Daily Market Outlook, December 2, 2020

.png)

Daily Market Outlook, December 2, 2020

Asian equity markets are generally higher this morning following gains yesterday in Europe and the US. Reports suggest that an early deal on a US fiscal stimulus package is still possible after discussions between Congressional Democrats and Republicans. President-elect Biden signalled his support. ECB President Lagarde repeated that the Bank’s monetary policy instruments would be ‘recalibrated’ at its December meeting. Australian Q3 GDP posted a larger-than- expected 3.3% rise after Q2’s 7.0% fall.

EU Chief Brexit Negotiator Barnier has told EU envoys that differences still remain on the three key sticking points in trade talks with the UK, a deal still hangs in the balance, according to a diplomat. Reports overnight noted that EU Chief Brexit Negotiator Barnier was under pressure not to give too much away as talks go to the wire.

England has entered a new regional tier system after the latest lockdown ended. The House of Commons signalled approval yesterday although 55 Tory MPs voted against the motion. UK regulatory go ahead has been given for the Pfizer Covid-19 vaccine but reports suggest that only health workers and care homes are likely to receive it this year.

The Eurozone October unemployment rate is expected to have ticked up to 8.4% from 8.3% in September. The rate has edged up from a low of 7.2% in March. The initial rise during the spring lockdown was much less marked than in the US because of government support but it has continued to rise through the summer. It seems likely to increase further during the new lockdown and what will probably be a difficult winter.

Meanwhile, the November ADP estimate of private sector employment will provide a gauge of trends in the US labour market ahead of Friday’s official release. ADP estimated that employment growth slowed to 364K its slowest pace in four months and the second smallest rise since the spring lockdown ended. That proved to be an underestimate of the official payrolls data, which showed a much stronger 906k increase. Expect a larger rise of 550k in November. Nevertheless, the underlying trend does appear to be slowing, which corroborates other data, such as the recent rise in weekly jobless claims, which suggests that the post-lockdown improvement in employment may be petering out.

Also of interest in the US is the Federal Reserve’s Beige Book, which is an anecdotal review of recent economic developments that is issued a couple of weeks before Fed monetary policy meetings. Normally it doesn’t get much attention but in the present circumstances, where economic data seems out of date even as is released, the Beige Book may offer some timely insights. In particular, it will be interesting to see if consumers and businesses seem more concerned about the current rise in Covid-19 cases or reassured by the vaccine news.

Fed Chair Powell and Treasury Secretary Mnuchin will testify for a second consecutive day to Congress on the effectiveness of policies to combat the economic impact of Covid-19. In yesterday’s testimony they clashed over Mnuchin’s decision to end most of the Fed’s emergency lending facilities.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.2050 (435M). EUR/JPY: 125.00 (466M)

- USDJPY: 104.00-05 (656M), 104.45-60 (1.2BLN), 105.00 (333M)

- GBPUSD: 1.3300 (600M)

- AUDUSD: 0.7350-60 (530M), 0.7400 (850M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1910 targeting 1.2120

EURUSD From a technical and trading perspective, as 1.1820 acts a support look for a retest of cycle highs at 1.20 anticipate a profit taking pullback on the initial test, while 1.1820 is defended then look for price to test the wave 5 upside objective at 1.2120

Flow reports suggest stronger offers through the 1.2080-1.2120 level with stronger offers around the 1.2100 level with weak stops likely to joined by breakout stops appear opening a move through to the 1.2200 level with again stronger offers appearing around the level, downside bids light through the 1.2000 area and weak stops likely to be plentiful on a dip through the 1.1980 area to open weakness through to the 1.1900 level and stronger bids

