Daily Market Outlook, November 27, 2020

Daily Market Outlook, November 27, 2020

Risk tone was cautious during the Asian trading session, as investors assessed the impact of the global pandemic on economic growth. For instance, New York’s new cases reached a seven-month high, while Germany’s total infections surpassed one million, although cases in France are falling. Stepping back, global equities have risen strongly this month, supported by encouraging vaccine news. In other news overnight, President Trump indicated he will leave the White House if the Electoral College declares Biden the winner, but he may never concede. In the UK, almost all of England will be placed in tier 2 or 3, once the national lockdown ends on 2 December. Most of northern England will be in tier 3.

The data calendar is very light again today. The Eurozone economic sentiment index (ESI) for November is likely to indicate deteriorating activity and prospects in light of stricter measures to tackle the pandemic across the continent. The ‘flash’ estimate for November consumer confidence already showed a fall to -17.6, the lowest since April, even though some responses came after the vaccine news. Industrial confidence and services confidence are forecast to fall to -10.9 and -16.3, respectively. The ESI overall is expected to decline to 86.0 from 90.9, the lowest since July. It all adds to the likelihood that the Eurozone economy will contract in Q4. While a cut in interest rates further to negative territory is not expected, the ECB is likely to announce other stimulus measures at its next policy meeting on 10 December.

There are no UK or US data releases today. The Lloyds Business Barometer for November will be released in the early hours of Monday. The last survey in October showed the first fall in business confidence since May, declining 7 points to -18%. Responses to the November survey will have taken place during a national lockdown in England, as well as measures taken in other parts of the UK, but it will also partly cover the period after the initial positive vaccine news. Markets will continue to follow Brexit headlines. It was reported yesterday evening that the EU’s chief negotiator Barnier called for an ‘urgent’ meeting of EU fisheries ministers today, which some have interpreted as a potential breakthrough in talks. There are also indications that the EU team will travel to London to resume negotiations this weekend.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1860 (1BLN), 1.1960 (500M), 1.2000 (500M)

- USDJPY: 104.00 (1.7BLN), 105.00 (1.5BLN)

- AUDUSD: 0.7300-10 (1.1BLN) , 0.7400 (732M)

