Daily Market Outlook, April 16, 2020

Daily Market Outlook, April 16, 2020

The Asian equity market is mostly down this morning following a fall yesterday on Wall Street. The declines followed very weak US economic data for March and April (including big falls in retail sales and industrial production). The number of confirmed global coronavirus cases is approaching 2.1 million. However, the pace of the increase continues to slow in a number of countries.

Germany was the latest to announce some easing of lockdown measures with some ‘non-essential’ shops reopening from next week. President Trump suggested that some US states may start to before the end of the month and that he would issue guidelines to state governors today. In contrast, Belgium has announced an extension of its lockdown to early May. The UK government is expected to confirm an extension to 7th May today.

Today’s UK and Eurozone data calendars are light on relevant economic data. In the Eurozone, industrial production for February will tell us nothing about the impact of the pandemic. Potentially of more interest, however, are EU March car registrations, which will be released early Friday. In the UK, the Bank of England’s Q1 Credit Conditions survey may paint a reassuring picture of the financial environment before the pandemic but will say little about the current situation. More timely is the Office for National Statistics weekly update on the coronavirus’ economic effect, although so far these reports have had no financial market impact.

In the US, weekly initial jobless claims are again expected to rise sharply. The last three weeks have seen a collective increase of more than 16 million and another 5 million plus gain is likely this week. March housing starts and the Philadelphia Fed’s April business survey will also provide timely updates. Both are forecast to fall sharply.

BoE policymaker Tenreyro and three US Federal Reserve policymakers are scheduled to give speeches on the impact of pandemic. Potentially of most interest amongst the Fed speakers will be New York Fed President Williams who is seen as a key figure on its monetary policy setting committee.

Early Friday China will release Q1 GDP data along with March releases for retail sales, industrial production and fixed investment. The GDP figures are expected to show that economic activity fell very sharply in Q1. However, markets will also be watching the March data for signs of a rebound as lockdown restrictions started to be eased.

