Daily Market Outlook, December 3, 2020

Daily Market Outlook, December 3, 2020

Asian equity indices were mixed despite the US S&P 500 closing at a fresh high. Supportive factors included renewed hopes of a US stimulus package, albeit for a lower amount of $908bn, and vaccine hopes including the UK’s formal authorisation of the Pfizer/BioNTech product.

China’s Caixin services PMI, meanwhile, beat expectations, rising to 57.8 from 56.8. On the other hand, Germany announced an extension of its partial lockdown to 10 January, while the US reported a record 2,700 Covid-related fatalities.

Today’s November services PMIs are final readings. In the UK, the preliminary ‘flash’ estimate declined for a third consecutive month and fell into contraction territory (below 50) for the first time since June, amid business shutdowns in hospitality and leisure. Still, the fall to 45.8 was less than had been expected. Look for a modest downward revision to the final outturn to 45.5.

In the Eurozone, Covid restrictions resulted in a further drop in services PMI to just 41.3 in November, although there were signs that encouraging vaccine news boosted business expectations. The headline index was particularly weak in France (38.0) and also showed contraction in Germany (46.2). Today’s final release is expected to be unrevised and we will also have details of other Eurozone countries (Italian and Spanish services PMIs were already below 50 in October). Eurozone retail sales for October are also due, with national releases pointing to upside risks to forecasts.

In contrast to Europe, US November services PMI increased to 57.7, the highest for more than five years. Expect that to be unrevised. The separate ISM services survey will draw more attention and there is scope for an improvement to 57.0 in November from 56.6 in October. US weekly initial jobless claims, meanwhile, have risen in two consecutive weeks, suggesting the labour market may be weakening. Nevertheless look for a fall to 730k from 778k, although the consensus forecast is notably higher (775k).

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.2000 (661M), 1.2115 (206M), 1.2200 (390M)

- USDJPY: 104.00 (3.4BLN), 104.45-50 (1.5BLN), 105.00-10 (1BLN)

- GBPUSD: 1.3200 (400M), 1.3450 (208M)

- AUDUSD: 0.7385 (200M)

