Euro Holds Firm Above Key Resistance Amid ECB Rate Cut Speculation

In the hustle and bustle of Monday's early New York session, the EUR/USD pair showcased resilience, maintaining its position above the critical resistance level of 1.0700. The spotlight now falls on the impending release of pivotal economic indicators within the Eurozone, including preliminary Q1 GDP figures and April's inflation data, scheduled for Tuesday.

Investor sentiment hangs in the balance as these economic metrics are poised to sway speculation regarding potential interest rate adjustments by the European Central Bank (ECB). Recent market chatter indicates a growing consensus among investors that the ECB may initiate policy easing come June, viewing such actions as increasingly plausible.

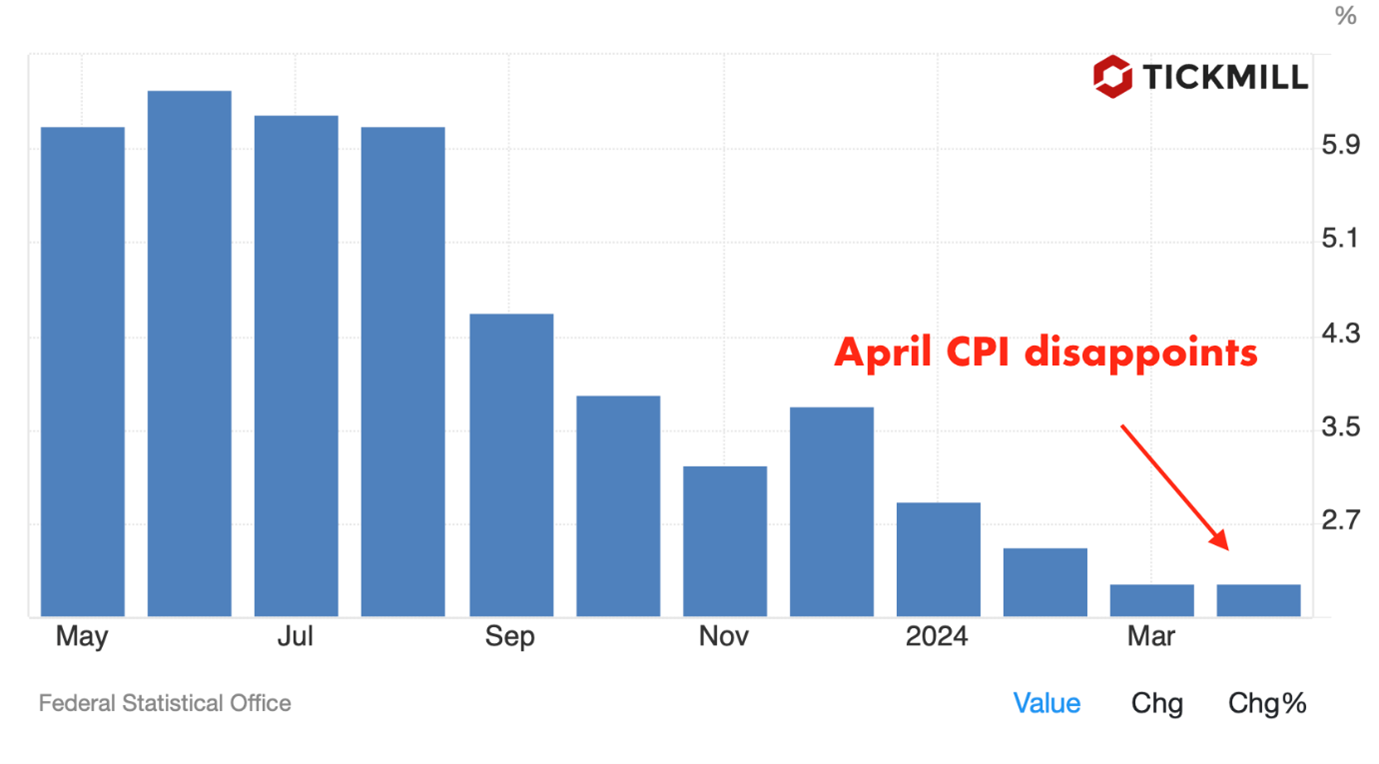

Echoing this sentiment, Banque de France Governor and ECB Council member François Villeroy de Galhau emphasized the timeliness of interest rate cuts, provided other factors remain steady. Villeroy's remarks underscore the ECB's readiness to pivot towards easing monetary policy, particularly with energy prices exhibiting stability, as noted in Monday's report revealing a plateau in Germany's April inflation figures:

However, the EUR/USD's trajectory hinges not only on Eurozone dynamics but also on the impending monetary policy decision from the Federal Reserve, slated for Wednesday. While market consensus anticipates the Fed maintaining interest rates within the 5.25%-5.50% range, all eyes are on the central bank's forward guidance.

Given robust Q1 GDP Price Index data and March's US core Personal Consumption Expenditure Price Index surpassing expectations, market expectations lean towards hawkish signals from the Fed regarding interest rates. Nonetheless, investors are keenly monitoring whether the Fed maintains its projection of three rate cuts in 2024, as indicated in interest rate derivatives pricing.

Technically, the EUR/USD appears to have stabilized ahead of the Federal Open Market Committee (FOMC) meeting. Yet, the divergence between market expectations and the Fed's forecasts, particularly evident in the dot plot, raises the specter of a dovish surprise. Such a scenario could propel the Euro higher, underscoring a bearish short-term outlook for the US Dollar in the lead-up to Wednesday's event:

Meanwhile, speculation swirls around the potential intervention by the Bank of Japan (BoJ) or its Ministry of Finance to bolster the Japanese Yen (JPY). The USD/JPY pair's significant depreciation, tumbling from 160.17 to 154.50, fueled market-wide weakness in the Greenback, amplifying volatility across forex markets.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.