ECB Easing to Weigh on EURAUD

AUD price action has been highly subdued over recent months given the deterioration in trade relations between the US and China. Following the announcement from Trump that he would be placing a fresh 10% tariff on a further $300 billion of Chinese goods as of September 1st, China responded by devaluing the Yuan, which sent USDCNH above the 7 level for the first time since the GFC in 2008. Just last week, China then announced a fresh set of 10% tariffs on a further $75 billion of US goods. Trump reacted aggressively, saying that he would order all US companies to cease operating in China. However, these comments have since been retracted, and for now, the market awaits the next set of trade talks between the two side, due to take place in September. In the meantime, the ECB is expected to announce significant measures in September which might move EURAUD downwards.

AUD Outlook Remains Clouded

The escalation in trade aggression has weighed heavily on AUD and the near term outlook remains bleak given the low expectations for a swift resolution to the trade stand off between the US and China. Indeed, speculative positioning reflects a market which is heavily short AUD, as traders continue to use it as a proxy for trading China. The underperformance of AUD has been particularly visible against EUR. However, there are some upside risks. If the RBA remains on hold over September, along with the country receiving divided payments from resource companies, this could help lift AUD somewhat. Furthermore, if the ECB announces a package of easing measures in September as it is expected to do, this too could create some room for upside in AUD against EUR.

Growth Gap Narrowing

The growth gap between the two economies has narrowed recently though remains in favour of Australia with growth expected to print 2.2% this year, vs 1.1% in the Eurozone. However, the current account surplus in the Eurozone has been a big lift, printing a solid 2.8% of GDP in Q1 of 2019, not too far below the 3.4% all time highs. A large part of this has been down to the large trade surpluses in Germany. On the other hand, Australia has been working to reduce its current account deficit by offering low yield pickup. However, the deficit has been narrowed significantly due to surging trade surpluses with the country reporting average surpluses of AUD 4.2 billion over the 12 months through June 2019.

ECB To Ease Ahead of RBA

The market is currently pricing an RBA rate cut for October, while the ECB is expected to announce significant measures in September. The minutes of the ECB’s July meeting showed that the majority of policymakers now favour a range of measures instead of just a single action. Such a move could be heavily bearish for EUR, creating downside in EURAUD, at least until the RBA cuts again.

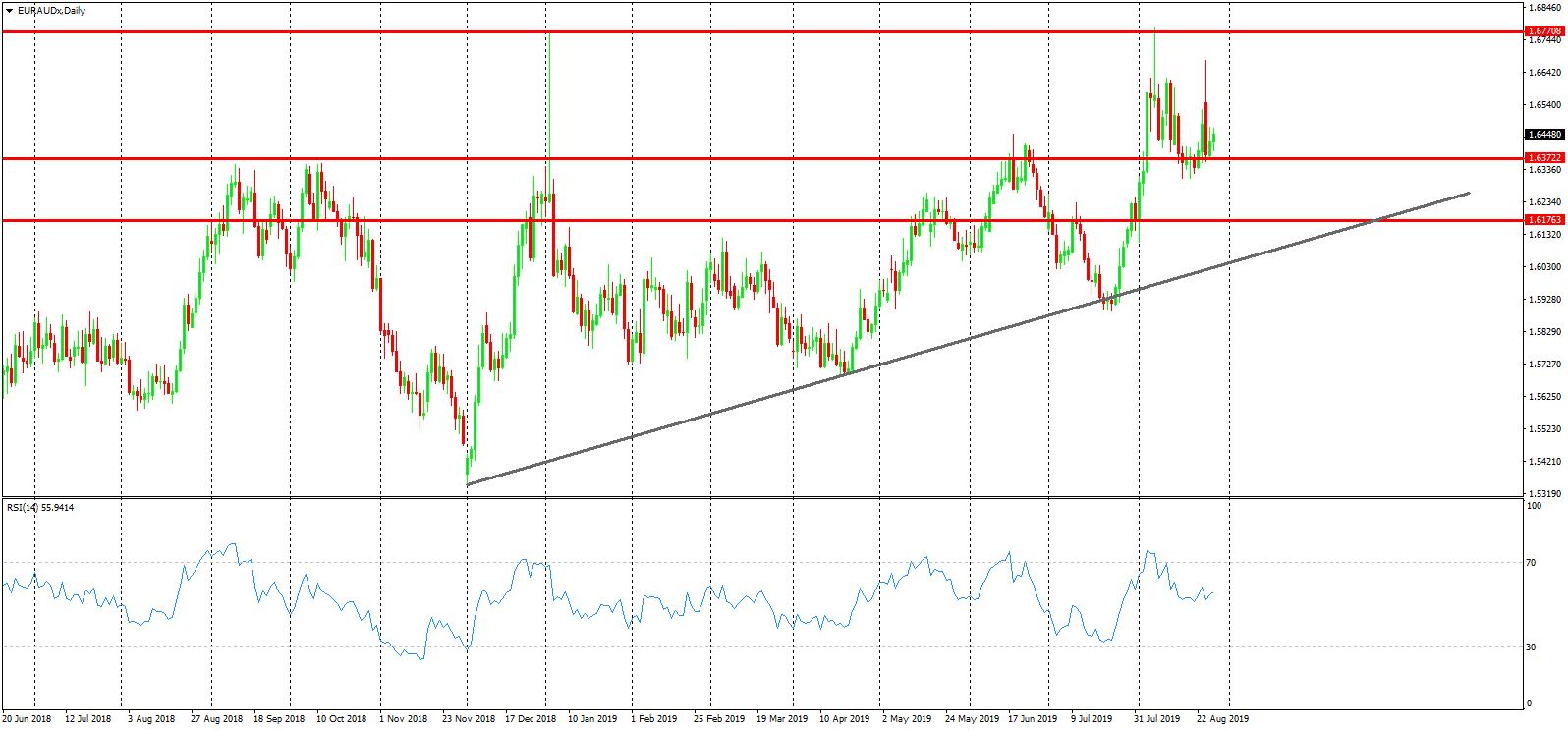

Technical Perspective

EURAUD is starting to show signs of topping out. The double top test of the 1.6770 level was accompanied by bearish RSI divergence with price currently putting in a lower high against the last peak. To the downside, the key level to watch is the 1.6372 zone. A break here will open the way for a deeper move down to the 1.6176 level where we have the rising trend line from 2018 lows.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.