Institutional Insights: Credit Agricole FX Weekly 28/11/25

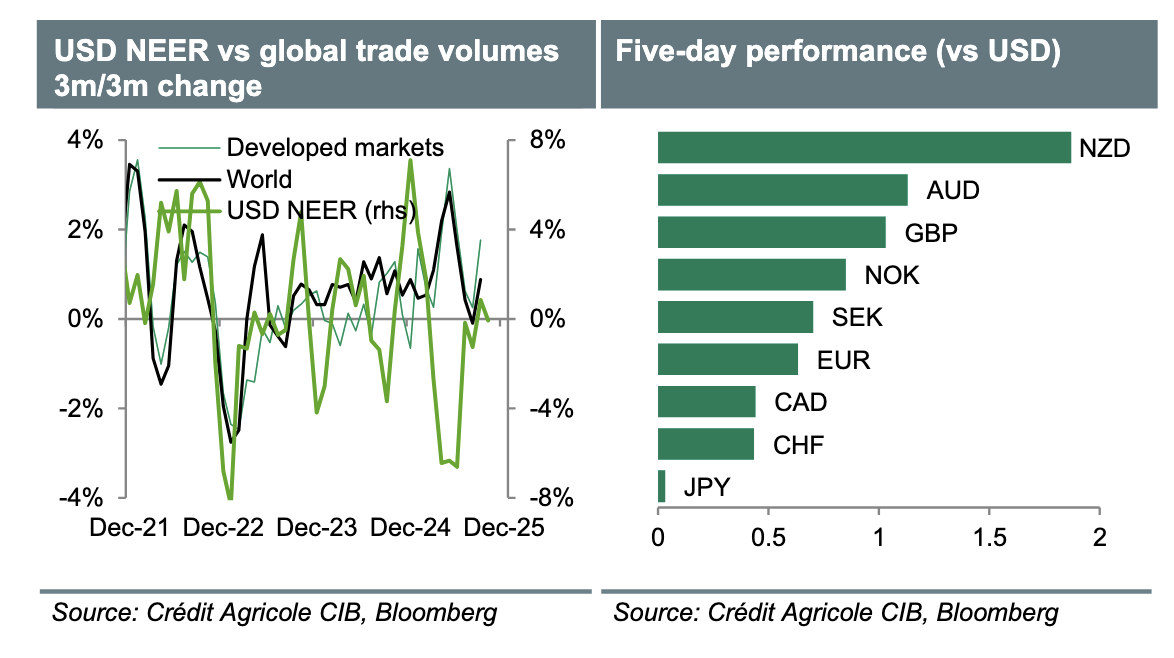

December has traditionally been a month where the US dollar (USD) tends to face broad-based selling pressure. Historical FX seasonality trends reveal that the USD has weakened in approximately 70% of Decembers over the past 25 years. Notably, the dollar has seen the sharpest losses against the Swiss franc (CHF) and Swedish krona (SEK), while holding relatively steady against the Japanese yen (JPY) and Canadian dollar (CAD).

Key factors driving this negative year-end seasonality include:

1. Foreign portfolio investors hedging and repatriating profits earned on USD-denominated assets.

2. Exporters converting their USD-based revenues into their home currencies, as most global trade is conducted in USD.

Looking ahead to this December, we anticipate another wave of significant USD selling. This expectation is supported by the recent increase in global trade flows, which historically exhibit a negative correlation with the USD. For example, during Q1 2025, the frontloading of US exports ahead of tariff introductions triggered USD-selling flows tied to hedging and profit repatriation. Additionally, with US equity and fixed income markets attracting record foreign portfolio inflows this year, we expect profit repatriation flows to intensify as the year concludes.

However, it’s worth noting that short-USD hedging flows from corporates and investors might be somewhat muted due to elevated hedging costs.

In the near term, market attention will turn to key US data releases, including the ISM indices and ADP employment report for November, as well as September’s Core PCE inflation data. With markets leaning toward a potential rate cut ahead of the Federal Open Market Committee (FOMC) meeting on December 10, only strong positive surprises in the data could bolster the USD. Meanwhile, euro (EUR) investors will closely monitor November's HICP flash estimate, final PMI readings, and any remarks from European Central Bank (ECB) officials. Developments related to the ongoing war in Ukraine and France's budget process may also draw interest.

Elsewhere, the British pound (GBP) will be influenced by Bank of England (BoE) speeches following the autumn statement. On the Canadian dollar (CAD) and Swiss franc (CHF) fronts, likely pauses in monetary policy from the Bank of Canada (BoC) and Swiss National Bank (SNB) are expected to have minimal impact in the near term. For Australia, upcoming GDP data will be pivotal in determining whether the Reserve Bank of Australia (RBA) can maintain a delicate balance between supporting growth and ensuring price stability—potentially sustaining the Australian dollar’s (AUD) recent strength.

Finally, all eyes will be on a speech by Bank of Japan (BoJ) Governor Kazuo Ueda, which is expected to set the stage for the central bank’s December meeting. The outcome will likely shape whether the Japanese yen (JPY) can continue its

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!