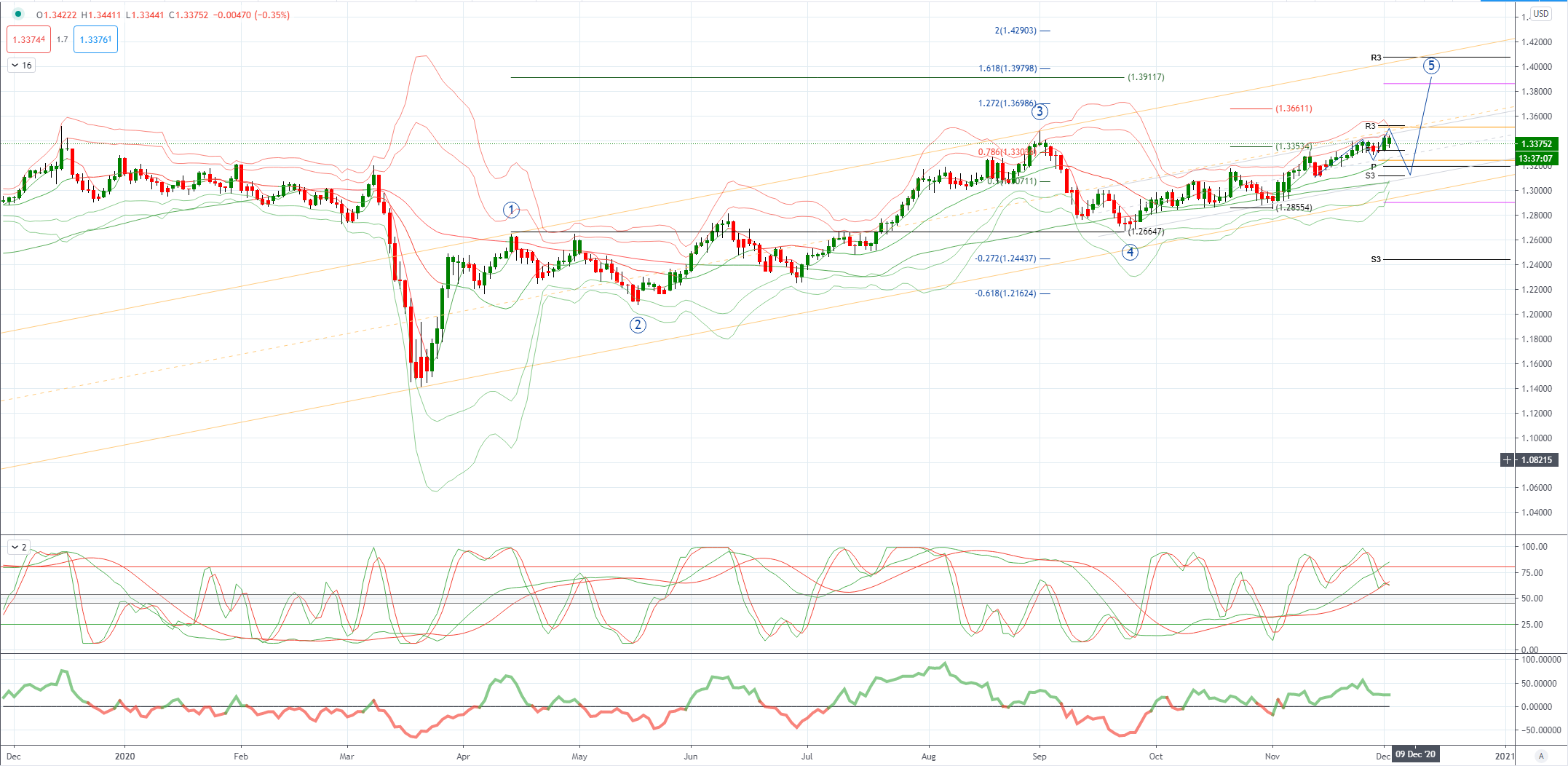

GBPUSD Bias: Bullish above 1.3250 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480, from here expect a profit taking pullback as 1.31 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area

Flow reports suggest offers topside sees light offers through to the 1.3450 area with some stronger offers through the level and then increasing offers through to the 1.3500 level with weak stops likely through the level and the market then opening through to the 1.3530-50 area, downside bids light through the 1.3400 level likely to be weak and open to stronger bids on a move through to the 1.3300 areas where stronger bids for a normal market however, weak stops turn into stronger stops and the market again opens for a deep move with limited bids through to the 1.3150 area and some stronger congestion.

USDJPY Bias: Bearish below 105 targeting 101.20

USDJPY From a technical and trading perspective,near term short covering to challenge offers to 105 descending trendline resistance, as this area contains upside attempts look for the next leg lower to target year to date lows at 101.20

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00

AUDUSD Bias: Bullish above .7230 bullish targeting .7700

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400 from here anticipate a profit taking pullback towards .7200 again before price attempts to extend higher again to target wave 5 upside objective towards .7700

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!