Daily Market Outlook, June 30, 2022

Daily Market Outlook, June 30, 2022

Overnight Headlines

- Fed’s Powell: Fed Must Accept Higher Recession Risk To Combat Inflation

- Fed’s Mester: Fed Is on Track for 0.75-Point July Rate Hike

- Bitcoin Trades Sub 20k Amid Global Reduced Risk Sentiment

- China's June Factory, Services Activity Expands First Time In 4 Months

- EU Seeks Open Talks On N.Ireland, Not Pre-Set UK Outcome

- UK Business Confidence at 15Mth Low As Cost Of Living Crisis Bites

- China Lockdowns Spark Sharpest Drop In Japan Output Since 2020

- Australia Job Vacancies Surge As Firms Struggle To Find Staff

- RBNZ Chief Economist Warns Housing No Longer One-Way Bet

- NZ Business Sentiment Continues To Weaken As Supply Issues Dominate

- Euro Under Pressure As Inflation Fears Send Investors To Dollar Haven

- Bonds Move To Price In A Half-Point Cut After Fed Reaches Peak

- SEC Rejects Grayscale’s Spot Bitcoin ETF Application

- Oil Set For First Monthly Decline This Year Before OPEC+ Meeting

- US Could Release Even More Oil From Strategic Stockpiles

- Iran, US Nuclear-Deal Talks End Without Progress

- US Agrees To Pay $3.2 Billion For More Pfizer Covid Vaccines

- Chinese Stocks Set For Largest Monthly Rise Since 2020

- Samsung Says It Is Manufacturing 3nm Chips In Global First

The Day Ahead

- Asian equity markets are mixed this morning. Most are down but Chinese indices are up. Chinese markets may have been supported by an upturn in June PMI data as the manufacturing index climbed above the 50 expansion level for the first time since February, while the non-manufacturing reading was the highest since April 2021. In Germany, retail sales rose by 0.6% in May following a big fall in April. French annual CPI inflation on the EU harmonised measure rose to 6.5% in May up from 5.8% in April.

- Today’s latest reading for the Lloyds Business Barometer showed a decline of 10 points in June as business confidence slipped to its lowest since the emergence from the second Covid wave. Despite today’s fall, the level of confidence is still equivalent to its long-term average. However, firms are now more cautious both about the economy as a whole and their own trading prospects. Indeed, eleven of the UK’s twelve regions and nations reported lower confidence this month. Firms’ hiring intentions have also moderated and, while pay and pricing expectations remain elevated, there were tentative signs of moderation compared with last month.

- Today’s Swedish Riksbank monetary policy update is expected to produce a second straight hike in interest rates. Indeed, most economists expect the Riksbank to adopt the same move as several other central banks and opt for a 50 basis points hike rather than repeating April’s move of 25bp. Further rises are also expected at the remaining two meetings of the year and some economists are forecasting 50bp increases at each of those meetings.

- Despite a fall in US retail sales interest rates in May, overall consumer spending is expected to have risen due to more spending on services. Nevertheless, yesterday’s downward revision to Q1 consumer expenditure growth added to concerns about the outlook that have already been lifted by the sharp decline in consumer confidence measures.

- The Fed’s preferred inflation gauge, the personal consumption expenditure (PCE) deflator, is expected to mirror the movements in the already released CPI. Expect the headline PCE deflator to rise to 6.5% from 6.3%, while the core PCE deflator is forecast to edge down to 4.8% from 4.9%. As elsewhere, inflation is expected to remain above target for a considerable period ahead. Finally, weekly jobless claims data, which have ticked up in recent weeks, will be watched for signs that employment growth is faltering.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0400 (703M), 1.0440 (307M), 1.0500 (692M)

- 1.0550-55 (1.12BLN) 1.0650 (207M), 1.0750 (938M)

- USD/JPY: 135.00 (263M), 136.00 (356M), 137.00 (311M)

- GBP/USD: 1.2300 (348M). USD/ZAR: 15.65-75 (370M)

- EUR/GBP: 0.8525 (259M), 0.8650 (701M)

