EUR/USD Cedes Ground Ahead of FOMC Minutes and PMI Data

In Wednesday’s European trading session, the EUR/USD currency pair is gradually ceding ground, dipping below recent short-term equilibrium level of 1.0850. Market players are adopting a wait-and-see approach ahead of crucial releases: the FOMC minutes and the preliminary PMI data from both the Eurozone and the United States, scheduled for Thursday. These reports are anticipated to shed light on trends in demand, inflation, and employment.

The Euro continues to hold its ground against the US Dollar, bolstered by skepticism over the ECB likelihood of further rate cuts post-June. Several ECB officials suggested during recent interviews that while a rate cut in June is plausible, any subsequent moves might be premature.

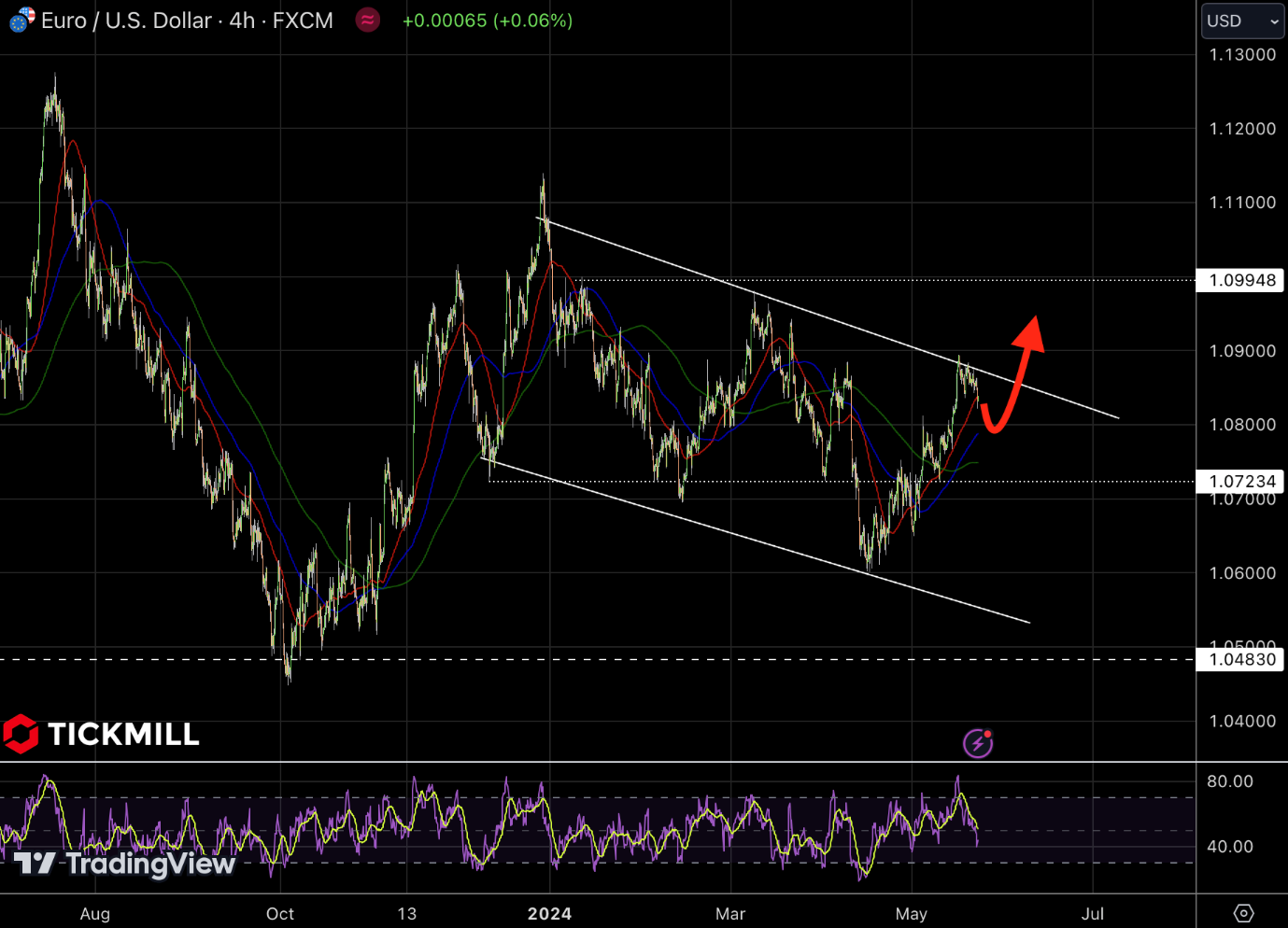

From the technical analysis perspective, the pair is currently moving within a descending channel, facing resistance near the 1.10 level. Recent price action indicates a potential for a pullback towards the mid-channel support around 1.0723 before any further upward momentum. The RSI is hovering around neutral levels, suggesting room for movement in either direction. If the pair can hold above 1.0723 and regain bullish momentum, it may challenge the upper boundary of the channel again. A break above this resistance could signal a trend reversal, targeting higher levels:

Across the Atlantic, the anticipated dip in the annual CPI for April hasn’t alleviated the concerns of Federal Reserve policymakers about sustained progress in curbing inflation. Given the robust state of the US economy, officials fear that easing price pressures may be short-lived.

