Two Charts that Show Equity Markets Have a Room for Growth

Buyers of risk assets are ending their hiatus and seem to be on the offensive today. Futures on US stock indices rose on Tuesday followed by European markets which are getting rid of fears (despite lockdown extensions) and also showed modest gains today. USD receives the biggest blow from rising demand for risk (due to the fact that investors dump cash and buy assets with yield) and the current situation is no exception. USD index is down almost 0.3% and is trying to defend support at 90.50 with mixed success.

Despite yesterday's blues, fundamentally, equity markets have benign environment for extension of the bull market. In global economies, we observe that financial stress subsides (i.e. credit risks decrease) and near-term future is being revised to the upside. For example, the little-known index of systemic risk of the ECB, which the regulator often takes into account when making policy decisions, slid to the pre-crisis level, despite the fact that the pandemic is not over yet and short-term risks persist:

The current value of the index indicates relatively low level of systemic risks, cancelling on of the reasons why central banks could preemptively change policy.

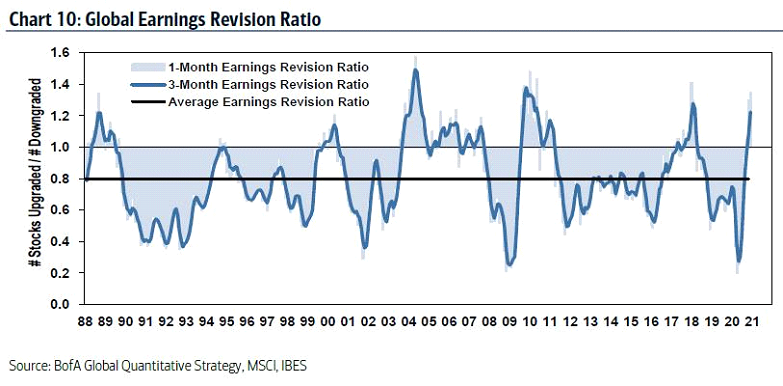

Forecasts of the future in the context of stock markets are expressed in forecasting the company's revenue. If we take the number of companies whose revenue was revised upwards according to the latest data and count those companies for which revenue was revised downwards, we get a certain ratio that characterizes which momentum prevails in expectations - positive or negative. This is exactly what BoFa did by calculating the corresponding indicator:

We can see on the chart a rather extreme shift in expectations about how firms’ revenue trend will change in the near future. One can argue that this has been already priced in the SPX near 3800 points, but let’s not forget that the US will soon have another stimulus by $2 tn. which proved to be extremely bullish for financial markets during the first round of the government aid.

The stimulus money, one way or another, will either boost expected revenue of companies due to emergence of an impulse in consumer demand, or will go into stocks through investment and speculations channel, as it was the case in the first round of stimmy payments. That is why there is talk about SPX at 4000, a new wave of risk-on and as a consequence continuation of bearish USD trend which is gradually getting its grip back on the US currency.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.