- USD/CHF: 0.9600 (630M), 0.9800 (250M)

- USD/CAD: 1.2750-55 (1.15BLN), 1.2830 (390M)

- 1.2850-60 (390M), 1.3000 (601M)

Technical & Trade Views

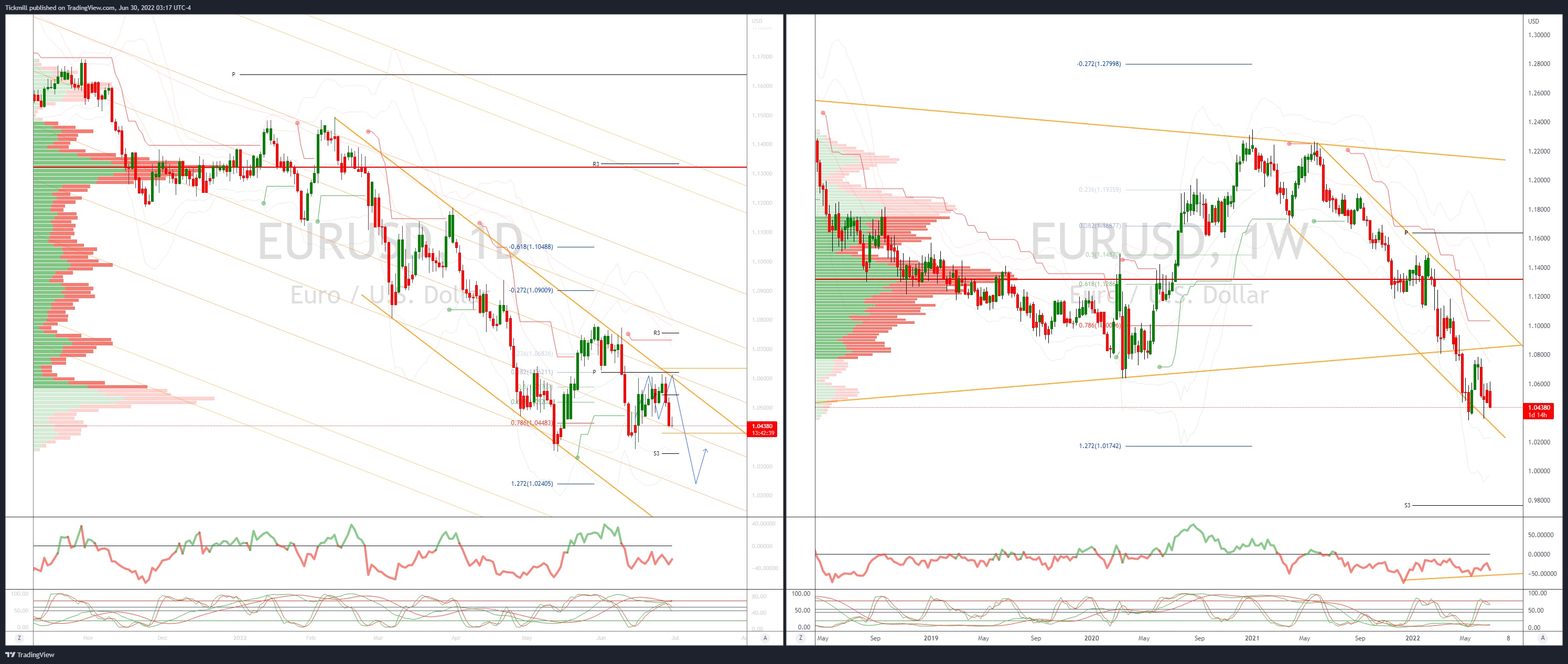

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR was the weakest major currency yesterday, trading 1.0450’s as LDN session starts

