Daily Market Outlook, April 22, 2020

Daily Market Outlook, April 22, 2020

The Asian market is mixed this morning after a second consecutive day of declines on Wall Street. Futures prices currently suggest that US markets prices will open higher.

The turmoil continues in the oil market with very volatile price movements. Brent crude is currently trading close to $16bbl, more than a two-decade low.

US President Trump and UK PM Johnson spoke yesterday about a coordinated response to the pandemic. Meanwhile, a number of southern US states including Georgia, South Carolina and Tennessee have announced plans to scale back restrictions. Spain has said that it will allow children under 14 to leave their homes from 26th April, while Italian PM Conte will this week unveil plans to ease Italy’s lockdown from 4th May.

The UK parliament is set to hold a virtual session. Human tests on two Covid-19 vaccines will begin in the UK on Thursday.

The US Senate on late Tuesday (early Wednesday morning Asia) unanimously approved US$484bn in additional coronavirus relief for the US economy and hospitals, sending the measure to the House of Representatives for final passage on Thursday for the fourth fiscal package since the onset of the global COVID-19 pandemic. Taken together, these four measures amount to about US$3tn in aid since March. The latest deal includes US$321bn for a small business lending program, US$60bn for a separate emergency disaster loan program - also for small businesses, as well as US$75bn for hospitals and US$25bn for national coronavirus testing. Congress already is working on a fifth coronavirus-response bill, which Senate Democratic leader Schumer said could be “similar in size” to the US$2.3tn economic stimulus enacted on 27 March.

As preparations continue for Thursday’s virtual summit of EU leaders, reports suggest that divisions continue over the details of the stimulus package previously agreed by EU finance ministers. A key sticking point remains whether joint coronavirus bonds will be issued to finance the so-called ‘emergency fund’. However, it was reported yesterday that Italian PM Conte is now prepared to accept a French and Spanish compromise that would not require any treaty changes. The ECB will hold a call conference on whether to accept junk bonds as collateral.

Government bond yields have continued to move lower reflecting the ‘risk off’ mood and 10-year US Treasury yields are close to 0.5%.The broad USD continues to be supported within the G10 space. The commodity currencies continued to underperform as a group. NZD saw some catch-up losses after holding firm compared to other cyclicals on Monday. The GBP also underperformed on a round of poor employment data and renewed concerns over Brexit.

Implied vols have spiked higher within the FX space over the past 48 hours, with the likes of AUD and CAD leading the way. Overall, expect the cyclicals to be most responsive to this round of USD strength.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0745-50 (1.5BLN), 1.0770 (1.25BLN), 1.0800 (325M), 1.0825 (1BLN), 1.0855-65 (600M), 1.0885 (400M), 1.0900 (1.5BLN), 1.0950 (1.1BLN)

- EURGBP: 0.8600 (1.3BLN), 0.8665 (300M)

- USDJPY: 108.25 (1.6BLN), 108.50 (650M)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.09 targeting 1.1250 Bearish below targeting 1.0630 )

EURUSD From a technical and trading perspective, the market continues to rotate in a contracting range, a breach of 1.09 opens a move to test the recent swing high at and the initial equality objective sighted at 1.1036 through here bulls will eye 1.1150/70 as the next upside objective. Failure to sustain trade above 1.09 will likely pressure newly minted EURUSD longs a breach of 1.08 will open 1.0750 en-route to 1.0650

