SP500 LDN TRADING UPDATE 26/11/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

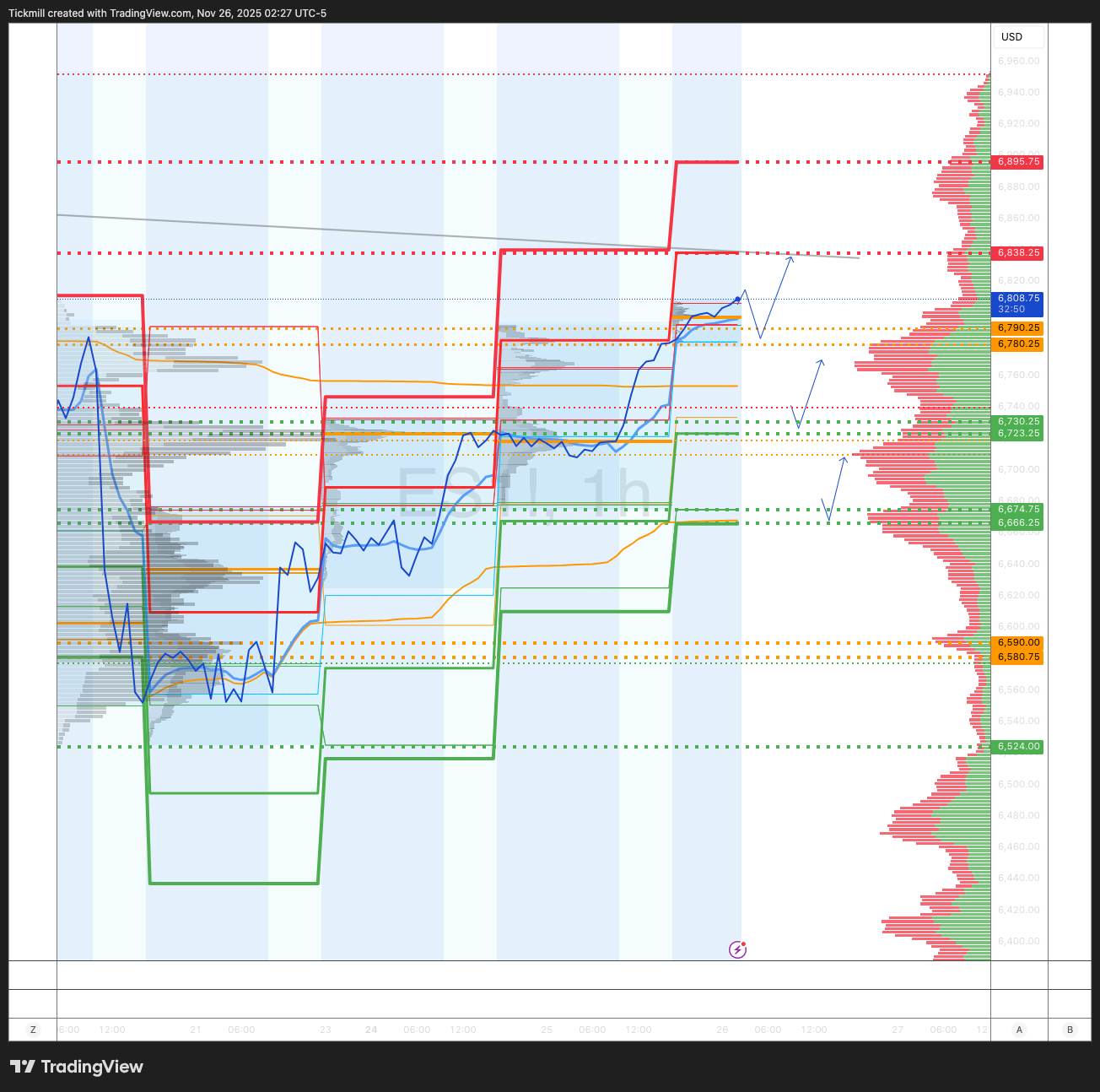

WEEKLY BULL BEAR ZONE 6590/80

WEEKLY RANGE RES 6765 SUP 6475

NOV EOM STRADDLE 7054/6626

DEC QOPEX STRADDLE 7025/6303

DAILY STRUCTURE – BALANCE - 6709/6594

DAILY BULL BEAR ZONE 6790/80

DAILY RANGE RES 6838 SUP 6723

2 SIGMA RES 6895 SUP 6666

DAILY VWAP BULLISH 6627

VIX BULL BEAR ZONE 22.2

TRADES & TARGETS

LONG ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: MO’ WOBBBLE

S&P rose +91bps, closing at 6,766 with a Market on Close (MOC) of $2.7bn to BUY. NDX gained +58bps to 25,018, R2K surged +214bps to 2,466, and the Dow climbed +143bps to 47,112. Total US equity trading volume reached 16.7b shares, below the year-to-date daily average of 17.48b shares. The VIX dropped -9.55% to 18.57, WTI Crude declined -153bps to $57.94, US 10YR yield slipped -2bps to 4.00%, gold edged down -10bps to 4,132, the DXY fell -32bps to 99.83, and Bitcoin dropped -176bps to $87,193.

Stocks edged higher despite a momentary wobble led by NVDA (-2.5%) following reports that META is in talks to invest billions in Google’s AI chips. The S&P Equal Weight index outperformed by ~1%, reversing yesterday’s trend. Trading volumes were down -10% compared to the 20-day average. Liquidity remained steady today but is expected to deteriorate significantly tomorrow and Friday due to the US holiday. Risk assets remain closely tied to rate expectations, and today’s backward-looking data (consumer confidence, retail sales, and PPI) supported the case for a rate cut.

Retail stocks outperformed (XRT +4.5%), driven by AI/Tech/momentum reversion and low consumer positioning, based on PB stats and 3Q filings. Earnings were mixed: BURL fell -12%, DKS was flat, while BBY rose +5% and KSS surged +42%. Even weaker earnings (e.g., BURL) showed signs of improvement as weather conditions normalized and the holiday season approached. Broader consumer subsectors, including travel/cruise, restaurants, gaming, and footwear, also gained, indicating a broad consumer recovery rather than EPS-specific factors.

Activity levels on the trading floor were moderate, rated a 4 on a 1-10 scale. The floor finished +186bps to buy, compared to a 30-day average of -175bps. Both long-only (LO) and hedge fund (HF) flows were roughly flat. Notably, HF demand in discretionary sectors rose +21% (~$400m buy skew). After-hours trading saw DELL down -1% and ZS dropping -9% on earnings.

Prime: Quality and defensive characteristics continued to dominate. US AI Beneficiaries basket (GSTMTAIP) constituents experienced significant net buying on Friday and Monday, led by Megacap Tech stocks. Meanwhile, Non-Profitable Tech basket (GSX1NPTC) saw minimal net activity, though aggregate short flow in these names has risen for five consecutive sessions (14 of the last 15).

Derivatives: Client sentiment is gradually improving, with the Vol Panic Index down to 8.3 from last week’s 9.6 peak. Bullish sentiment appears to be returning. Volatility continues to compress as markets rally into peak dealer gamma. The yield curve is now fully un-inverted, and demand for macro options remains subdued despite lower volatility levels. The straddle for the remainder of the holiday week closed at ~0.75%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!