Daily Market Outlook, April 27, 2020

Daily Market Outlook, April 27, 2020

A broad improvement in risk market tone has swept across most major asset classes this morning, led by optimism of an easing in lockdowns around the world.

New York Governor Cuomo announced a phased plan to reopen the state – possibly as early as 15 May. Meanwhile across Europe, Italian PM Conte said that the country would begin easing lockdown measures from 4 May, while Spain is expected to follow suit and announce some relaxation from 2 May.

Early this morning, the Bank of Japan kept policy rates unchanged but removed its target of expanding the monetary base by JPY80 trillion a year, effectively paving the way for unlimited government bond purchases.

Following the Bank of Japan’s announcement, the rest of the day is devoid of any major data releases and events. However, the rest of the week has plenty to offer in terms of first quarter GDP releases in the US and Eurozone and central bank meetings from the ECB and US Federal Reserve.

The focus remains on the global fight against the coronavirus and the appropriate policy response required to ensure that a recovery is supported once the easing in lockdown measures becomes more widespread.

UK PM Boris Johnson is due to return to work today, after having contracted Covid-19 earlier this month. The UK government has faced some criticism for failing to announce its exit strategy from lockdown, which is due to be reviewed on 7 May. Other countries have been more forthcoming, providing guidance on how the government would seek to balance demands to reopen the economy with risks of a second wave of infections. Overnight the April Lloyds Business Barometer will provide further insight into the opinions of UK firms on their trading prospects, the general economic outlook and other issues including employment, wages and prices. It will also contain some special questions on the coronavirus’ impact on demand and on how long before firms expect supply chains to return to ‘normal’.

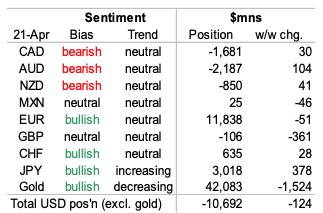

This week’s snapshot of speculative FX sentiment and positioning via the CFTC’s Commitment of Traders Report shows the bearish bet on the USD that has accumulated over the past five weeks moderating very slightly. The aggregate USD-bearish position, reflected in the market’s overall exposure to the major currencies, eased USD124mn to stand at USD10.7bn. Limited changes overall for the week reflect weak conviction amongst speculators amid heightened volatility.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0760 (600M), 1.0775 (265M), 1.0800 (1.1BLN) 1.0820 (503M), 1.0845-50 (550M)

- EURGBP: 0.8700 (775M).

- EURJPY: 116.00 (400M), 120.25 (1.6BLN)

- USDJPY: 107.00 (1.2BLN), 107.50-60 (2BLN), 108.00 (1.3BLN)

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.09 targeting 1.0630, Bullish above 1.09 targeting 1.1050 )

EURUSD From a technical and trading perspective, 1.09 remains pivotal, a close above 1.09 would open a test of 1.1050. A continued failure to overcome the 1.09 hurdle will likely see prices grind lower to retest and breach last weeks lows en route to the 1.0630 target

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a pivotal test of the daily descending trendline is underway. A failure to sustain a breach of 1.2470 would concern the near term bullish bias suggesting another leg lower to test support back towards 1.2150

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, range contraction persists,albeit with a downside bias, a breach of 106.80 should inject downside momentum. A topside breach of 108 would delay donside objectives opening a retest of range resistance above 109 before lower again

AUDUSD (Intraday bias: Bullish above .6250 targeting .6700)

AUDUSD From a technical and trading perspective, as .6250 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6250 would concern the bullish bias

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!