Technical & Trade Views

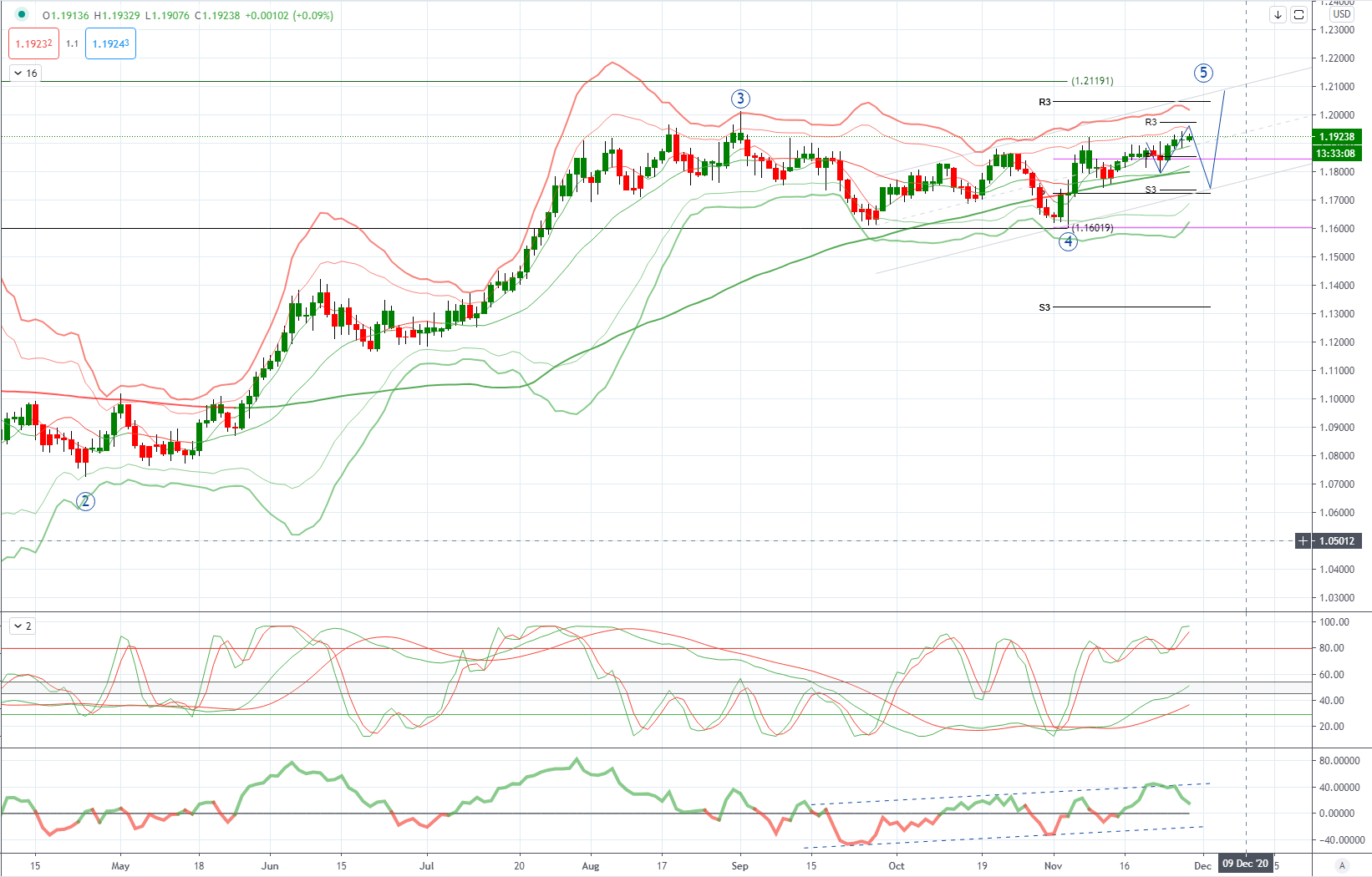

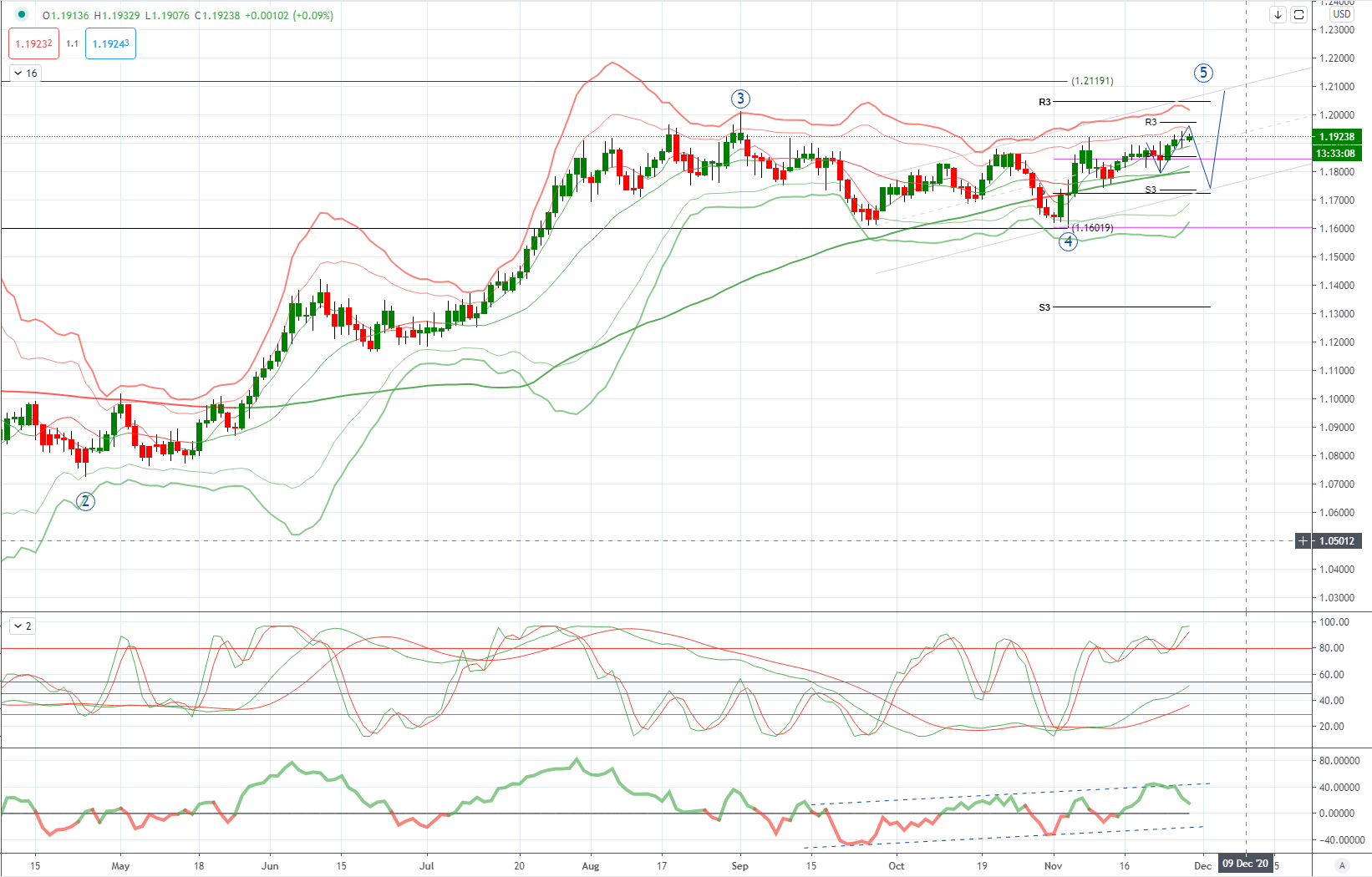

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest strong offers into the 1.3400 level with weak stops likely through the level before running into stronger offers from the 1.3440-50 area, a break here is likely to see stronger stops appearing and the market testing to the 1.3500 with stronger offers again reappearing however, a strong push through the level will allow the market over time to test to the 1.40-43 area, downside bids light through the 1.3300 area and weak stops likely to appear with limited congestion through to the 1.3200 level with again limited bids and stronger congestion on the move starting to appear to match off with any weak stops on a run to the 1.3150 and stronger bids.

USDJPY Bias: Bearish below 104 bullish above

USDJPY From a technical and trading perspective, look for another test of 103.20 projected ascending trendline support, another hold here could prompt near term short covering to challenge offers to 105 descending trendline resistance

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!