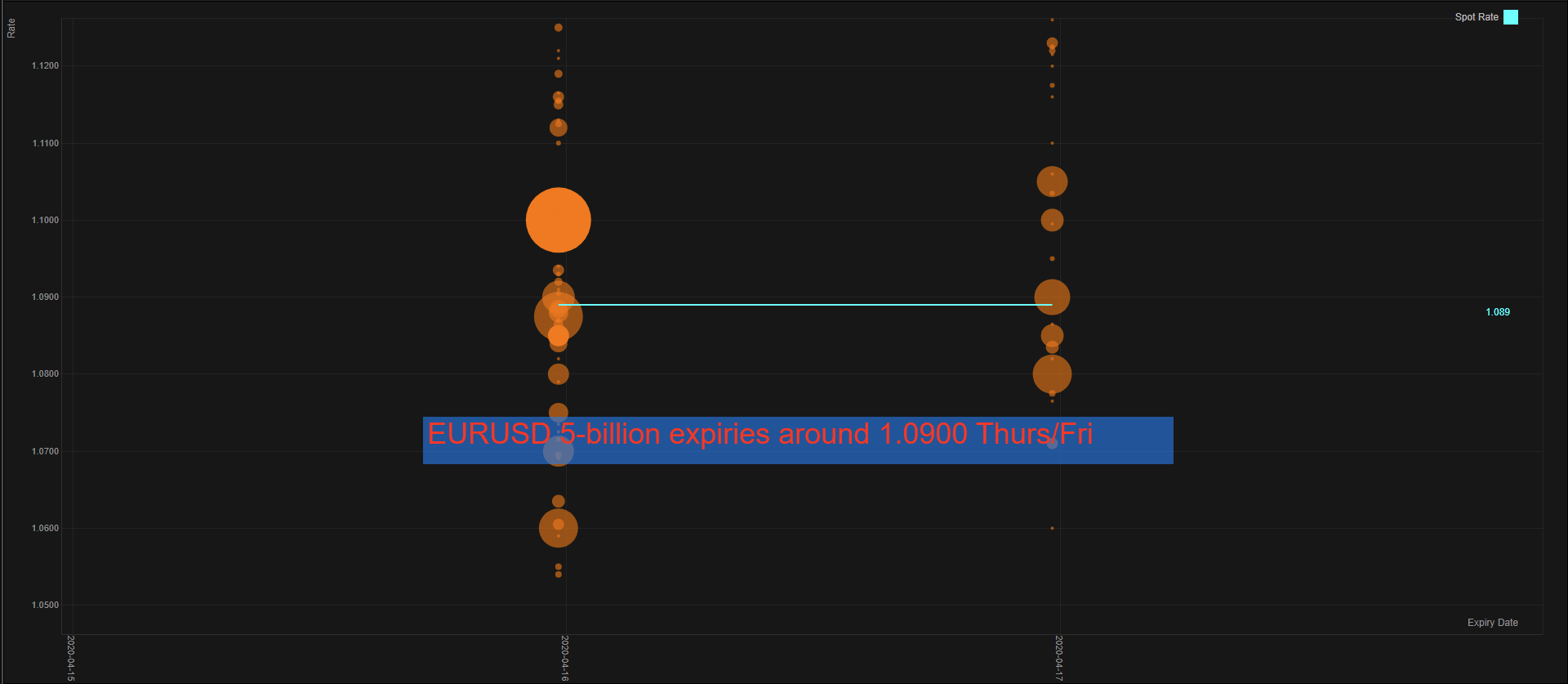

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0800 (686M), 1.0840-50 (1.5BLN), 1.0875 (1.5BLN), 1.0880-85 (1.1BLN), 1.0900 (950M), 1.0920 (282M), 1.0930-40 (600M), 1.0995 (550M), 1.1000 (2.1BLN), 1.1025 (450M)

- USDJPY: 107.25-30 (850M), 108.00 (1.8BLN), 108.50 (2.2BLN)

