Daily Market Outlook, August 15, 2022

Daily Market Outlook, August 15, 2022

Overnight Headlines

- Bitcoin Falls As 140K BTC Have Been Released To MTGox Customers

- Oil Prices Ease As Saudi Aramco Ready To Boost Crude Output

- Asia Equity Markets Mixed As China Cuts Rates, Data Disappoints

- Dems Send Landmark Climate, Tax And Health Care Bill To Biden

- US Lawmakers Arrive In Taiwan With China Tensions Simmering

- Granholm Sees US Gasoline Prices Dropping Further, With Caveat

- Rhine River At Key Waypoint Set To Steady At Low Water Level

- Liz Truss 22 Points Ahead In Race To Be Britain's Next PM: Poll

- China Central Bank Unexpectedly Cuts Key Rate To Spur Growth

- China’s July Retail Sales, Industrial Output Fall Short Of Estimates

- Japan’s Economy Accelerates Following Relaxation Of Covid Curbs

- Oil Prices Ease As Saudi Aramco Ready To Boost Crude Output

The Day Ahead

- China’s central bank unexpectedly lowered its key interest rates as it sought to provide more support to its economy. The cut came just ahead of data, which showed weaker-than-expected increases in retail sales and industrial activity in July, while house prices reportedly fell 0.1% m/m. Elsewhere, the preliminary estimate of Q2 GDP for Japan posted a smaller-than-expected rise of 0.5% q/q (consensus: 0.7%), albeit that still meant that the economy recovered to its pre-pandemic size in the second quarter.

- With other major central banks set to continue tightening monetary policy for some time yet, measures of economic activity will be watched for signs that global demand is slowing across the major economies. The coming week sees a host of US economic activity data that will provide further insights into current economic conditions and whether GDP is likely to rebound in the second half of 2022 after falling in the first two quarters. This afternoon, the Empire State manufacturing survey for August is expected to show that factory output growth continues to moderate and we forecast the headline balance slipping from +11 in July to +7. Some attention will also likely be on the survey’s six-month ahead outlook index, which fell below 0 in July for only the fourth time since this measure began in 2001 (note that it stayed positive throughout 2020 and 2021). Expect the US NAHB survey to show housebuilders’ confidence to remain at its recent low of 55 in August, unchanged from its July reading.

- Elsewhere, there are no major releases due for the UK or Eurozone. Beyond today, however, it is a busy week for UK data releases with the latest labour market and inflation prints due early on Tuesday and Wednesday respectively. Tomorrow morning, expect the former to show further employment gains, look for 275k increase in overall employment in the three months to June. This will have kept the unemployment rate at 3.8%, only slightly above its recent low and equal to the pre-pandemic low. That seems clear evidence that the labour market remains very tight as does the very high level of unfilled job vacancies. There may, however, be tentative indications in the latter that the job market is starting to slow. More timely weekly data suggests that job vacancies are now moderating and that could be reflected in a small drop in the overall number of vacancies on the monthly measure, although it should still show them close to their recent highs. The headline measure of annual earnings growth is expected to have dipped to 4.5% from 6.2% previously, mainly due to the end of the bonus period. Regular earnings (ex-bonus) are forecast to pick up to 4.5% from 4.3%.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0200-10 (350M), 1.0400-05 (494M)

- USD/JPY: 131.50 (300M), 133.00 (365M), 133.75-85 (365M)

- 134.00 (685M): EUR/JPY: 136.00 (340M)

- GBP/USD: 1.2285 (766M): EUR/GBP: 0.8535 (742M)

- USD/CAD: 1.2730-40 (662M), 1.2950 (655M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0410

