Two Interesting Facts About the Pfizer Vaccine

Bullish momentum in the vaccine-driven rally somewhat eased, but the downside moves on Tuesday failed to convert into a correction. Today we see quite confident upside in the commodity market, in particular oil, which hopes that the coming vaccination will allow economies to say “goodbye” to lockdowns once and for all. Another interpretation of the rally in oil is upcoming positive from OPEC+ at the end of November. Risk assets appears to be drawing optimism from the developments in the oil market.

An interesting fact about the Pfizer vaccine is that it must be stored at a temperature of -70C, which of course raises doubts about the possibility of mass and rapid vaccination. On the other hand, in order to bring an end to devastating lockdowns, it is necessary to decrease the rate of hospitalization to an acceptable level, which means that mass vaccination is not needed at the initial stages - it is enough to vaccinate people from the risk group (who are over 70 and who make up the biggest share of hospitalizations). This is quite realistic even with vaccine which has such limitations.

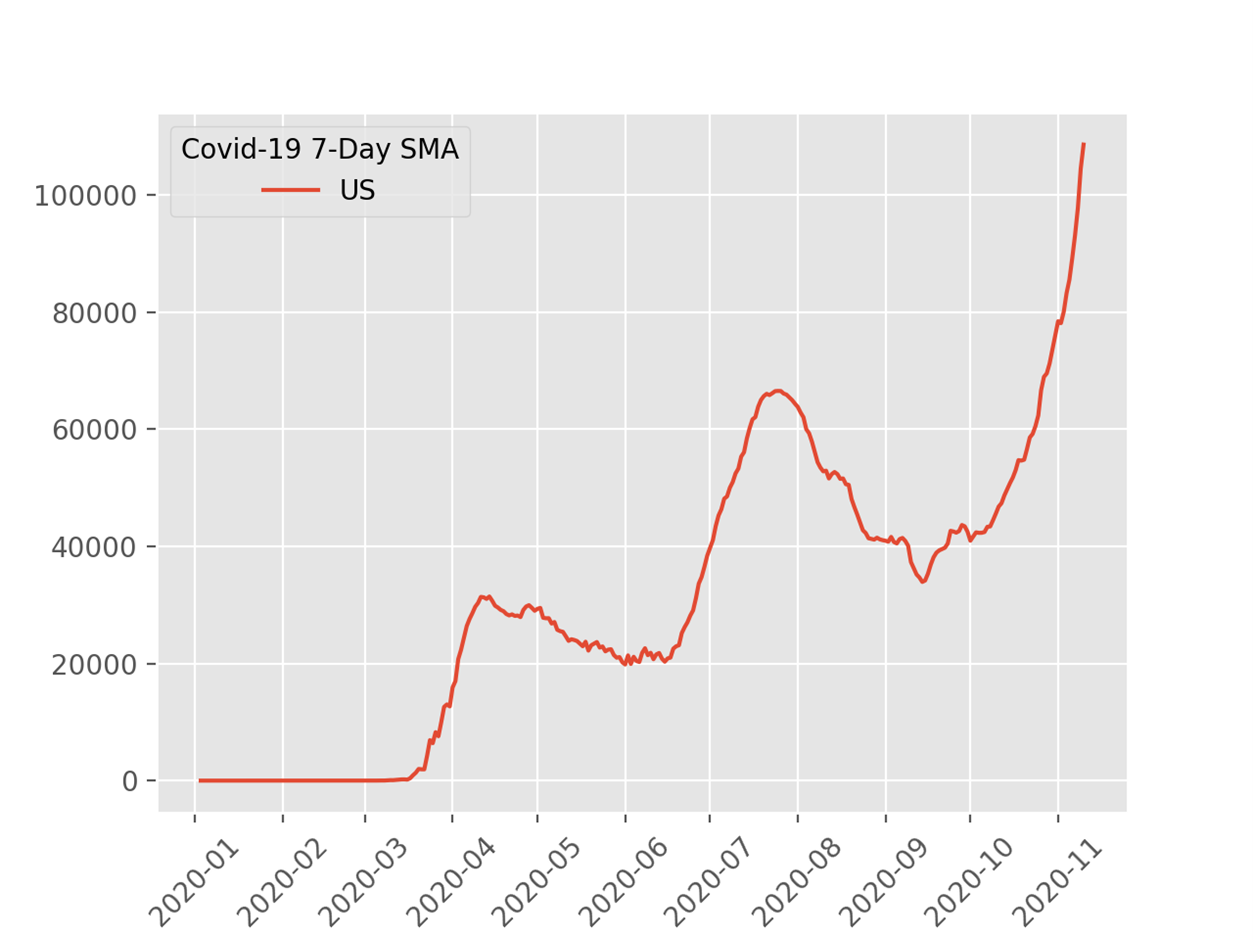

Talking about near-term outlook, risky assets could be spooked by short-term social restrictions in the US which likelihood appears to be growing. This is something that the markets haven’t fully priced in. The positivity rate in Texas exceeded 1 million people while daily cases in the US has been on the rise, breaking all-time highs again:

However, even if Covid-related shocks are possible in the US, they are likely to be short-term. Goldman Sachs has updated its SPX growth forecast and sees a breakdown of 3,700 points by the end of 2020 (due to a traditional New Year rally?), 4,300 points by the end of 2021 and 4,600 by 2022.

As for the European economy, the main focus is on assessing damage from the second lockdown, which should help to estimate degree of the ECB intervention at the December meeting (and assess pressure on the Euro). The ZEW business climate indicators for the European Economy and Germany, released on Tuesday, were worse than expected indicating that ECB may deliver more than previously expected. These expectations caused additional pressure on EUR which declined against USD, helping greenback index to breach weekly high at 93.00 level. European currency is expected to decline more as lockdown-induced shocks appear to deliver more harm than previously anticipated.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.