SP500 LDN TRADING UPDATE 19/11/25

SP500 LDN TRADING UPDATE 19/11/25

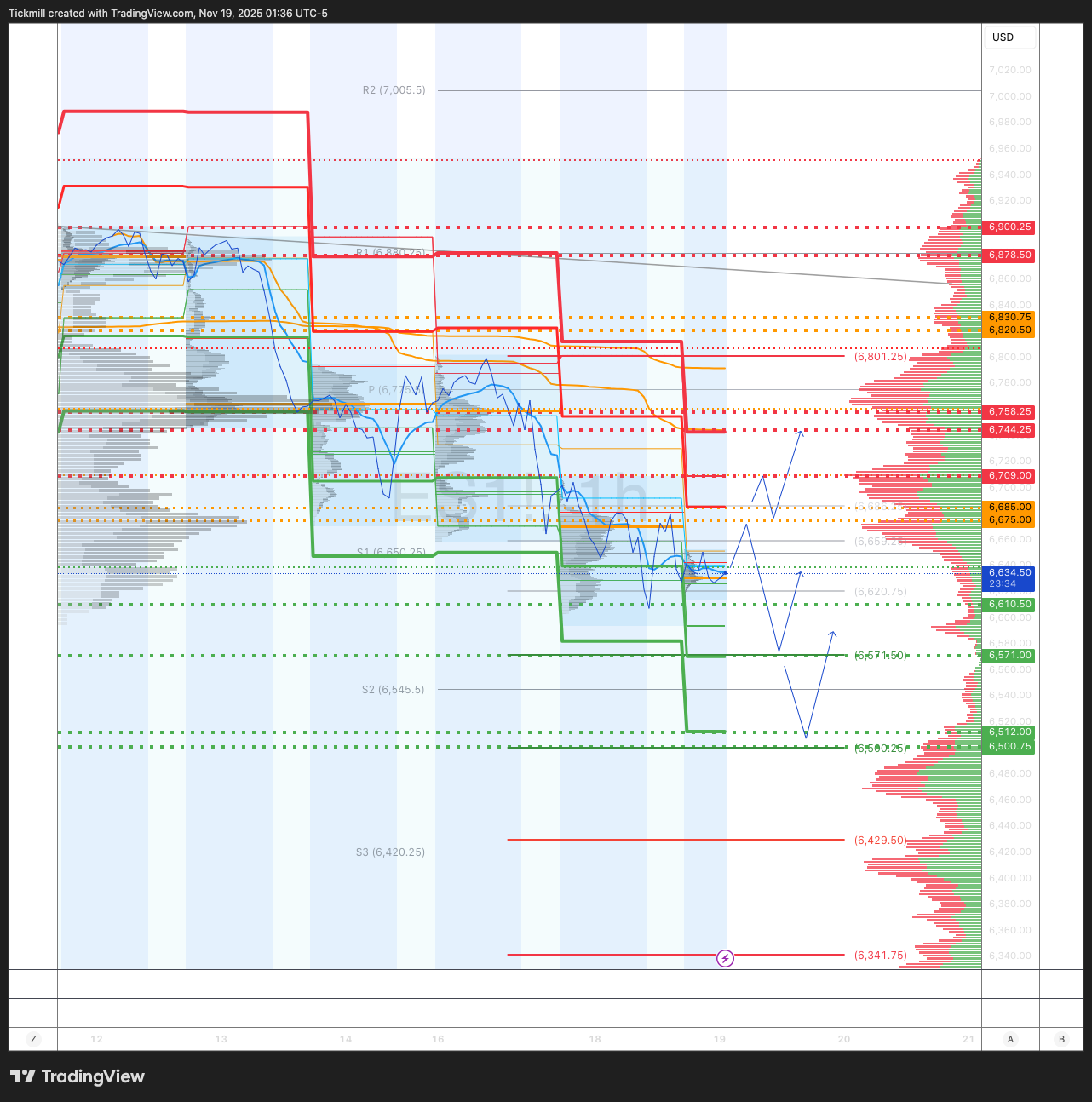

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6900/6610

WEEKLY VWAP BEARISH 6780

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

DAILY STRUCTURE – BALANCE - 6892/6746

DAILY BULL BEAR ZONE 6675/85

DAILY RANGE RES 6784 SUP 6569

2 SIGMA RES 6743 SUP 6511

DAILY VWAP BEARISH 6760

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

SHORT ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ACCEPTANCE ABOVE DAILY BULL BEAR ZONE 2 SIGMA RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: LENGTH REDUCTION