Cleveland Fed President Loretta Mester emphasized the need for consistent, favorable inflation data over several months before she would support a shift towards policy normalization. Similarly, Atlanta Fed President Raphael Bostic indicated no expectation of rate cuts before Q4 2024. Bostic also noted that while business owners report diminished pricing power, they remain optimistic about the economic outlook.

Investors are keenly awaiting the release of the FOMC minutes from the May meeting, due later today in the New York session. However, given that the Fed's recent decisions have been heavily influenced by persistent inflation data from early 2024, the impact of these minutes might be minimal.

Meanwhile, the GBP/USD pair is on the rise, hitting 1.2760 in Wednesday’s European session. This movement follows the UK Office for National Statistics’ report indicating a slower-than-anticipated decline in April’s CPI. Despite the softening from March, inflationary pressures in the UK remain higher than expected, suggesting that the Bank of England’s elevated interest rates are continuing to exert downward pressure on inflation.

The less-than-expected decline in UK inflation dampens the outlook for BoE rate cuts, which markets had anticipated might begin at the August meeting. The key factor disrupting these expectations is the modest decrease in annual service inflation, which edged down to 6.0% from 6.1%, still posing a significant barrier to achieving the 2% inflation target.

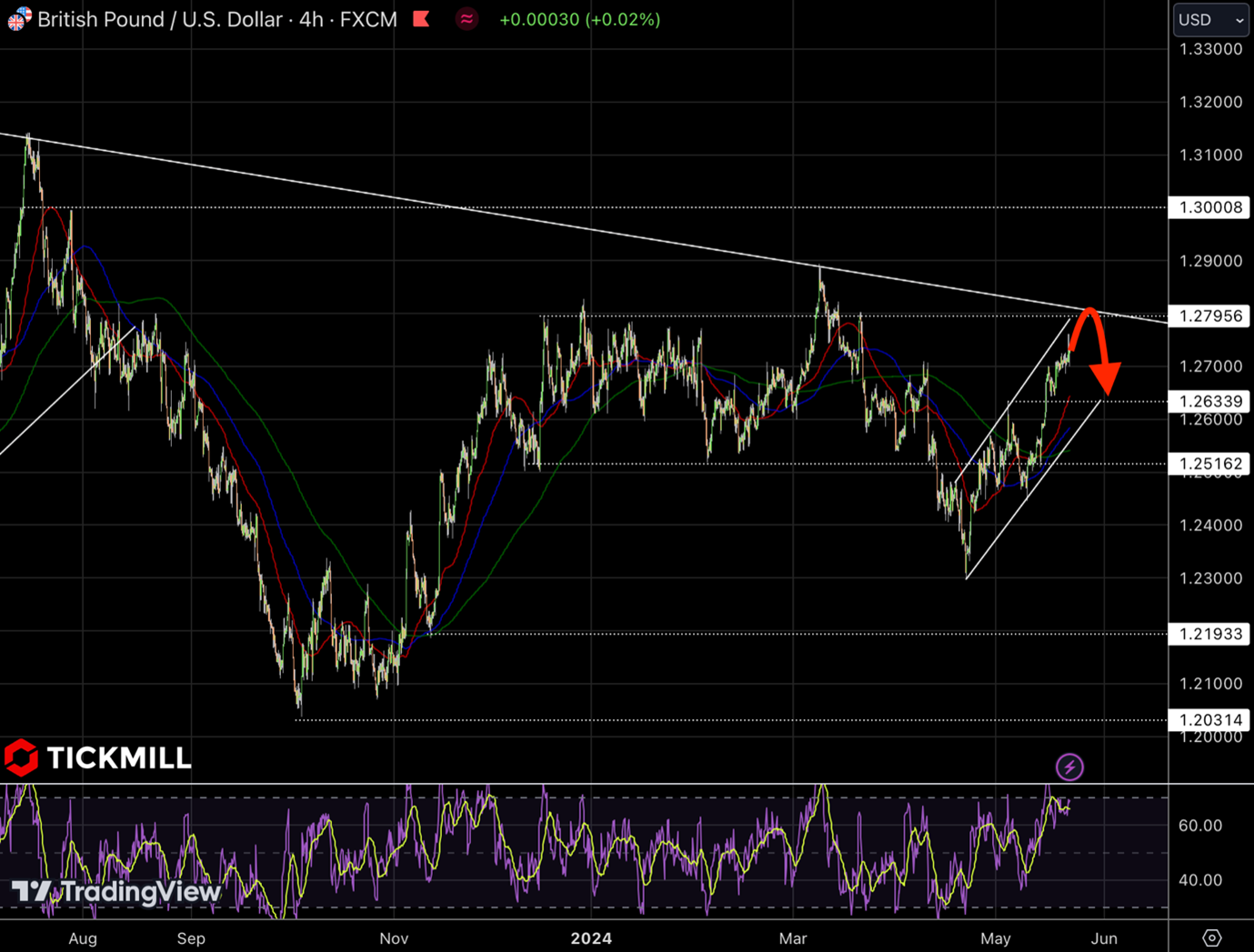

On the technical side, the GBP/USD pair is currently approaching a significant long-term resistance line near 1.2800, as indicated by the downward sloping trendline. The recent upward movement appears overstretched, suggesting a potential pullback. The RSI is also entering overbought territory, reinforcing the likelihood of a retracement. Immediate support is seen around 1.2630, followed by 1.2516. A breach below these levels could signal a deeper correction:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.