Daily Market Outlook, April 17, 2020

Daily Market Outlook, April 17, 2020

Major equity indices tracked higher during the Asian market session after President Trump outlined plans for the US economy to reopen. Sentiment was also supported by claims of a successful trial for an experimental drug to combat the virus.

Markets shrugged off a sharp fall in China Q1 GDP of 6.8%y/y, the first decline for decades, and below the consensus forecast for a fall of 6.0%. There were more positive signs in China’s March industrial production figures which showed a much smaller year-on-year decline of 1.1%, as factories restarted. Retail sales, however, were weaker than expected at ‑15.8%, although less weak than the first two months of the year.

The economic calendar thins out today. Earlier this morning, European car sales were reported down 52%y/y in March The final reading of Eurozone March CPI inflation will attract limited attention and is expected to confirm preliminary ‘flash’ estimates. That revealed a sharper-than-expected fall in the headline measure to 0.7%y/y from 1.2%y/y in February, mostly driven by a significant decline in energy prices, consistent with developments in world markets. It looks like energy prices will continue to drag headline inflation lower in April. Core inflation, excluding food and energy, also edged down to 1.0%y/y in March from 1.2%y/y in February. We will get more details on the source of that decline (particularly within services prices), which may inform on the early impact of the coronavirus on domestic inflation pressures.

The US Conference Board leading index for March is also released today, but it contains little in the way of new information. Nevertheless, it is predicted to fall by more than 7% on the month, concurring with other indicators that the scale of the current economic downturn exceeds that of the global financial crisis of just over a decade ago. The previous record monthly decline for the leading index was ‑3.4% in October 2008.

Central bank speakers today include the Fed’s Bullard taking part in a seminar on “Reinventing Bretton Woods” and the ECB’s Rehn speaking on a webinar on “The World Economy Transformed”.

US initial claims for state unemployment benefits dropped 1.370 million to a seasonally-adjusted 5.245 million for the week ending 11 April. Data for the prior week was revised to show 9,000 more applications received than previously reported, taking the tally for that period to 6.615 million. A total of 22.034 million people have filed claims for jobless benefits since 21 March, representing about 13.5% of the labour force.

Philadelphia Fed President Patrick Harker said on Thursday that US authorities should not rush to reopen the economy in order to avoid a potential second wave of coronavirus infections and said the central bank would keep interest rates low until the U.S. economy fully recovers.

New York Fed President John Williams said on Thursday that the Federal Reserve’s efforts to support the markets and economy through the COVID-19 crisis are beyond anything it has done before. Williams said the Fed now has to make sure those moves perform as they are intended. Meanwhile, Dallas Fed President Robert Kaplan said Thursday in a Bloomberg TV interview with David Westin that a recovery will be slow to take hold once social-distancing measures are rolled back.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0800 (1.7BLN), 1.0835-50 (1.9BLN), 1.0900 (1.2BLN) 1.0950 (400M), 1.1000 (770M), 1.1050 (1BLN)

- GBPUSD: 1.2100 (765M), 1.2700 (320M)