Technical & Trade Views

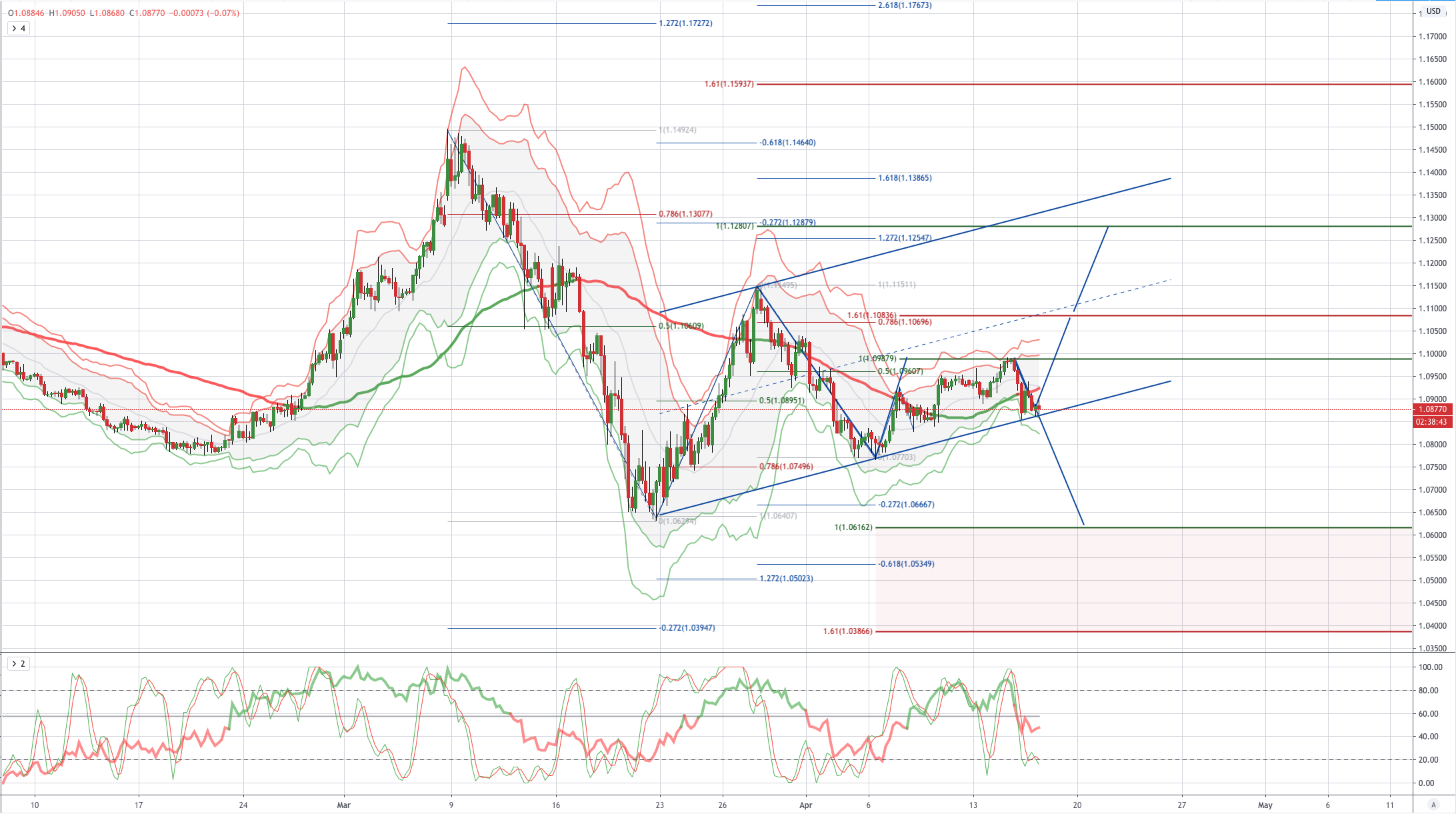

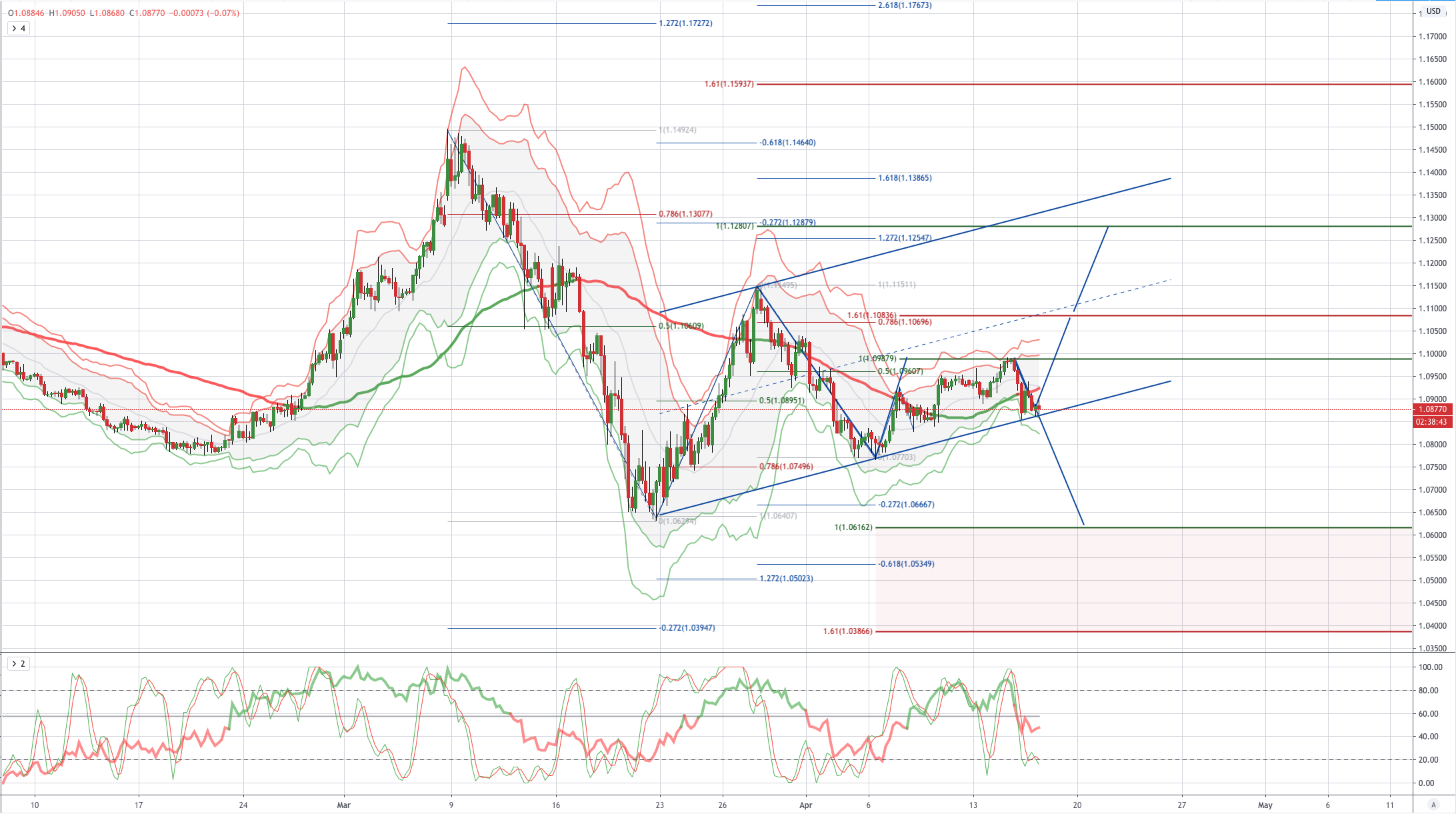

EURUSD (Intraday bias: Bullish above 1.09 targeting 1.1250 Bearish below targeting 1.0630 )

EURUSD From a technical and trading perspective, daily chart has flipped bullis has per the near term volume weighted average price, the anticipated move through 1.890 has injected further upside momentum challenging the first decision point at 1.0960/80, through this area opens a test of pivotal 1.1070/80, if bulls can sustain a breach here then 1.1250/80 is the primary upside objective. On the day only a close sub 1.09 and a breach of 1.0850 would concern the bullish bias.UPDATE 5 billion EURUSD option expiries 1.0875-1.0900 Thurs-Fri. Bulk of those roll off Thursday 10-am New York. Technically the daily chart has flipped bearish a breach of yesterday's lows opens a retest of March lows