- USD broadly bid with hawkish comments from Fed Cheif Powell

- EUR/CHF selling saw prints below parity to a 15-year low

- EUR/USD closed below support at 1.0470 and now targets June 15 low at 1.035

- EUR pressured by diverging central bank expectations and month-end flows

- EUR/USD's rally attempts are laboured ECB comments and risk aversion weigh

- A daily close under the 1.0450 would be another bearish development

- Initial offers are seen at 1.0615/20 ahead 1.0650

- Bids 1.0450 stops below to fuel a test of 1.04

- 20 Day VWAP is bearish, 5 Day bearish

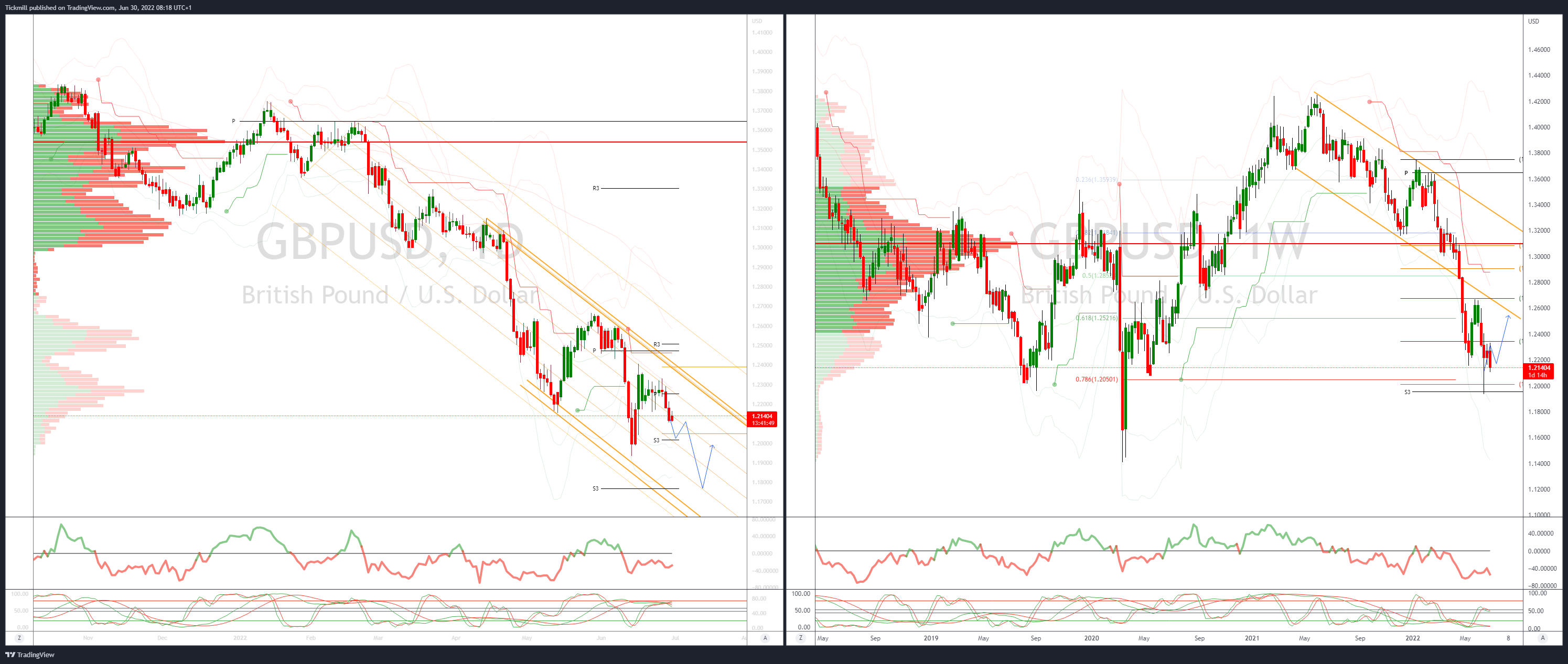

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBP offered on fears the BoE may delay further hikes

