Reflation Bet in the US Appears to be Gaining Traction

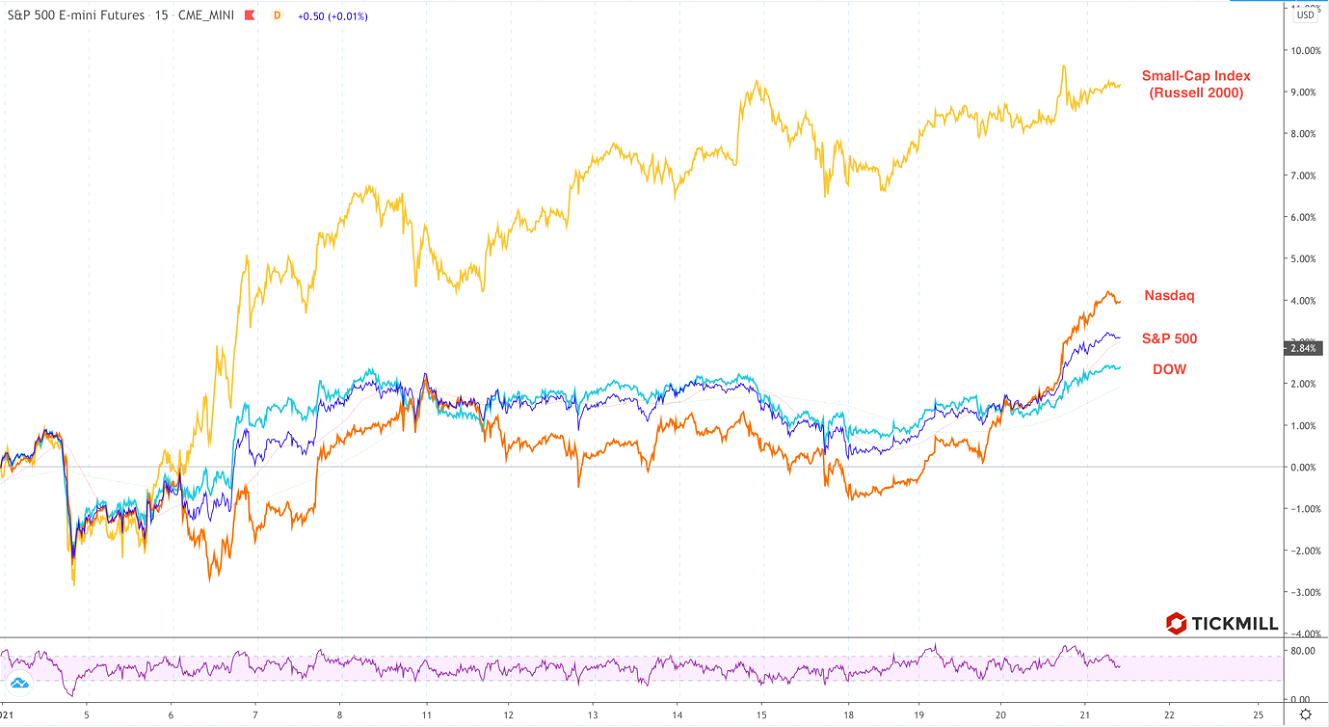

US futures and European stocks resumed rally anticipating more bullish updates from the new US administration. We saw fresh highs in S&P 500 yesterday and extension of bullish sentiment in today’s session with SPX futures hitting new peak at ~ 3860 point. Recall that we discussed possible reasons of market participants to increase their exposure in US stocks. Breaking down returns of US equity markets by indexes and taking the start of 2021 as the starting point, we see strong evidence that investors are increasing their bets on reflation (economic rebound) in the US economy:

The small caps that make up the Rusell 2000 Index posted a combined 9% return in 21 days, while returns of its peers are much lower - 2-4%. It’s well-known empirical observation that small-caps benefit from early stages of pickup phase of a business cycle and recent market developments clearly reflect the efforts of investors to price such expectations. We also see that tech sector has caught up its peers in recent days, most likely because rhetoric of the new administration is dominated by talk about stimulus and, to a lesser extent, about taxes, regulation and scary things for Nasdaq firms. This helped investors in the index to breathe out. Democrats’ discussion about income redistribution, taxes on rich and corporations should nevertheless begin later when risks for the economy subside.

Consumer prices in the UK came out higher than expected in December, what increased Pound’s appeal in the FX space. GBPUSD saw a brief bout of resistance at 1.37 and from the technical standpoints aims to break through the range with targets at new multi-year highs:

The UK economy, or rather the consumer component, judging by inflation in December, showed pretty strong resistance to a lockdown, which is a surprise for expectations.

The Bank of Japan was unable to salvage long positions in USDJPY, although it said it was too early to abandon its policy of low rates and yield curve control. The dovish stance of the Bank of Japan is factored in yen’s exchange rate and attention of investors is focused on another important factor - fiscal stimulus in the United States. Earlier, we discussed why a fiscal impulse in the US could have a positive effect on Japanese assets, and therefore increase the attractiveness of the Japanese currency.

After weak consumer inflation print in Canada as shown in the report released on Wednesday, the Bank of Canada was expected to express concerns, but it turned out exactly the opposite, which caused USDCAD to move down from 1.2990 to 1.2920. Due to the unusual stance of the Central Bank, the movement along the dovish trend in USDCAD will probably remain in force. As a macro factor, persistent upside pressure in the oil market helps CAD to stay strong. Judging by shifts in exposure in the US stock market (clear overweight in cyclical small-caps), we may also see a preparation for a breakout through local highs in the oil market. But let’s not forget that we have US shale sector which is still alive (despite Biden agenda which is long-term negative for US oil) and the US inventories, according to the latest API update rose for the first time in weeks which is definitely a worrying development for OPEC and oil market participants.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.