Easy Jet Stocks Plummet 65%

Among the sectors hardest hit by the collapse in global equities prices over the last six weeks, airlines have suffered a devastating blow. The travel restrictions put in place by a number of countries now has decimated passenger numbers for all major and smaller airline providers alike. The industry had already been under pressure from a severe loss of customer demand amidst the ballooning outbreak of COVID-19 which has rocked markets this year.

Airlines Note Massive Drop in Demand

Initially airports were reporting a drop in air traffic as flyers began shying away from airline travel following reports of many instances of infection from airports and flights. Initial reporting around the COVID-19 outbreak sparked a selling spree in airline stocks as traders began speculating on a rout in demand.

However, the situation has materially worsened over recent weeks as a number of countries have announced flight restrictions. China, the US, Italy, Spain and France now all have flight restrictions in place. In the UK, Britons have been advised to avoid all air travel for 30 days. Though this falls short of the official 30 day ban imposed by the US administration, it adds to the gloomy outlook for airline providers.

Boeing Credit Rating Cut

Many airlines have already fallen into severe difficulty during the outbreak. Airline provider FlyBe went into administration earlier this month, citing a loss of demand due to the COVID-19 outbreak. Earlier this week, airline giant Boeing had its credit rating slashed by the S&P. At BBB, Boeing’s credit rating is now only one level above “junk” status.

In Europe, airlines have been equally hard hit. TUI, the largest holiday firm in Europe has seen its share price collapse by 76% since the beginning of February while EasyJet has seen a similar drop of over 60%. As travel restrictions look set to develop further, the outlook for airline providers is increasingly dire.

Global Events Being Cancelled

Another blow to the industry has been the cancellation of many key global events. The Australian Grand Prix, Rugby Six Nations fixtures, the Grand National, SXSW in the US, and a number of other major tourist events have been cancelled. Looking ahead to the summer, there is now a grave concern that the traditional summer holiday boom for airlines will not take place, which will surely signal the end for many providers.

Technical Views

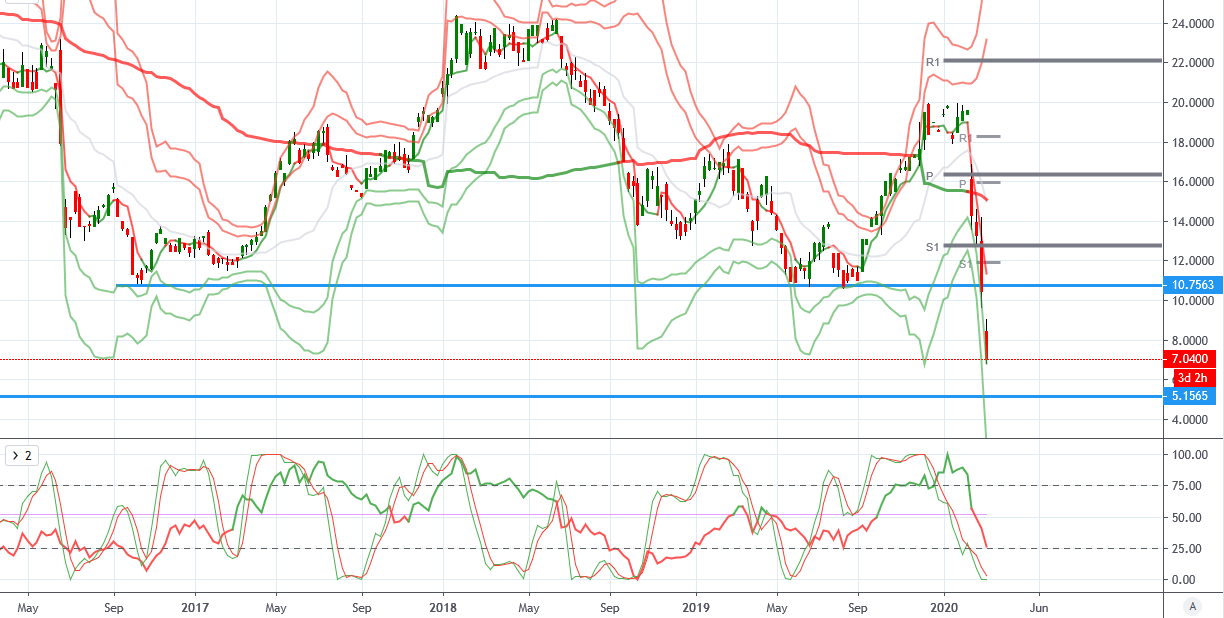

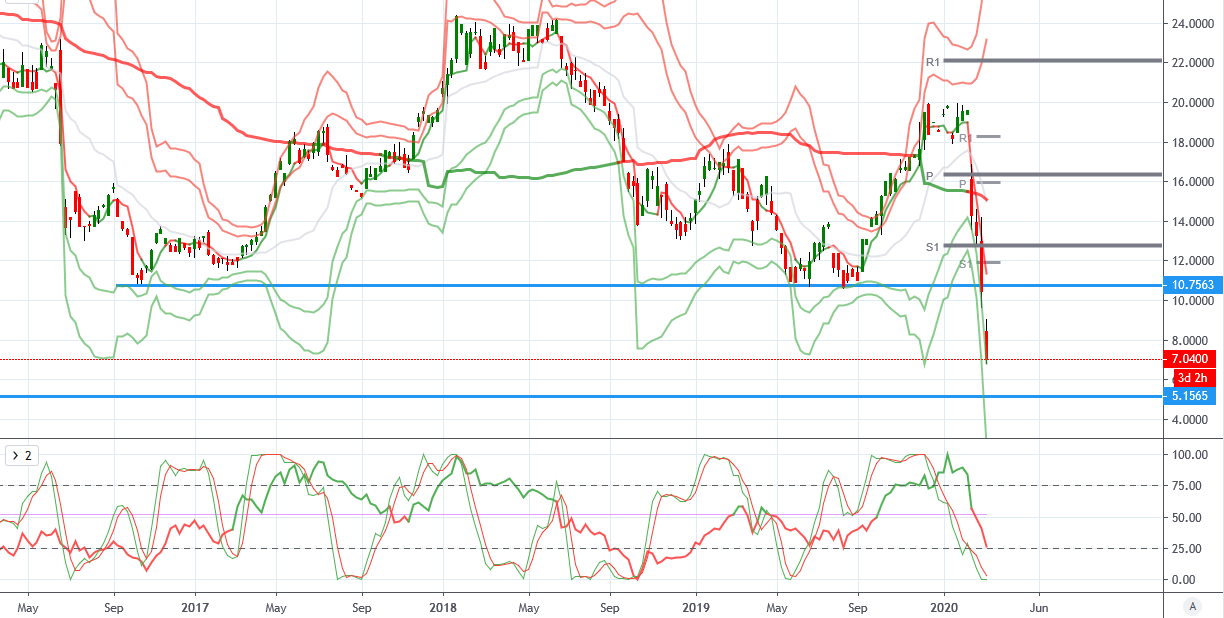

EasyJet (Bearish below 10.7563)

From a technical viewpoint. EasyJet has seen severe declines over the last six weeks taking price down through the yearly and monthly pivots. With longer term VWAP firmly negative, price has now also broken down through the 10.7563 level which is a major long-term support level. Unless price is able to recover above this level, a test of the 5.1565 level looks increasingly likely and a break here would be a worrying development for EasyJet.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!