- New BoE board member Dhingra prefers 'very gradual' approach on rates

- Markets sense BoE may fall behind the curve in a similar fashion to the ECB

- Souring risk sentiment weighs on GBP trading sub 1.2150

- Month end USD bids add further downside pressure

- Resistance remains sited at 1.2410

- Support eyed at 1.2150 failure here will open 1.2050

- 20 Day VWAP is bearish, 5 Day bearish

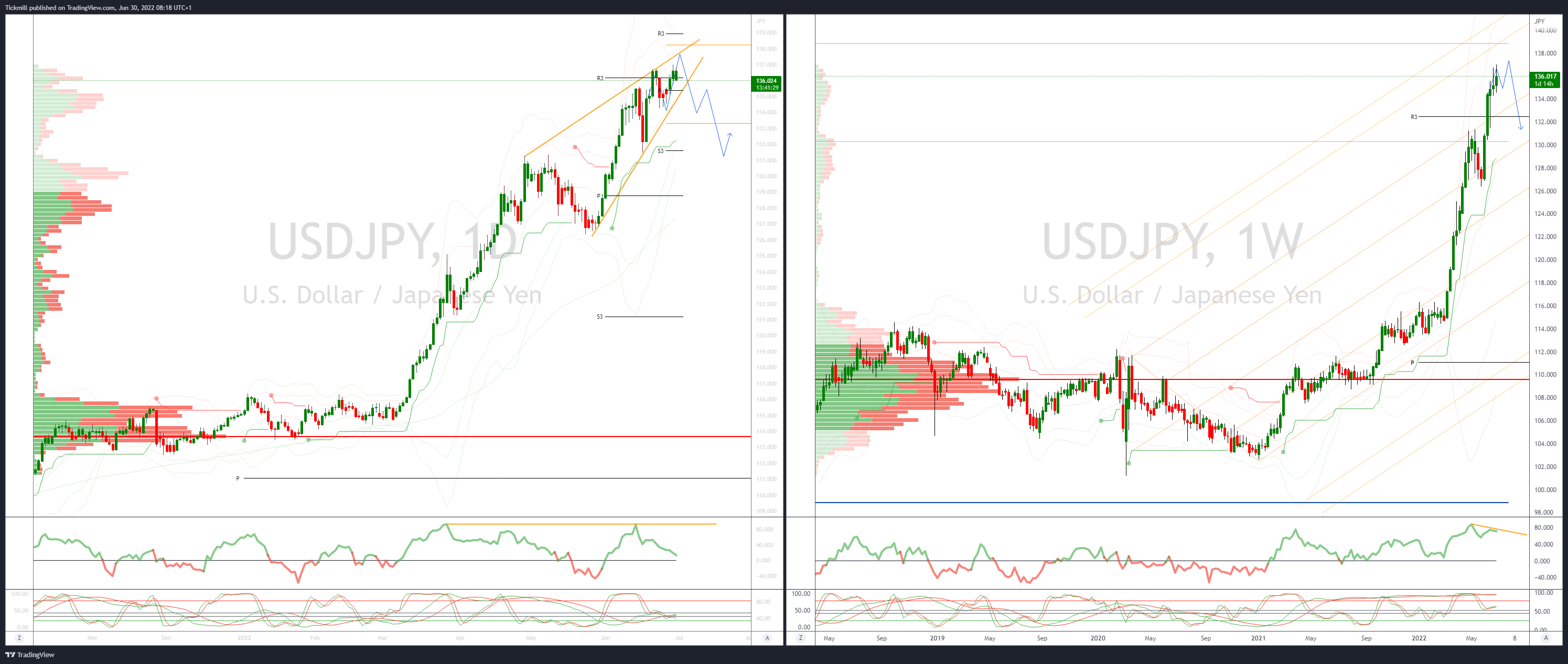

USDJPY Bias: Bullish above 134 Bearish below

- USD/JPY up to 137.00 before retreating with lower US yields

- 137.00 traded but didn't trade above, any option structures are likely still in play

- Risk off sentiment driven by growth concerns, inflation and hawkish Fed

- USD/JPY trades at highest levels since 139.95 in September 1998

- Longer-term trend is bullish driven by BoJ-Fed divergence, US yields correlation

- US yields soften on recession fears, 10 yr Treasury trading 3.06%

- Japanese importer bids sited towards 135

- Notable options expiries at 133.50 and 134.00 strikes go off Friday

- Option barriers quoted at 137

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD steadies as China PMIs improve