Technical & Trade Views

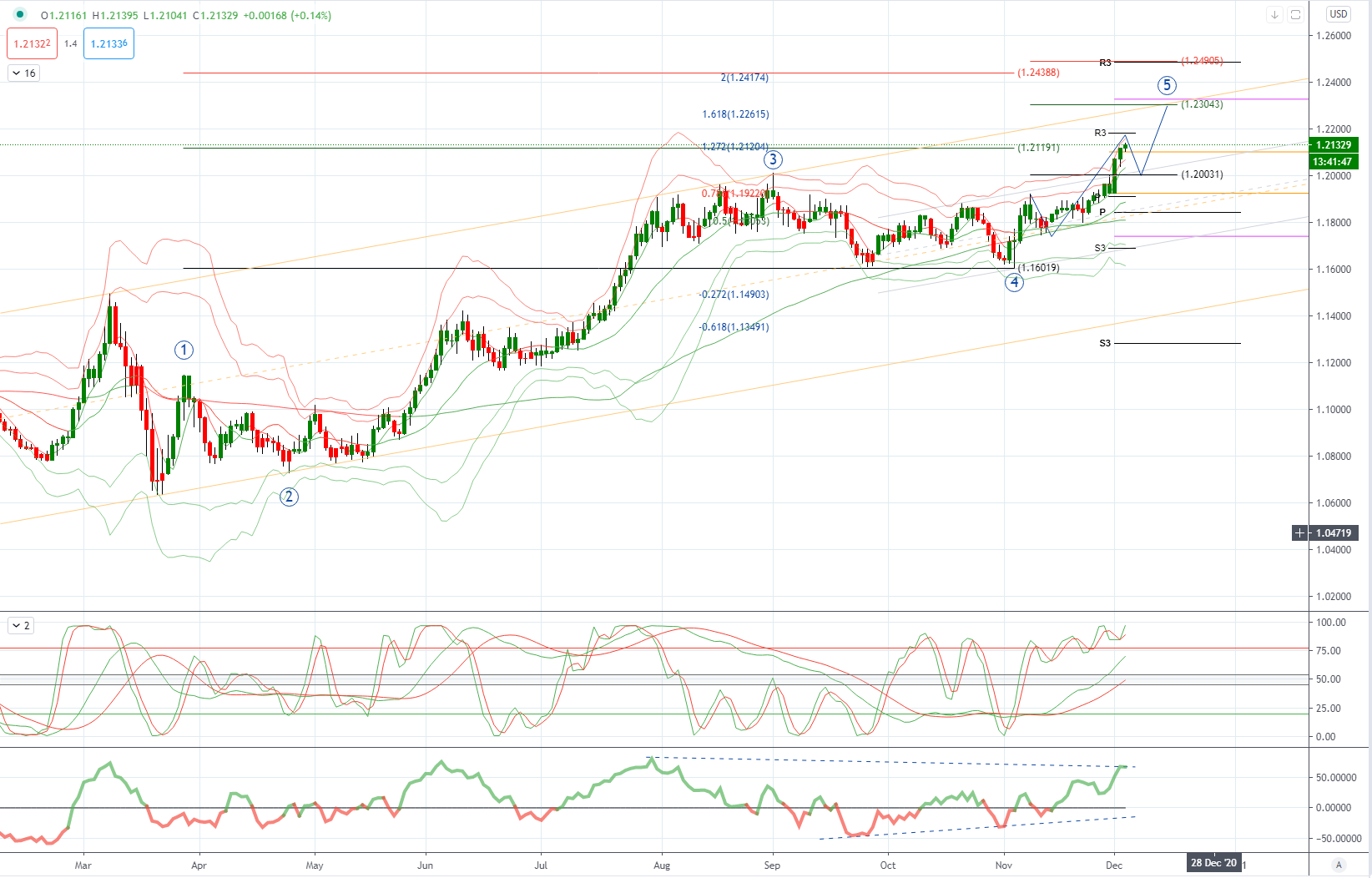

EURUSD Bias: Bullish above 1.1910 targeting 1.2120

EURUSD From a technical and trading perspective, as 1.1820 acts a support look for a retest of cycle highs at 1.20 anticipate a profit taking pullback on the initial test, while 1.1820 is defended then look for price to test the wave 5 upside objective at 1.2120 UPDATE target achieved as 1.20 now acts as support bulls target primary ascending trendline resistance to 1.23

Flow reports suggest topside offers through the 1.2140-60 area likely to be light with stronger offers building through the 1.2180-1.2220 area and weakness through to 1.2300 and onwards where stronger congestion is likely to be spread through the area to the 1.2400 stronger levels. downside bids light through the 1.2000 area and weak stops likely to be plentiful on a dip through the 1.1980 area to open weakness through to the 1.1900 level and stronger bids.

GBPUSD Bias: Bullish above 1.3250 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480, from here expect a profit taking pullback as 1.31 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area

Flow reports suggest offers topside sees light offers through to the 1.3450 area with some stronger offers through the level and then increasing offers through to the 1.3500 level with weak stops likely through the level and the market then opening through to the 1.3530-50 area, downside bids light through the 1.3400 level likely to be weak and open to stronger bids on a move through to the 1.3300 areas where stronger bids for a normal market however, weak stops turn into stronger stops and the market again opens for a deep move with limited bids through to the 1.3150 area and some stronger congestion

USDJPY Bias: Bearish below 105 targeting 101.20

USDJPY From a technical and trading perspective, near term short covering to challenge offers to 105 descending trendline resistance, as this area contains upside attempts look for the next leg lower to target year to date lows at 101.20

