IMF Urges Governments To Raises Taxes & Borrowing

"Lasting Damage"

In its latest set of economic forecasts released this week, the International Monetary Fund struck a firmly dovish tone. The IMF warned that the COVID pandemic will cause “lasting damage” to living standard’s around the globe and warned that governments may need to increase taxes on rich people and corporates in a bid to deal with the economic damage.

Growth Revised Higher But Still Worst Since Great Depression

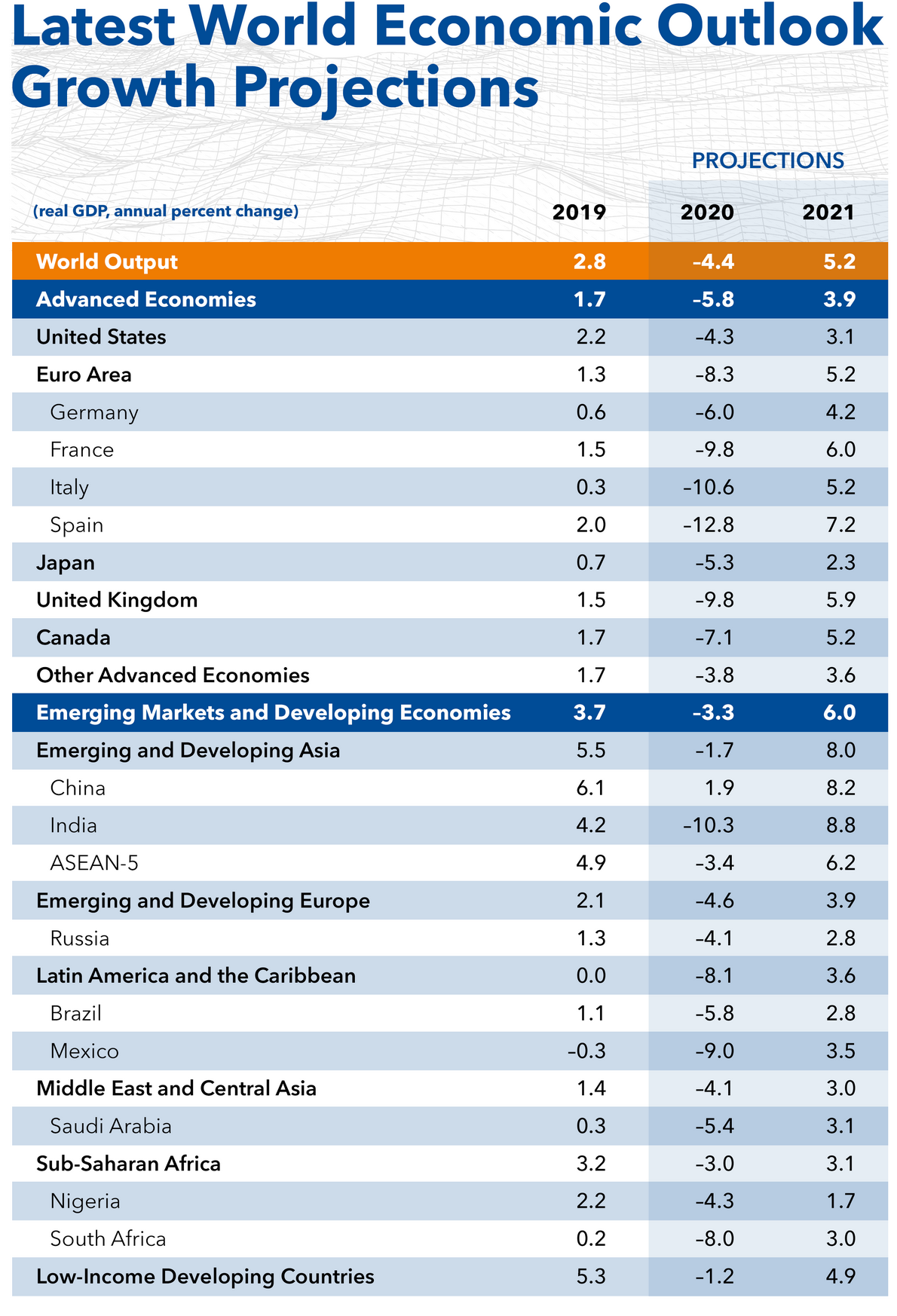

The IMF warned that job losses and redundancies will change many sectors causing a shift in industries which will be slow and painful. While the bank has revised its 2020 growth forecasts higher from the last update in June, it still sees almost all leading economies suffering the worst economic contraction since the Great depression. The IMF now sees global growth contracting 4.4% in 2020, up 0.8% from the June forecast.

Tourism & Commodities Countries To Suffer

In its twice-yearly report, the IMF cited countries which rely heavily on tourism and commodities exports as those likely to be worst affected by the crisis. Additionally, as economies adjust to less travel and commuting, more bankruptcies will cause “significant losses of output” even once the pandemic has subsided.

In terms of the recovery, the IMF projects that, provided the pandemic is brought under control next year, global growth should recover by 5.2% in 2021, 0.2% lower than the June forecast. However, by the end of 2021, the IMF forecasts that advanced economies will be 4.7% smaller than initially forecast with emerging economies contracting by 8.1%. In terms of the longer-term impact, the IMF forecasts advanced economies to contract by 3.5% and emerging economies by 5.5%.

The IMF’s chief economist Gita Gopinath said: “The persistent output losses imply a major setback to living standards relative to what was expected before the pandemic. Not only will the incidence of extreme poverty rise for the first time in over two decades, but inequality is set to increase.”

Governments Should Raise Taxes & Borrowing

In terms of addressing the economic crisis, Gopinath said: “Although adopting new revenue measures during the crisis will be difficult, governments may need to consider raising progressive taxes on more affluent individuals and those relatively less affected by the crisis — including increasing tax rates on higher income brackets, high-end property, capital gains and wealth”. Gopinath concluded by saying that those countries who can, should borrow as much as possible in the near term to help buffer their economies from the crisis and limit the damage caused. The IMF’s chief economist urged that this should happen before government’s start removing sector specific work and encouraging workers to shift away from sectors harmed by social distancing.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.