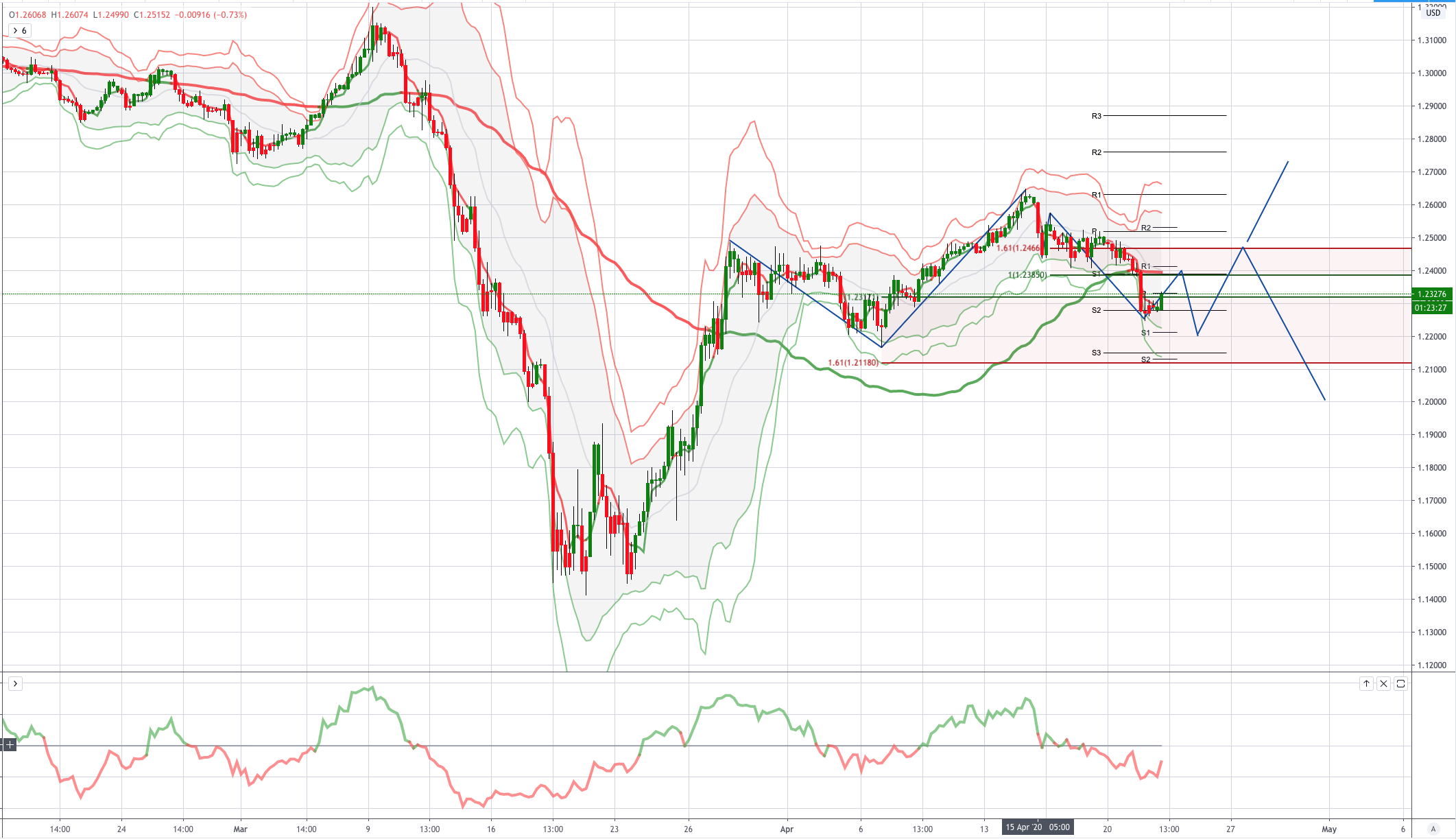

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a move back through 1.24 would suggest a broader corrective phase to unwind near term overbought momentum, 1.20/1.1950 will be pivotal this week, if bulls fail to defend this area, a deeper decline could ensue to test bids and stops below 1.17 UPDATE the bullish bias is under threat with yesterday’s sharp sell off opening the possibility of a deeper decline bulls will need to overcome symmetry swing resistance at 1.2385 to renew bullish spirits

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, double bottom delays downside objective with a whipsaw back to 110 before lower again. Through 107 would suggest downside targets are directly in play

AUDUSD (Intraday bias: Bullish above .6200 targeting .6700)

AUDUSD From a technical and trading perspective, as .6200 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6200 would concert the bullish bias

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!