SP500 LDN TRADING UPDATE 17/10/25

SP500 LDN TRADING UPDATE 17/10/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~60 POINTS***

WEEKLY BULL BEAR ZONE 6750/60

WEEKLY RANGE RES 6693 SUP 6411

OCT EOM STRADDLE 6602/6891

OCT MOPEX 6842/6487

DEC QOPEX 6303/7025

DAILY MARKET BALANCE – 6581/6806

DAILY BULL BEAR ZONE 6620/30

DAILY RANGE RES 6771 SUP 6600

2 SIGMA RES 6828 SUP 6774

VIX DAILY BULL BEAR ZONE 23.5

TRADES & TARGETS

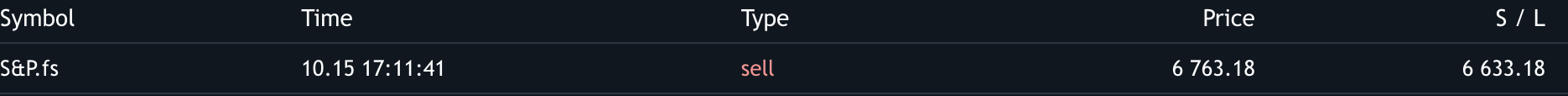

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 2 SIGMA SUPPORT

LONG ON TEST/REJECT 2 SIGMA SUP TARGET DAILY RANGE SUP FROM BELOW

LONG ON TEST/REJECT OCT MOPEX SUP 6487/96 TARGET 6541

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: REGIONAL WORRIES

S&P closed down 63bps at 6,629 with a MOC of $3.7b to buy. NDX dropped 36bps to 24,657, R2K fell 204bps to 2,468, and Dow declined 65bps to 45,952. A total of 22.4b shares traded across all US equity exchanges compared to the YTD daily average of 17.2b shares. VIX surged +2011bps to 24.98, WTI Crude slid 137bps to $57.46, US 10YR yields dropped 5bps to 3.97%, gold rallied +263bps to 4,317, DXY fell 45bps to 98.35, and Bitcoin declined 264bps to $108,260.

Significant intraday moves raised questions, though headlines offered little clarity on the market's downward trajectory. The tape felt macro-driven as ETF activity spiked to ~35% (up from 31%) during the afternoon roll, with underlying cross currents adding discomfort. Key observations include regional banks (ZION, WAL, JEF) under pressure due to credit provisioning weakness—marking the group’s second-worst day since SIVB in March 2023. Waller’s unexpectedly hawkish stance, despite being considered the most dovish FOMC member, added to concerns. The ongoing government shutdown is nearing the point where traders may start paying closer attention. Dealer gamma dropped by $5b last Friday, the largest single-day drop in over three years, reducing the market’s shock absorption capacity. Additionally, the Trump-Putin meeting kept investors cautious.

Regional banks drew heightened scrutiny, with generalists frequently asking "WHAT IS GOING ON" in financials. ZION reported a $50mn net charge-off from two credits, linked to investment funds unrelated to First Brands and Tricolor, potentially validating Jamie Dimon’s "more than one cockroach" theory. WAL faced pre-market pressure due to a separate lawsuit seeking to recover $100mn from borrowers. Increased focus on NDFI loan exposure suggests growing anxiety around private credit shifting toward regionals. A detailed note is expected at the bell.

Gold continued its sharp climb, up ~7.5% over five days—one of the top five stretches in over a decade—while VIX broke out to its highest level since April/May. Cryptos were lower, and US 10YR yields broke below 4%, with markets now pricing in slightly more than two rate cuts before year-end (up from fewer than two a week ago). Consumer Staples outperformed today, driven by strong earnings overseas and underweight positioning. Nestlé’s +8% earnings boosted HSY, MDLZ, and other names, while Beverages (+170bps) and Food Products (+20bps) also rallied.

Key events tomorrow include US cross-border investment, housing starts, industrial production, Eurozone CPI, and a speech by Fed member Musalem (voter, 12:15pm). On the micro front, pre-market EPS reports are expected from TFC, RF, FITB, HBAN, AXP, SLB, STT, CMA, BANF, ALLY, and WBS. Additionally, an estimated $1.9 trillion in SPX options and $760 billion notional in single-stock options will expire Friday (10/17), marking the largest October expiration on record. VIX is holding above $23 for the first time since last Friday’s trade tensions.

Flows today were moderate, with activity levels rated a 5/10. The session ended with a +250bp buy skew, as LOs were slight net buyers, while HFs provided notable supply (> $1.5b net notional for sale). LOs net bought Info Tech but sold Industrials and Discretionary sectors. HFs net sold across nearly all sectors, led by Macro Products, Industrials, and Info Tech.

Derivatives traded in a wide intraday band (1.75%), with volatility remaining bid even early in the day when markets were in the green. Skew steepened further, with wingier SPX put skew hitting 10-year highs (5d/25d), while the 25dp/ATM skew was less extreme. HYG saw heightened activity, with put volume at 2x the 20-day average. Notably, a buyer purchased 150k HYG Nov 65 Puts (4d). Tomorrow, over $3.4 trillion in notional options exposure is set to expire, including $1.9 trillion in SPX options and $760 billion in single-stock options, marking the largest October expiration on record. The Friday PM straddle is priced at 1.02%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!