EUR/USD Holds Ground Amid German CPI News But Technical Signal Points To Further Weakness

The EUR/USD pair has found temporary stability around the 1.0830 mark following the release of Germany's May Consumer Price Index data, which came in slightly hotter than expected. Monthly headline CPI ticked up by just 0.1%, falling short of the anticipated 0.2%, while harmonized inflation met expectations with a 0.2% rise. On an annual basis, headline inflation matched forecasts at 2.4%, up from the previous 2.2%.

Germany's inflation figures are crucial as they significantly influence the European Central Bank's monetary policy, given Germany's substantial contribution to the Eurozone's GDP. The ECB has maintained a stringent interest rate policy since July 2022, and market participants are keenly awaiting signals on how the ECB will adjust its rates post-June. ECB policymakers are currently hesitant to set a clear path for future rate cuts, preferring to remain flexible and data-driven.

ECB's Villeroy de Galhau recently dismissed the idea of committing to quarterly rate cuts, emphasizing the need for freedom in timing and pace. This cautious stance contributes to the uncertain near-term outlook for EUR/USD, as investors brace for the upcoming Eurozone preliminary CPI data for May and the US core Personal Consumption Expenditure (PCE) data for April, both set to be released on Friday.

These inflation reports are expected to significantly impact market expectations regarding rate cuts from both the ECB and the US Federal Reserve (Fed). The Fed's preferred inflation measure is projected to show steady growth, with monthly and annual increases of 0.3% and 2.8%, respectively.

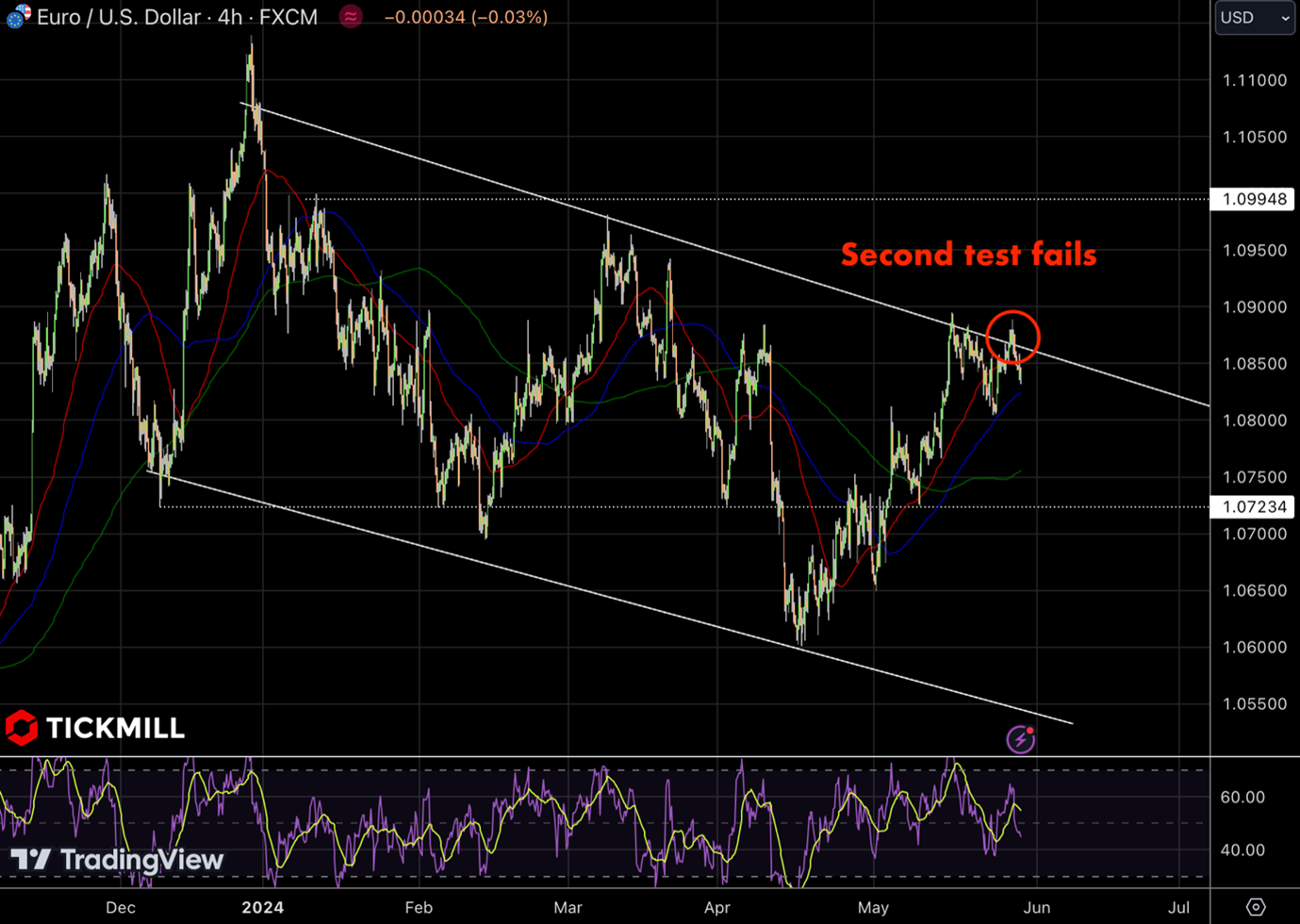

The EUR/USD chart indicates a downtrend within a descending channel, with the pair recently failing to break above the upper boundary for the second time around the 1.0900 level. This failure to breach resistance suggests continued bearish momentum. The Relative Strength Index (RSI) is hovering near the midline, indicating neutral momentum but with the potential for a downturn if it drops below 50. Support is visible near the 1.0723 level, which could be tested if the bearish sentiment persists. Overall, the technical outlook remains bearish unless the pair can decisively break out of the descending channel:

The Pound Sterling retreated to 1.2730 against the US Dollar (USD) during Wednesday's American session, pulling back from a fresh 10-week high of 1.2800 reached on Tuesday. This pullback in the GBP/USD pair is due to a combination of a softer UK inflation outlook and a stronger USD.

Recent data from the British Retail Consortium (BRC) showed a significant easing in UK shop price inflation for May. The annual change in shop prices grew by only 0.6%, the slowest rate since November 2021, down from the previous 0.8%. Notably, food price inflation dropped for the 13th consecutive month to 3.2%, from 3.4% in April, as retailers passed on cost savings to consumers.

This downward trend in UK inflation could heighten expectations for rate cuts by the Bank of England (BoE), which has maintained a restrictive interest rate stance since December 2021. Investors are now speculating that the BoE might begin its policy normalization process as early as the August meeting.

On the technical side, GBPUSD encountered stiff resistance near the key medium-term resistance line, as indicated on the chart below. The price pulled back as expected, and downward momentum could push the price towards the lower areas of support, such as 1.2650 and lower:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.