EUR/USD Leaps on Weak USD and Strong Eurozone PMI Data

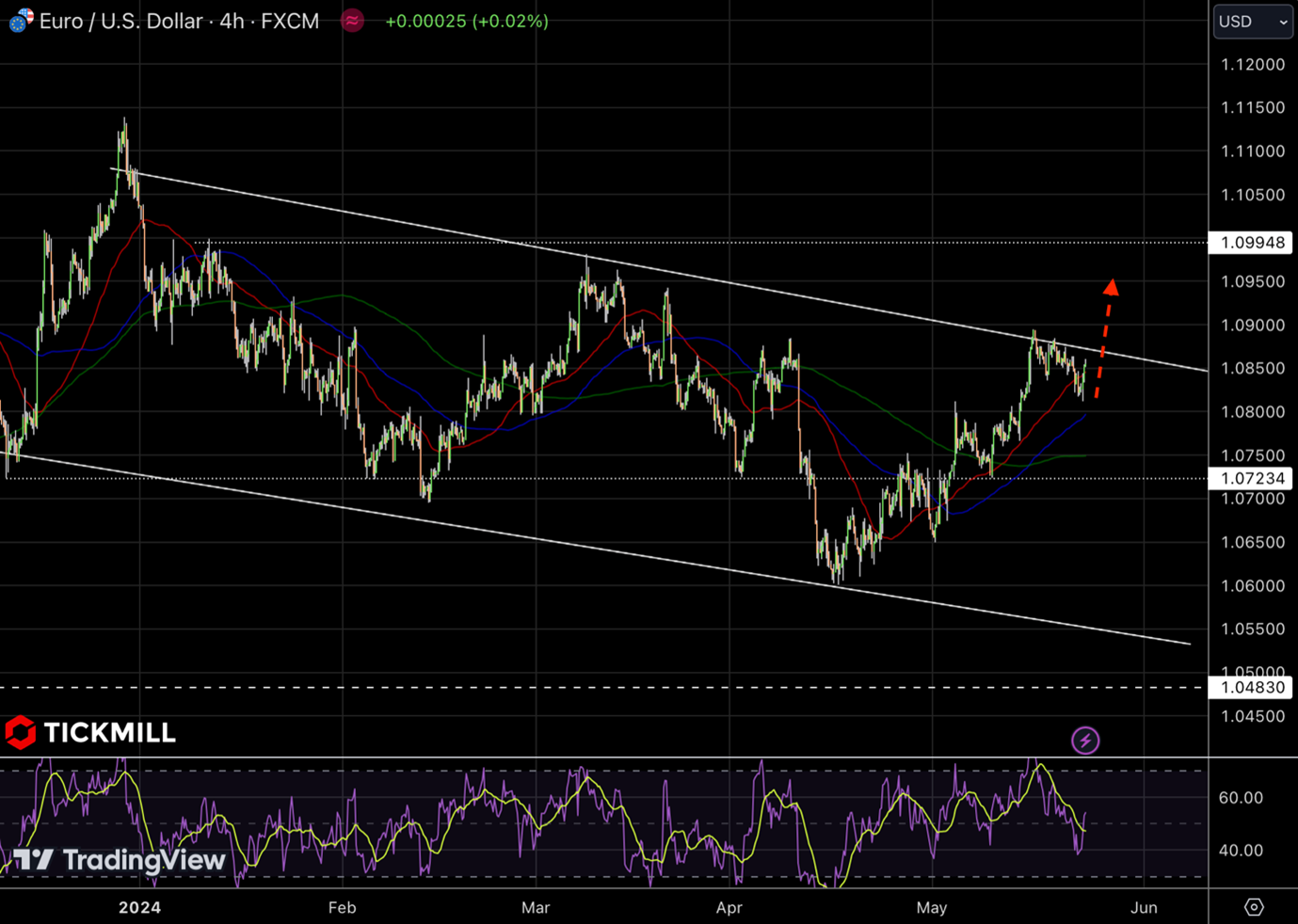

The EUR/USD pair saw a remarkable uptick, bouncing back strongly after bottoming out near the crucial 1.08 support level during Thursday’s American session. This surge comes on the heels of a softer US Dollar and surprisingly strong preliminary PMI figures from the Eurozone for May. The price braces for a second test of the upper bound of the bearish corridor, increasing the risk of a bullish breakout:

The US Dollar Index which tracks the greenback against six major currencies, slid to 104.65, just shy of the critical 105.00 resistance. The Dollar's rebound seems to be running out of steam as traders bet that the Federal Reserve will start slashing interest rates by September.

Wednesday's FOMC Minutes revealed that while Fed officials expect inflation to eventually ease, the current rate of decline isn't fast enough to justify cutting the fed funds rate, which remains between 5.25% and 5.50%, at least until September. Despite hints at possible rate hikes to tackle stubborn inflation, the market is holding firm on the expectation of rate cuts by September, bolstered by an anticipated drop in inflation hinted at by April’s Consumer Price Index data.

The strength of the labor market remains a key factor in the Fed’s decision-making. Recent discussions among Fed officials even included the possibility of raising rates further. This initially gave the US Dollar a boost, but the momentum was reversed by a fresh wave of USD selling following upbeat European economic data, particularly in the Services and Manufacturing PMIs.

According to the HCOB agency, the Eurozone's Manufacturing PMI climbed to 47.4, surpassing forecasts of 46.2 and the previous reading of 45.7. Although still under the 50.0 mark, indicating contraction, the Composite PMI jumped to 52.3, beating the consensus of 52.0 and the prior 51.7. The Services PMI, which represents the service sector, rose to 53.3, though it missed the expected 53.5.

Several ECB policymakers prefer a data-driven approach to further rate cuts in July, wary that aggressive monetary easing could stoke inflationary pressures once again. They also fret about balancing monetary stimulus with inflation and other financial indicators. Markets are pricing in three ECB rate cuts this year. UBS, a leading financial institution, suggests that after an initial cut in June, the ECB might pursue a gradual reduction strategy, with 25 basis point cuts each quarter, totaling a 75-basis point reduction in 2024 and an additional 100 basis points in 2025.

On the labor front in the US, the Department of Labor reported that initial jobless claims for the week ending May 17 were lower than expected, at 215K versus the forecasted 220K and the upwardly revised prior figure of 223K. This underscores the resilience of the job market, adding complexity to the Fed's rate decision landscape.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.