Gold Soars On Fresh Trump Tariff Fears

Trump Tariff Threats

Gold prices have surged higher again on Monday with the futures market trading up to fresh record highs. Markets were plunged into fresh uncertainty over the weekend after Trump threatened to hit China with 100% tariffs amidst frustration over failure to agree proper trade terms. The prospect of a return to all-out trade war between the two economic superpowers is a grim one for markets with risk sentiment having suffered greatly earlier in the year when tariffs came into effect. Following the threat on Friday, Trump posted on social media over the weekend telling people not to “worry about China” and that “it will all be fine”.

US Govt Shutdown Rolls On

These remarks suggest that Trump is likely employing his well-known tactic of a hard threat followed by a walk-back, still gold prices are surging all the same showing that safe haven demand is strengthening here. The US government shutdown is continuing into its third week and with no end is sight, traders are increasingly sensing this could become the longest shutdown in US history (over 35 days). With downside impact on the economy growing, gold prices should continue to draw demand as traders eye a heavier need for the Fed to press ahead with furtehr easing.

Fed Speakers on Watch

In light of the shutdown, most US data will be postponed again this week leaving focus on a raft of Fed speakers, including Powell who speaks on Tuesday. With comments likely to lean on the dovish side, gold should stay supported. Ahead of that, Trump joins world leaders in Egypt today for Gaza ceasefire discussions which could also produce market moving headlines.