- Global growth concerns will likely keep the AUD/USD under pressure

- Bids are tipped toward support at June 14 lows 0.6850

- 20 Day VWAP remains untested confirming downside

- Bears now targeting a test of the base towards 0.6840’s

- Offers seen towards .6960, bids eyed .6850

- 20 Day VWAP is bearish, 5 Day bearish

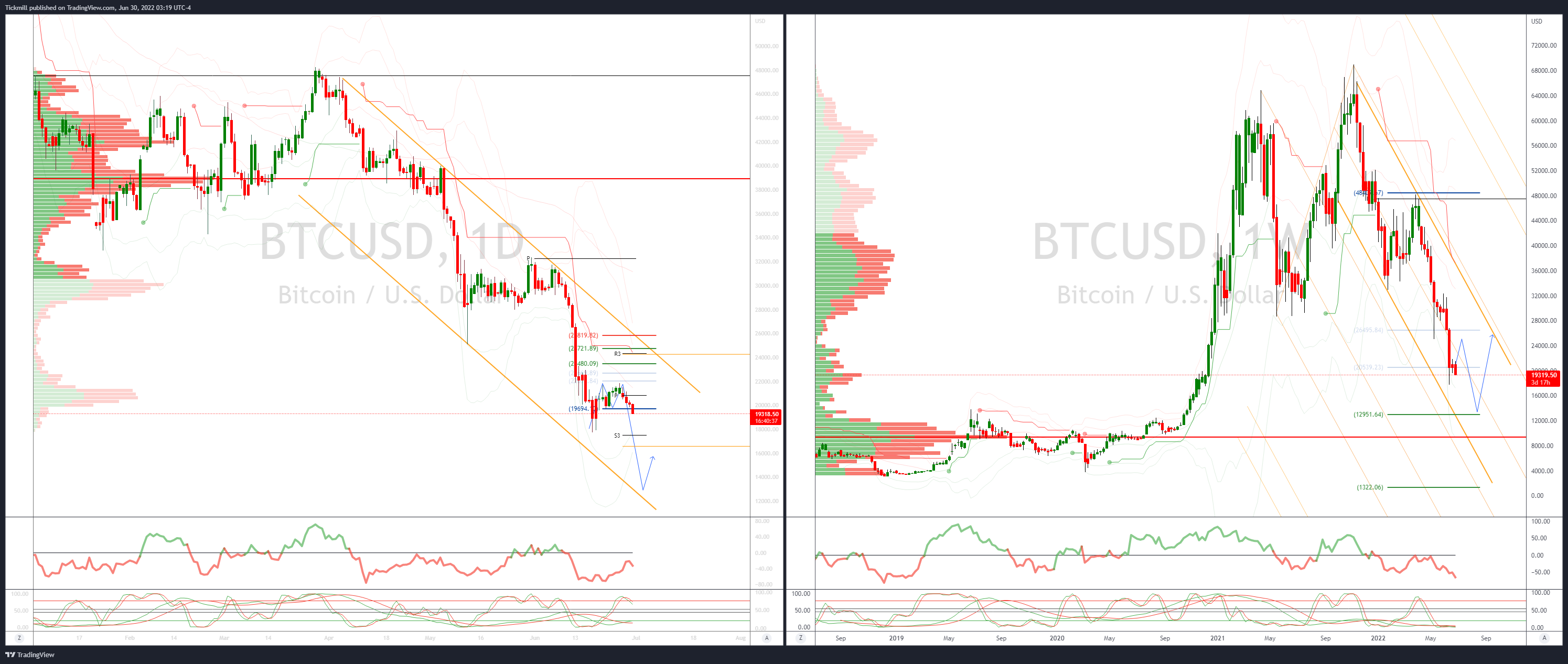

BTCUSD Bias: Bullish above .22000 Bearish below

- BTC sinks below 20k as EU seeks a deal on Crypto regulation

- Trend remains down as within broader bearish channel beckons

- BTC gaining traction below 20k

- Support at 19,690’s eroded bears targeting a retest of 19k

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!