- EUR/USD opened 1.0255 after falling 0.61% on Friday

- After trading up to 1.0269 it drifted lower for much of the morning

- Weak China activity data took some of the shine off risk assets

- EUR/USD traded down to 1.0240 before settling around 10250

- Resistance 1.0325, support 1.0190

- 20 Day VWAP bullish, 5 Day bearish

GBPUSD Bias: Bearish below 1.23

- Pivotal support in view after range resistance capped

- -0.05%, closed -0.65%, despite better than forecast UK GDP

- UK Treasury proposes plan to cut fuel costs extra £400, Times

- Cost of living crisis will be the key issue for the next prime minister

- Drought could be the next hurdle for the UK economy

- Offers sited at 1.2280/1.23 bids 1.2060

- 20 Day VWAP is bullish, 5 Day bearish

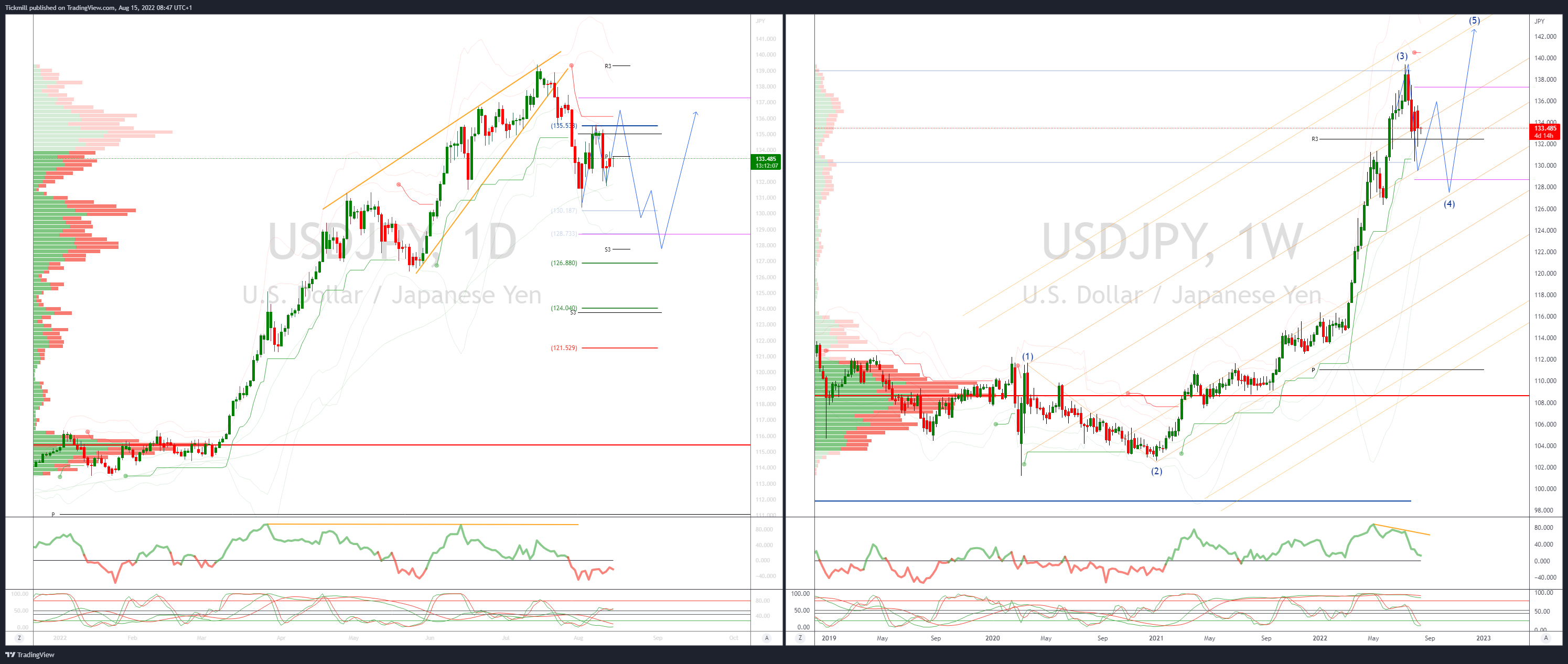

USDJPY Bias: Bearish below 136

- Heavy early, as GDP misses expectations

- -0.3% as Japan Q2 GDP grew 2.2% against 2.5% forecast

- Japan economy recovering from COVID led downturn, but outlook uncertain

- USD/JPY trades within the usually resilient 132.06-135.17

- 20 Day VWAP is bearish, 5 Day bearish

AUDUSD Bias: Bullish above .7050

- Dips below 0.7100 as weak China data weighs

- AUD/USD dipped in a delayed reaction to weak China data