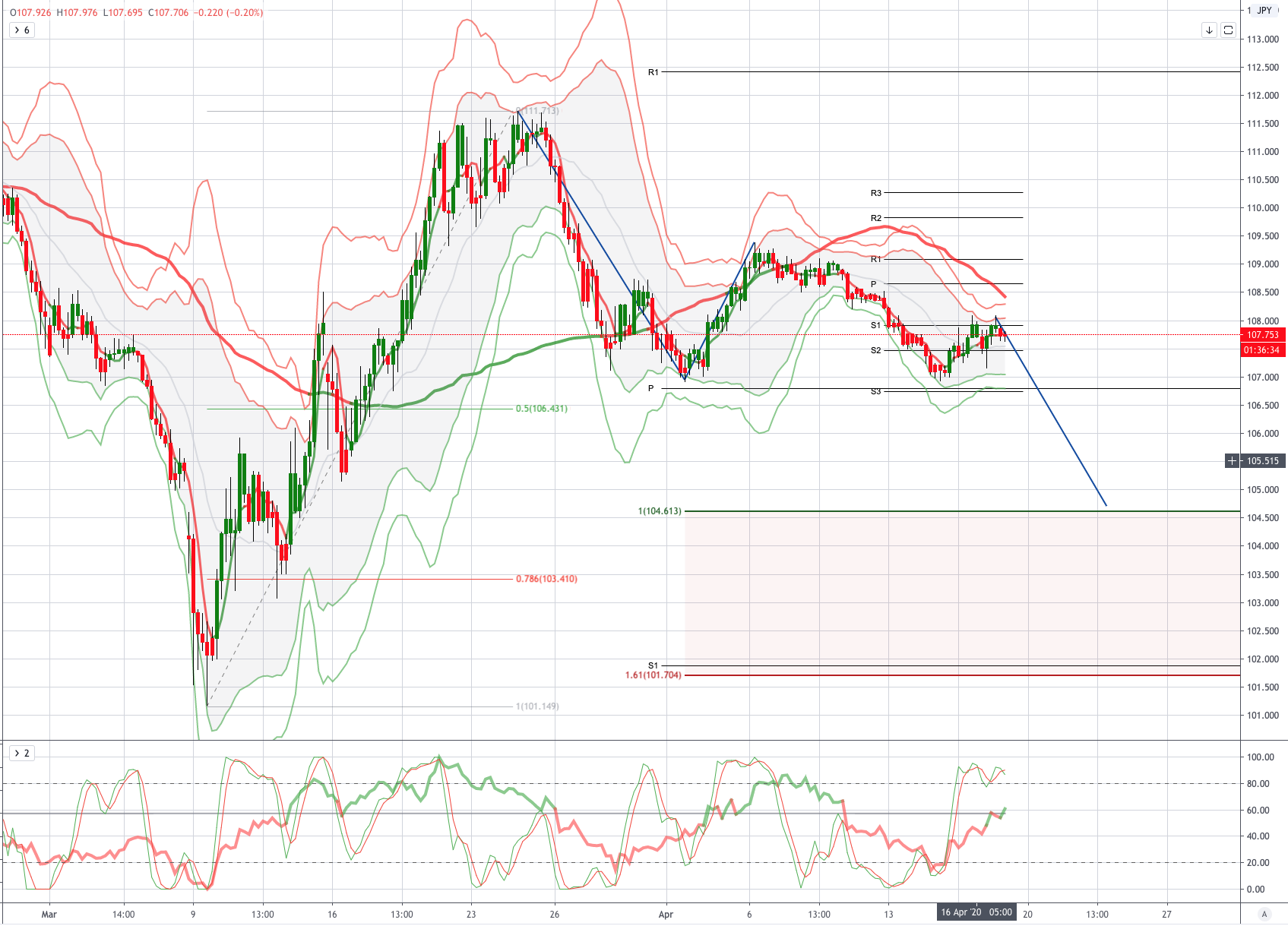

- USDJPY: 107.00 (2.1BLN), 108.00 (211M), 109.40 (600M)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.09 targeting 1.1250 Bearish below targeting 1.0630 )

EURUSD From a technical and trading perspective, daily chart has flipped bullis has per the near term volume weighted average price, the anticipated move through 1.890 has injected further upside momentum challenging the first decision point at 1.0960/80, through this area opens a test of pivotal 1.1070/80, if bulls can sustain a breach here then 1.1250/80 is the primary upside objective. On the day only a close sub 1.09 and a breach of 1.0850 would concern the bullish bias.UPDATE 5 billion EURUSD option expiries 1.0875-1.0900 Thurs-Fri. Bulk of those rolled off Thursday 10-am New York. Technically the daily chart has flipped bearish a breach of yesterday's lows opens a retest of March lows UPDATE the breach of the Wednesday reversal candle confirms the downside objective only a daily close back through 1.09 would delay downsdie objectives.

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a move back through 1.24 would suggest a broader corrective phase to unwind near term overbought momentum, 1.20/1.1950 will be pivotal this week, if bulls fail to defend this area, a deeper decline could ensue to test bids and stops below 1.17 NO CHANGE IN VIEW

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, double bottom delays downside objective with a whipsaw back to 110 before lower again. Through 107 would suggest downside targets are directly in play NO CHANGE IN VIEW

AUDUSD (Intraday bias: Bullish above .6200 targeting .6430)

AUDUSD From a technical and trading perspective, as .6200 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6250 would concert the bullish bias. NO CHANGE IN VIEW

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!