SP500 LDN TRADING UPDATE 12/1/26

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

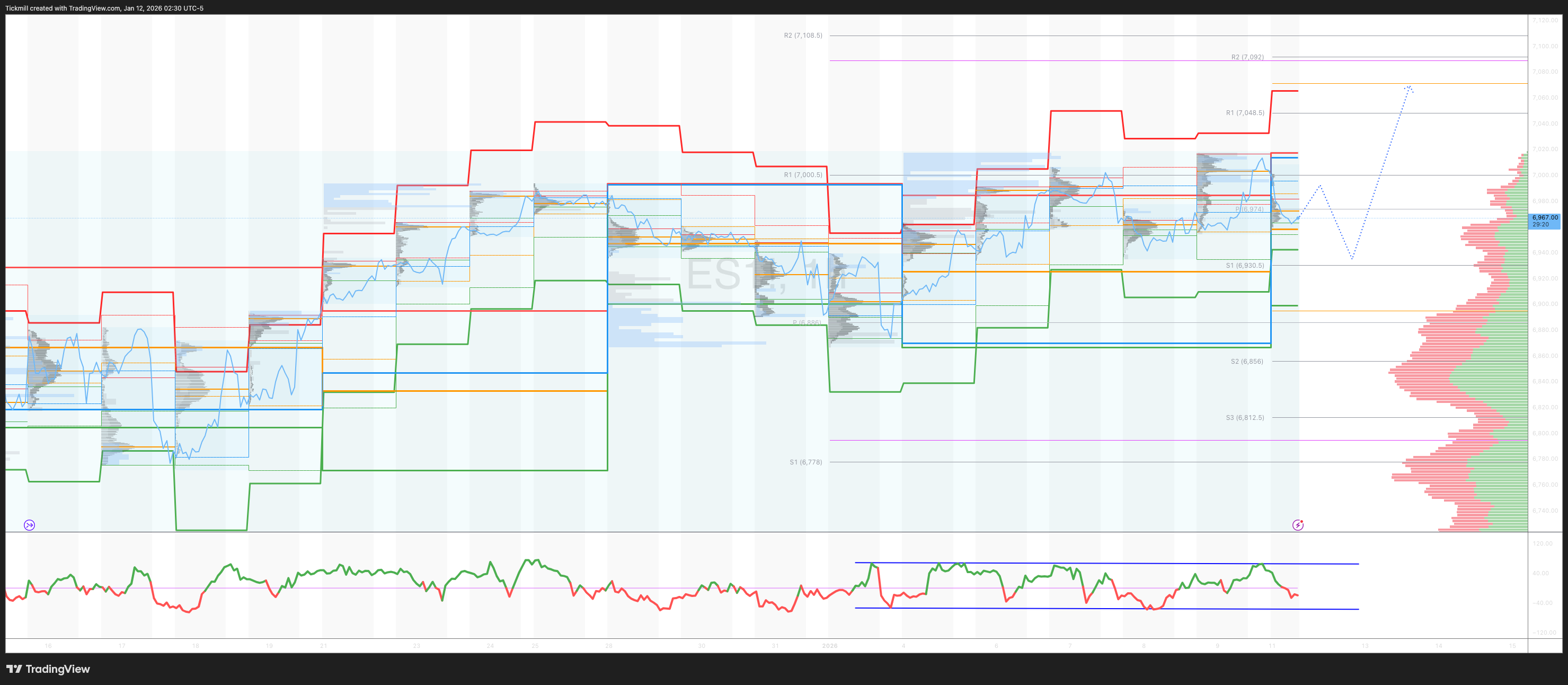

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 7090 SUP 6920

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The SPX aggregate gamma flip zone is around the 6880 level. There is a sharp increase in upside gamma starting at 6970 and above. Conversely, below 6770, the downside gamma becomes very steep.

DAILY VWAP BULLISH 6972

WEEKLY VWAP BULLISH 6905

MONTHLY VWAP BULLISH 6852

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6955

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6932

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favouring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Higher (OTFH): This represents a market trend where each successive bar forms a higher low, signalling a strong and consistent upward movement.

One-Time Framing Lower (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

US stocks closed higher on Friday, with the S&P 500 gaining over 1.5% for the week as investors navigated ongoing geopolitical uncertainty, shifting US policies, signs of resilience in the economy, and strategic positioning at the start of the new year. This marked a continuation of above-average equity returns for three consecutive years.

The first full trading week of 2026 brought a mix of new developments, yet felt reminiscent of patterns observed in 2025. Key highlights:

- Venezuela and Energy: US actions in Venezuela had a limited impact on global oil prices, with front-month Brent crude rising 4% this week. However, unlocking Venezuela’s substantial oil reserves could lead to lower prices in the long term, as noted by Daan Struyven in “Oil: Price Risks From Venezuela.” At the Energy Conference in Florida, Neil Mehta reported that Chevron (CVX) confirmed its Venezuelan operations remain unaffected, contributing approximately 1-2% of cash from operations through joint ventures in compliance with US regulations.