- AUD has outperformed other currencies recently due to bounce in commodities

- The data today suggests demand may weaken and weigh on sentiment

- Iron ore is down around 1.85% today while Lon copper is -0.90%

- Offers eyed .7270/30, bids .7040’s

- 20 Day VWAP is bullish, 5 Day bullish

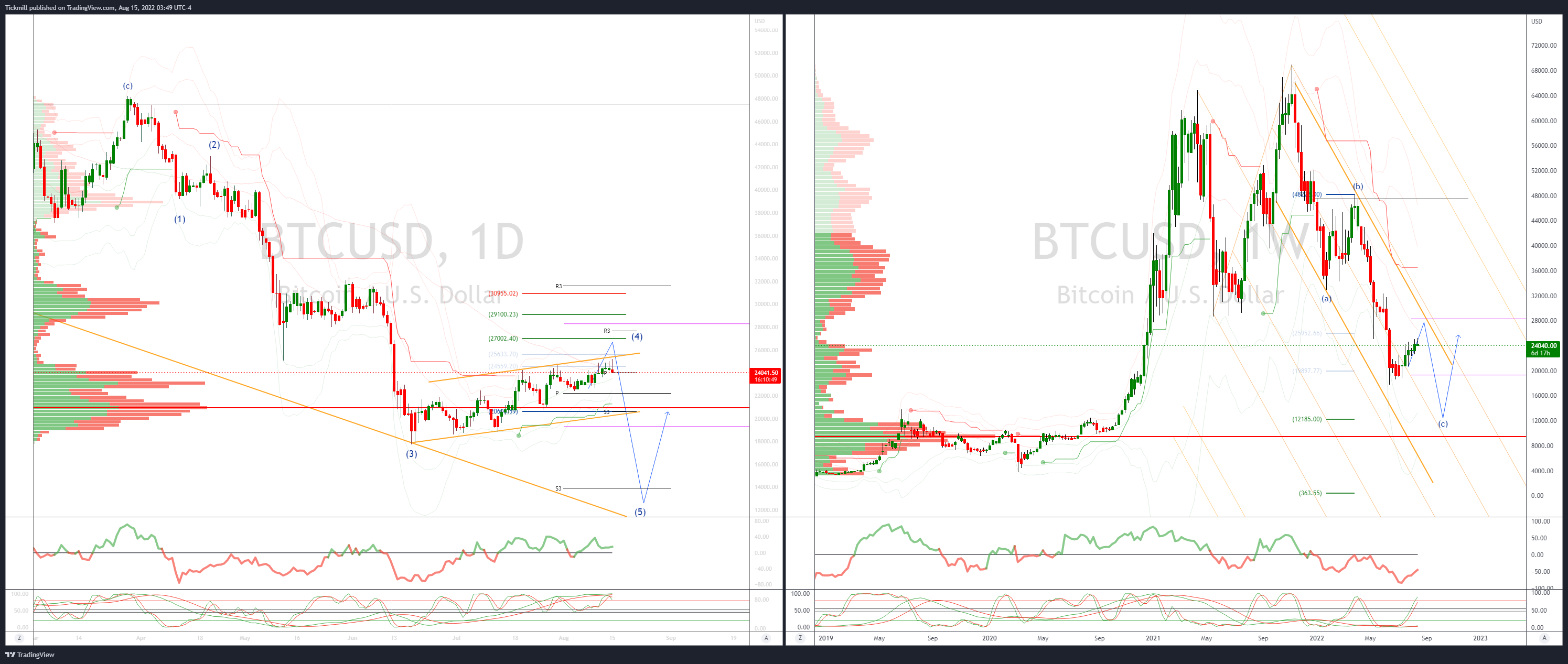

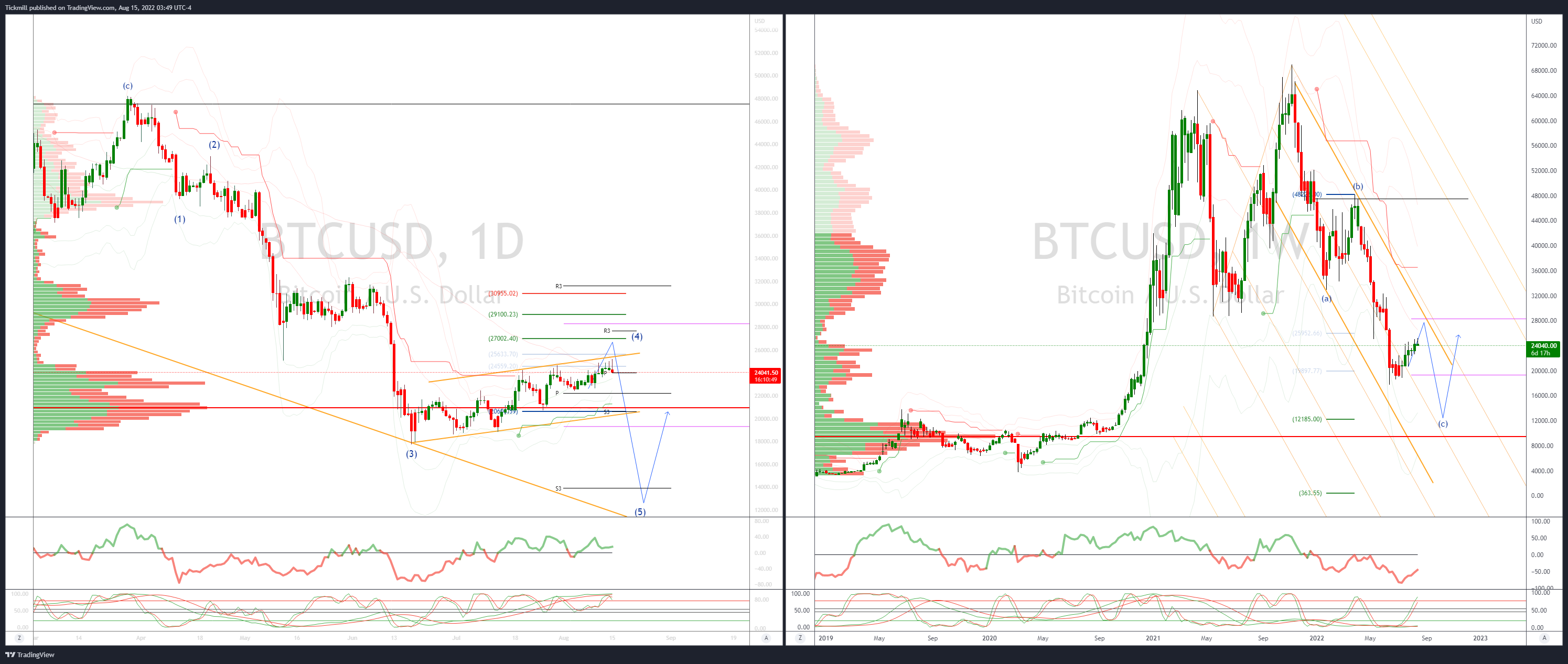

BTCUSD Bias: Bearish below 25.3K

- Unable to capture pivotal 25k level

- Sells off on news of 140k BTC to released to MtGox clients

- Profit taking on release in liquidation weighs on BTC

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!