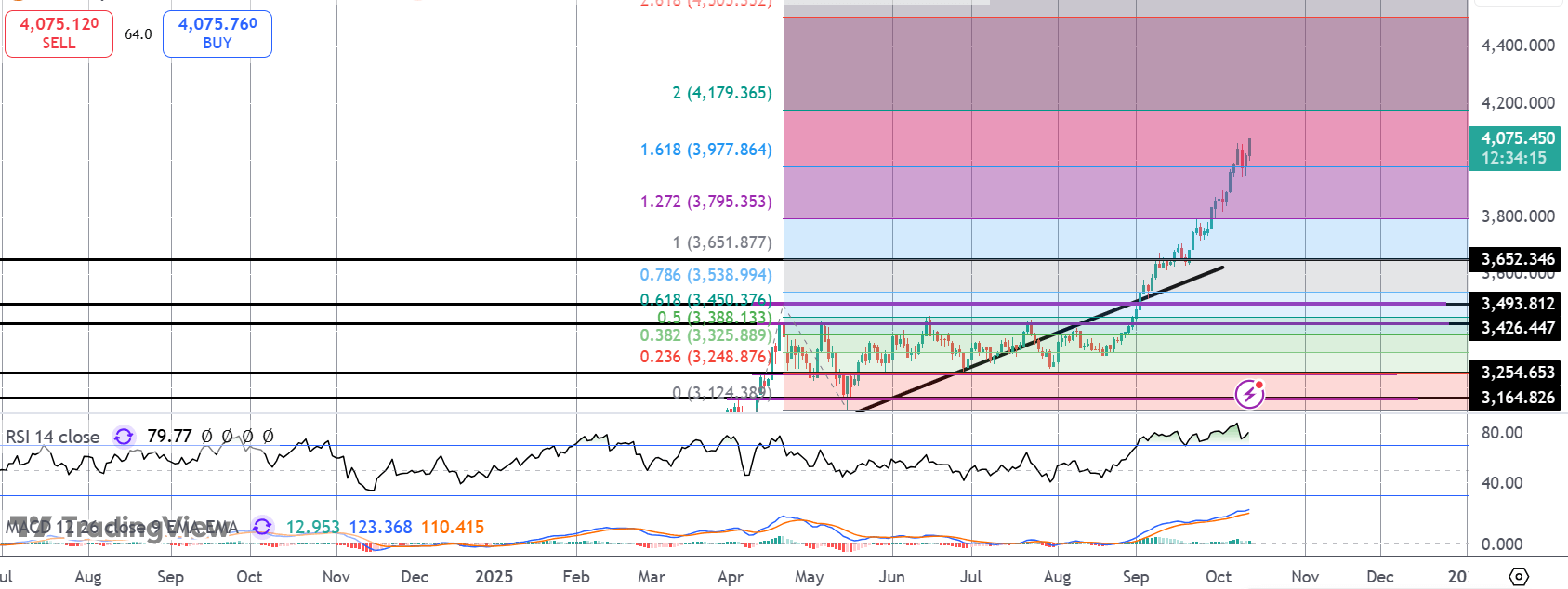

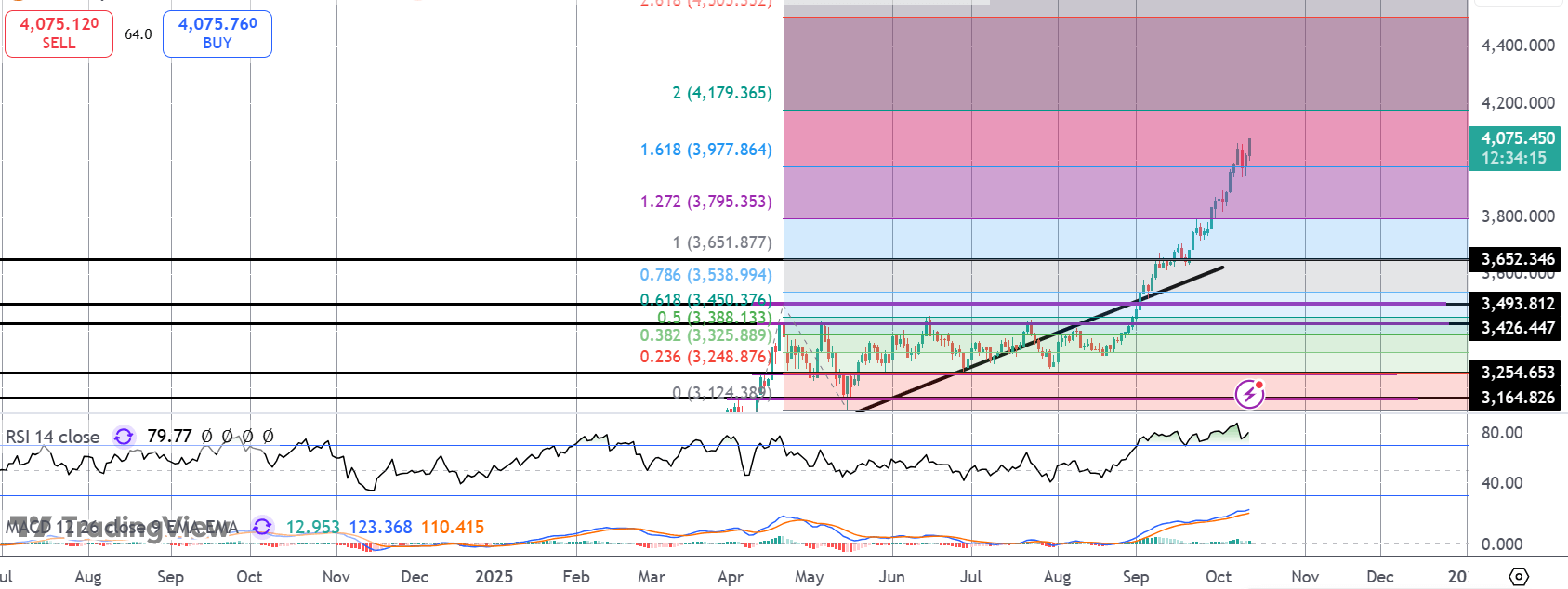

Technical Views

Gold

The retest of the broken 1.61% Fib level has seen fresh demand taking the market higher again. While above this level, and with momentum studies bullish, focus is now on a test of the 2% Fib level next around the 4,179.36 mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.