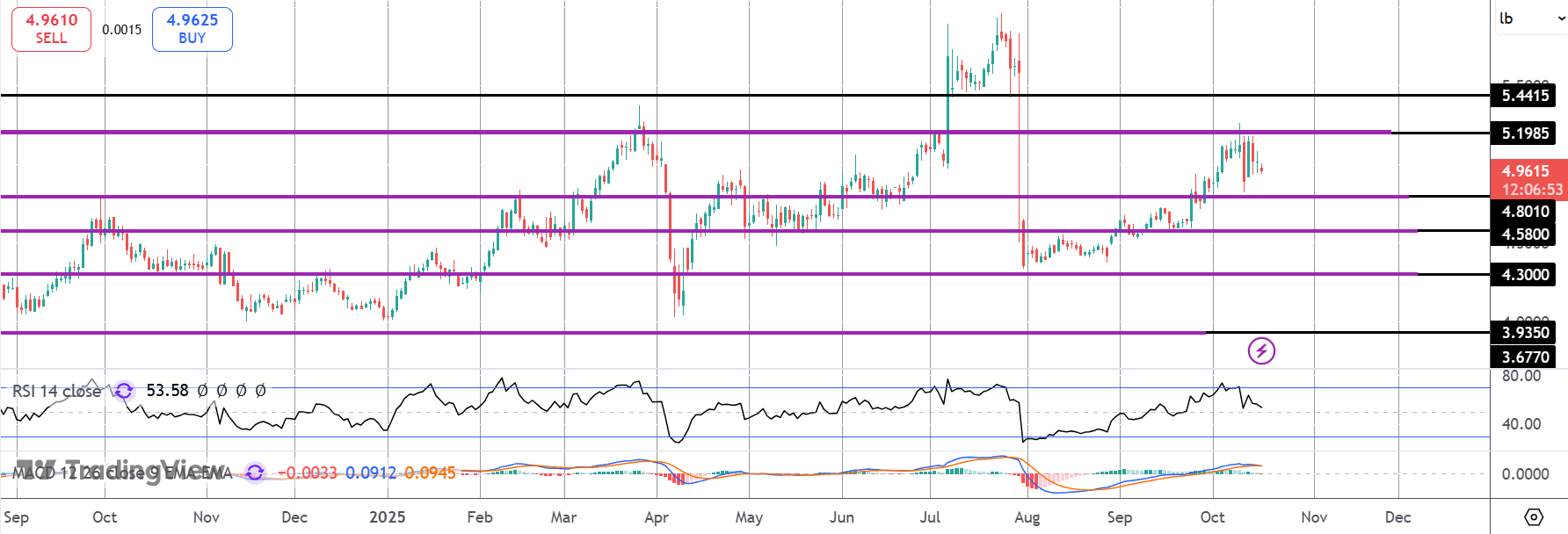

Copper

The rally in copper has stalled for now into the 5.1985 level with price since correcting lower. While 4.8010 holds as support, however, the focus remains on an eventual return to upside with 5.4415 the next target for bulls. Should we break lower here, 4.5800 is the next support level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.