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00

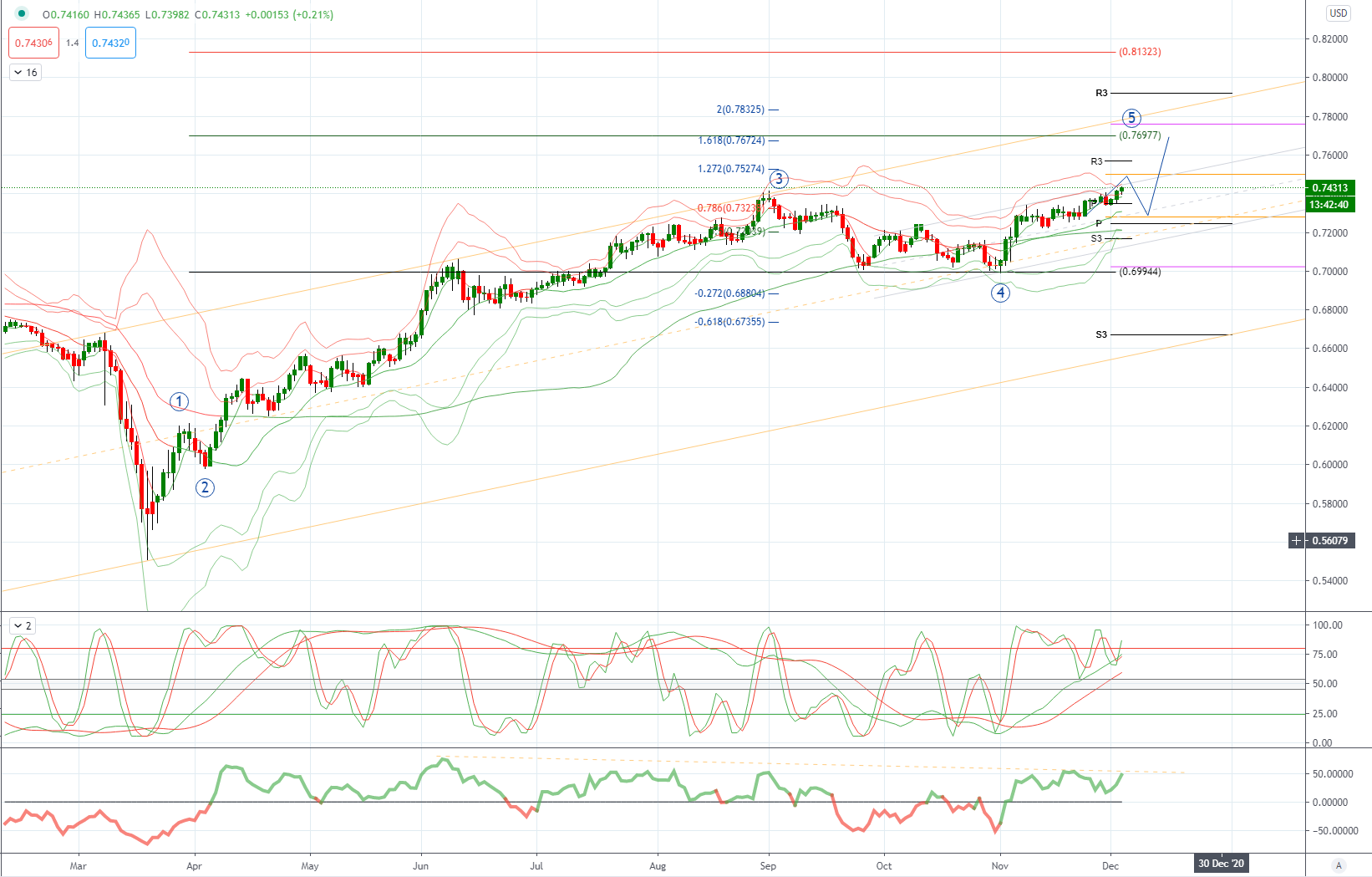

AUDUSD Bias: Bullish above .7230 bullish targeting .7700

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400 from here anticipate a profit taking pullback towards .7200 again before price attempts to extend higher again to target wave 5 upside objective towards .7700

Flow reports suggest downside bids into the 0.7320 area slowly building with limited congestion in front, a push through to the 0.7280 area will likely see weak stops appearing and increasing bids through to the 0.7260-40 levels Topside offers through the 0.7350 area likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the sentimental 0.7450 area likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!