S&P closed down 83bps at 6,617, with a Market-On-Close (MOC) buy imbalance of $230M. The Nasdaq 100 (NDX) dropped 120bps to 24,503, while the Russell 2000 (R2K) gained 53bps to 2,353. The Dow Jones fell 107bps, closing at 46,092. Total US equity trading volume reached 18.4 billion shares, exceeding the year-to-date daily average of 17.48 billion. The VIX rose 226bps to 24.6. WTI Crude increased 135bps to $60.72, the US 10-year Treasury yield dipped 2bps to 4.11%, gold declined 10bps to $4,070, the DXY rose 1bp to 99.60, and Bitcoin climbed 102bps to $92,814.

It was another quiet but directionally negative session, with the S&P finishing modestly lower as concerns mounted ahead of Nvidia's earnings report tomorrow. Shorts, laggards, non-profitable tech, and small caps outperformed large-cap tech today. Additionally, Home Depot’s 5% cut in full-year guidance, citing cautious consumer behavior on big-ticket home purchases, fueled ongoing discussions about a weaker consumer. Hedge funds showed scattered long supply in discretionary sectors, while long-only funds remained mostly inactive. Despite the downbeat sentiment, there were bright spots: Medtronic (MDT) rose 5% on strong earnings, reaching three-year highs; Alphabet (GOOG/L) launched its new Gemini Model 3; and cryptocurrencies rebounded constructively from overnight lows, potentially signaling forward momentum.

Macro factors dominated over micro, with ETFs accounting for 42% of total equity volume, well above the year-to-date daily average of 28%, nearing highs last seen in April (45%). CTAs currently hold $45B in long S&P 500 positions, ranking in the 94th percentile historically. Over the next week, CTAs are expected to sell $8B in S&P 500. If the S&P 500 drops below 6,452—where medium-term momentum turns negative—this selling could double. On the other hand, corporate buybacks remain robust, with 95% of companies in open trading windows, running at 1.5x 2024 YTD average daily trading volumes.

Trading activity on the floor was rated a 4 out of 10 in terms of overall engagement. The floor ended the session with a +119bps buy imbalance, compared to a 30-day average of -163bps. Client flows were benign, with long-only funds being small net sellers, showing supply in tech and discretionary sectors but demand in healthcare and REITs. Hedge funds were net buyers by $800M, favoring tech and macro products while selling discretionary and financials.

Derivatives: Despite a choppy session trending lower, there was no significant panic. Dealers remained short gamma to the downside, but there was no rush for hedges or additional downside protection. Instead, a large clip of QQQ December puts was sold alongside unwinds. The day saw a slight upward parallel shift in the term structure, with a small bid in skew. Nvidia's earnings straddle for tomorrow is priced at a 1% move.

Callahan’s Thoughts on Nvidia: Positioning is rated 8 out of 10 going into Nvidia’s earnings. The stock has consolidated for nearly four months, trading at similar levels to August as investors digest the evolving AI narrative. Recent weeks have seen increased caution on the AI theme, suggesting cleaner positioning ahead of the report. Investors are likely anticipating another beat-and-raise, with consensus revenues of ~$55B for October and ~$62B for January. Nvidia’s recent earnings beats have been more normalized, with topline outperformance of ~1-3% in recent quarters. There’s debate over the incremental upside of this report, given Nvidia’s recent ~$500B commentary at GTC. For context, the stock has moved +/- 1-3% on three of the last four earnings reports (T+1).

GIR Official September Payrolls Preview: Nonfarm payrolls are estimated to have risen by 80K in September, above the consensus of +55K and the prior three-month average of +29K. Private sector job growth showed a firmer pace, but government payrolls are expected to decline by 5K, with a 10K drop in federal payrolls offset by a 5K increase in state and local government jobs. August payrolls are likely to be revised higher, consistent with historical trends, though 2023 revisions have leaned disproportionately downward.

Looking ahead, October nonfarm payrolls are expected to decline by 50K, largely due to a 100K headwind from the conclusion of the federal government’s deferred resignation program. While we do not expect the Bureau of Labor Statistics to produce an October unemployment rate, we estimate it likely would have increased, reflecting upward pressure from shutdown-related furloughs and increases in broader measures of labor market slack

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!