- Payrolls: December saw 50k non-farm payroll additions, but prior months were revised downward by 75k. This has reduced the underlying pace of job growth to just 11k, below the level needed for economic equilibrium, according to economists in “USA: Payroll Growth Somewhat Below Expectations.” The report strengthens the case for the Federal Reserve to skip a rate cut at the January FOMC meeting, potentially delaying the next cut to March.

- Consumer Sentiment: The University of Michigan’s consumer sentiment index rose slightly to 54.0 from 52.9, remaining near the lower end of its post-pandemic range. Inflation expectations edged higher, while housing activity showed no improvement. October housing starts fell 1.7% month-over-month, highlighting ongoing challenges in the sector.

Looking ahead, Kate McShane predicts a continued K-shaped economy in 2026, with middle-to-upper income consumers benefiting from increased discretionary cash flow, while lower-income households face pressure from rising food and healthcare costs due to cuts in SNAP, Medicaid, and Obamacare. Ronnie Walker forecasts core PCE inflation to decline by 70 basis points to 2.1% in 2026, driven by easing tariff pressures, lower housing inflation, and slower wage gains. Arun Manohar projects mortgage rates to end the year at 6.15%, which may not be low enough to resolve the housing turnover slowdown caused by the post-GFC era’s ultra-low rates followed by recent increases.

On employment, Joseph Briggs and team explored the long-term impact of AI-driven productivity gains, which could displace 6-7% of jobs. However, historical trends suggest new technology creates new opportunities. For instance, only 40% of workers today are employed in occupations that existed 85 years ago. While temporary frictional unemployment may rise by 0.5 percentage points during AI transitions, new specialties and industries could emerge, boosting discretionary demand in areas like pet care, tutoring, and private coaching.

In terms of investment strategies, Ben Snider highlighted the potential upside for pro-cyclical stocks driven by above-consensus US economic growth in “2026 US Equity Outlook: Great Potential.” The evolving AI sector is expected to favor app providers and companies leveraging productivity gains from AI. Steve Kron and team updated the US Conviction List, adding AVGO and DKS as top picks for the year in “US Conviction List - Directors’ Cut: January 2026 Update.” For short-term strategies, John Marshall shared key ideas for the upcoming 4Q earnings season, starting with JPM and DAL.

Looking ahead to next week, key updates include December inflation data (CPI and PPI), retail sales figures, and the January Philly Fed and Empire Manufacturing surveys. Additionally, 4Q25 earnings season begins, with results expected from major financial institutions such as JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Morgan Stanley, BlackRock, Bank of New York Mellon, State Street, PNC, and Regions Financial.

markets / macro :: the big questions of 2026.

10 January 2026

Tony Pasquariello

Goldman Sachs & Co. LLC

The first week of 2026 showed market strength with higher highs, healthy breadth, and strong momentum, despite tech underperformance. Key questions for 2026:

1. US GDP Growth (Joseph Briggs):

Forecast at 2.8% (vs. 2.1% consensus) due to government shutdown rebound, fading tariffs, tax cuts, and easier financial conditions. Strong growth expected in H1 (3.3% Q1, 2.6% Q2) before moderating in H2 (2.1%).

2. US Consumer (Elsie Peng):

Consumer spending to rebound with job growth (70k/month), tax cuts, and wealth effects. Forecasted 2.2% growth in 2026 (Q4/Q4), stronger in H1.

3. US Housing (Ronnie Walker):

Challenging outlook with limited mortgage rate relief. Minimal growth in home prices, starts, and sales. Affordability remains a key policy focus.

4. Trump Administration Policies (Alec Phillips):

Focus on affordability, potential tariff cuts, or a fiscal package (unlikely). Deregulation to continue, with housing affordability actions (e.g., 50-year mortgages) under consideration.

5. US Budget Deficit (David Mericle):

Deficit to remain around 6% of GDP, though unsustainable long-term. Additional fiscal stimulus unlikely.

6. US Bond Market (Will Marshall):

Range-bound 10-year yields (~4.2%) with a steeper curve as Fed cuts rates. Growth upside likely early in the year, followed by disinflation later.

7. S&P Valuation (Ben Snider):

P/E at 22x is high but justified by macro and corporate fundamentals. Multiples risk skewed higher if earnings and Fed policy align with expectations.

8. AI Earnings Impact (Ryan Hammond):

AI infrastructure and productivity gains to boost S&P 500 earnings by 0.4% in 2026 and 1.5% in 2027. Uncertainty remains, with broader impacts expected over time.

9. Equity Positioning (Gail Hafif):

Equity positioning remains high (+8 on a -10 to +10 scale). Institutional and retail investor activity is elevated, with systematic strategies showing mixed positioning.

10. Additional Notes:

- Podcast with Ben Snider on US equities outlook.

- Global defense stocks off to a strong start (US +13%, Europe +21%, Korea +27%).

- Uncertainty around replicating 2025’s market demand intensity.

- Consumer discretionary space shows both challenges and opportunities, with client exposure at low levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!