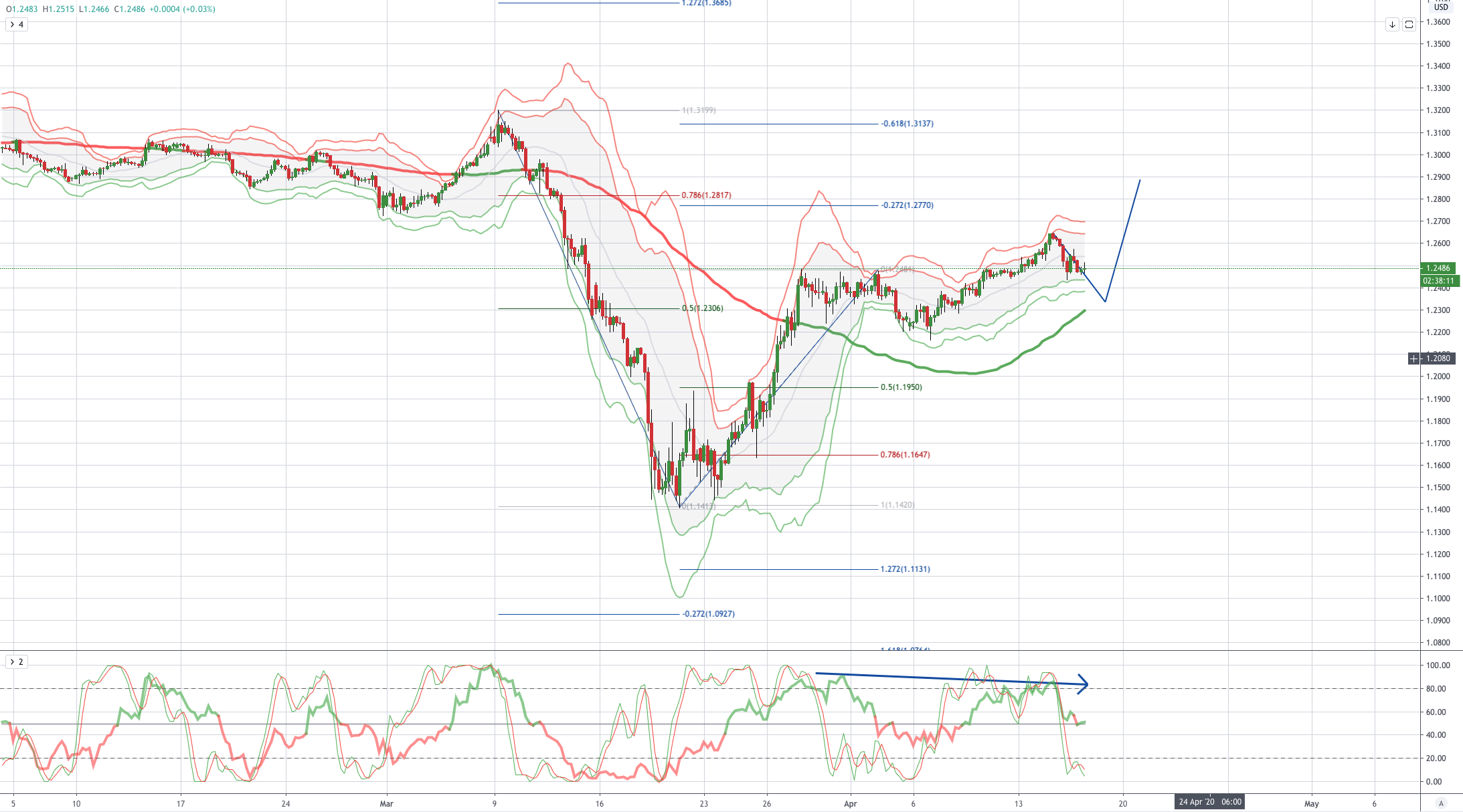

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a move back through 1.24 would suggest a broader corrective phase to unwind near term overbought momentum, 1.20/1.1950 will be pivotal this week, if bulls fail to defend this area, a deeper decline could ensue to test bids and stops below 1.17 NO CHANGE IN VIEW

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, double bottom delays downside objective with a whipsaw back to 110 before lower again. Through 107 would suggest downside targets are directly in play NO CHANGE IN VIEW

AUDUSD (Intraday bias: Bullish above .6200 targeting .6430)

AUDUSD From a technical and trading perspective, as .6200 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6250 would concert the bullish bias. NO CHANGE IN VIEW

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!