Market Extends Rally on Positive Headlines, SPX Eyes Breakout to New All-time Highs

US stocks climbed higher yesterday, with cyclicals leading the rally, gaining 1.95%. Defensive stocks which benefit from the times of risk aversion, added much less, 0.68%. The rally in the market were fueled by fresh headlines on fiscal stimulus in the US, supply and distribution of vaccine, as well as US blue chips’ earnings reports beating expectations.

Late last week, doubts emerged that vaccine companies wouldn’t be able to deliver on time. The source of еру negative news was the dispute between Astra Zeneca and the European Ministry of Health. The latter accused the British company of disrupting supplies. Nonetheless, this week the Biden administration raised optimism in investors by announcing that weekly vaccine shipments in the United States will be increased, and retail pharmacies will also engage in distribution of vaccines. The statements from the White House improved confidence in the pace of vaccination in the leading world economy.

Yesterday Google and Amazon released their earnings reports and the data showed that the companies' revenues significantly exceeded market expectations, which helped to revise the decline in consumer spending due to the crisis in positive direction.

The term structure of interest rates in the US extended its shift which indicates that expectations of economic expansion strengthened in bond markets: after a brief pullback, the spread between 2 and 10-year Treasuries is back to 100 basis points:

That is, the appeal of bonds with longer maturity continue to fall against bonds of shorter maturity. This usually happens due to expectations of increased inflation in the future or higher central bank interest rates.

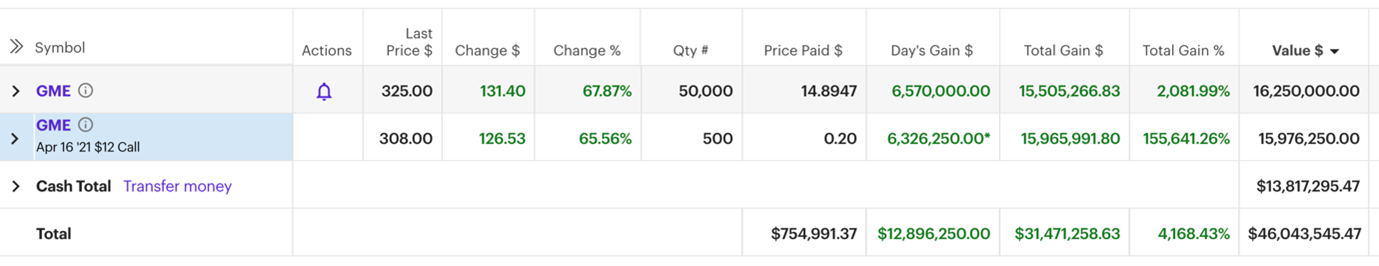

The bubble in Gamestop and other meme stocks continues to rapidly deflate. In just a few days, the stock’s price fell from $470 to $ 90. The Wallstreetbets’s mastermind DeepF ** ingValue lost $19 million in two days. It’s fair to say though that he put up $52,000 in GameStop in 2019, turning them into $46 million (portfolio value at the peak of the bubble):

Goldman Sachs reported that hedge funds slashed leverage en masse last week, using gains from market favorites to cover losing short bets. The move triggered correction in the stock market we observed last Thursday and Friday. Recall that I explained in my article last week, the pullback in stock market would be short-lived. There is much less space left for short-squeeze trades, and it is unclear what those who continue to hold GME or similar overheat stocks are counting on.

Short-squeeze has apparently weakened in silver as well, which after falling 8% on Tuesday, continues to decline on Wednesday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.