Upbeat China exports could hide growing “transshipment” goods flow

Surprising uptick in Chinese foreign trade data for July showed that exporters are able to satisfactorily solve the problem of diversifying sources of foreign demand (or implement workarounds) as direct trade with the main partner - United States - continues to sag under the tariff burden. The data, though, can be interpreted in two ways - on the one hand, the later warring parties find their “pain threshold”, the more protracted trade conflict can be expected. Further escalation moves and a longer and negative impact on corporate optimism become more likely in this scenario. On the other hand, for the near future, upbeat export data curbs concern about adverse impact of tariffs for global trade and somewhat improves overly negative news background.

The data to some extent contained the panic, causing a pullback in defensive assets and bonds. XAUUSD lost 0.23%, staying below $ 1,500 per troy ounce, USDJPY keeps the defense at 106.00, VIX went below 20 points.

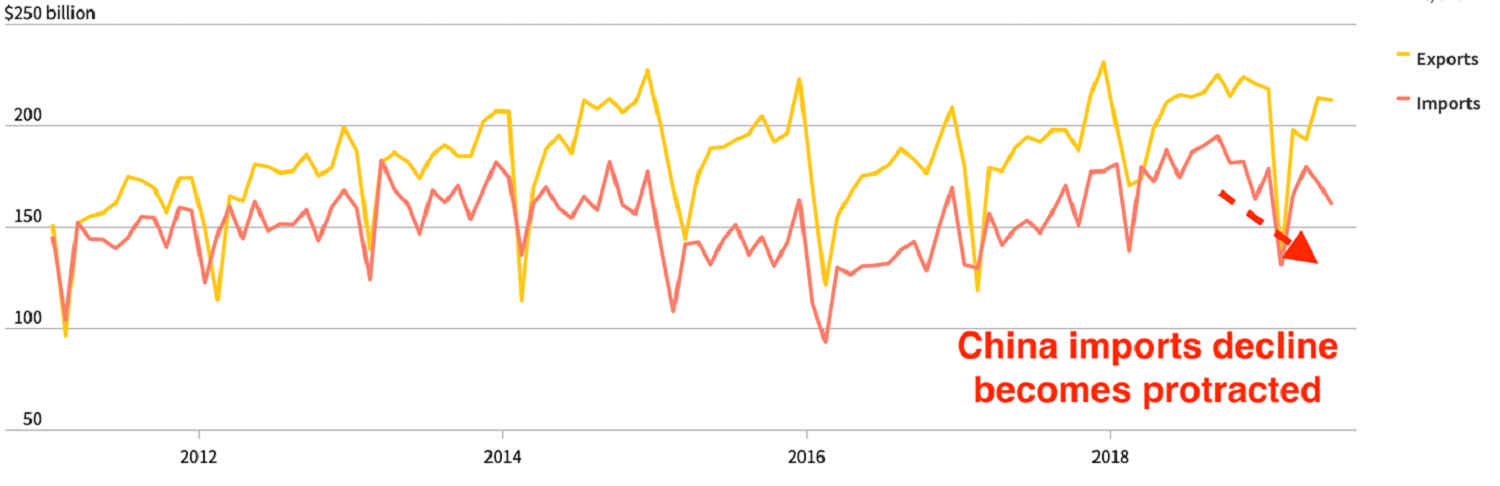

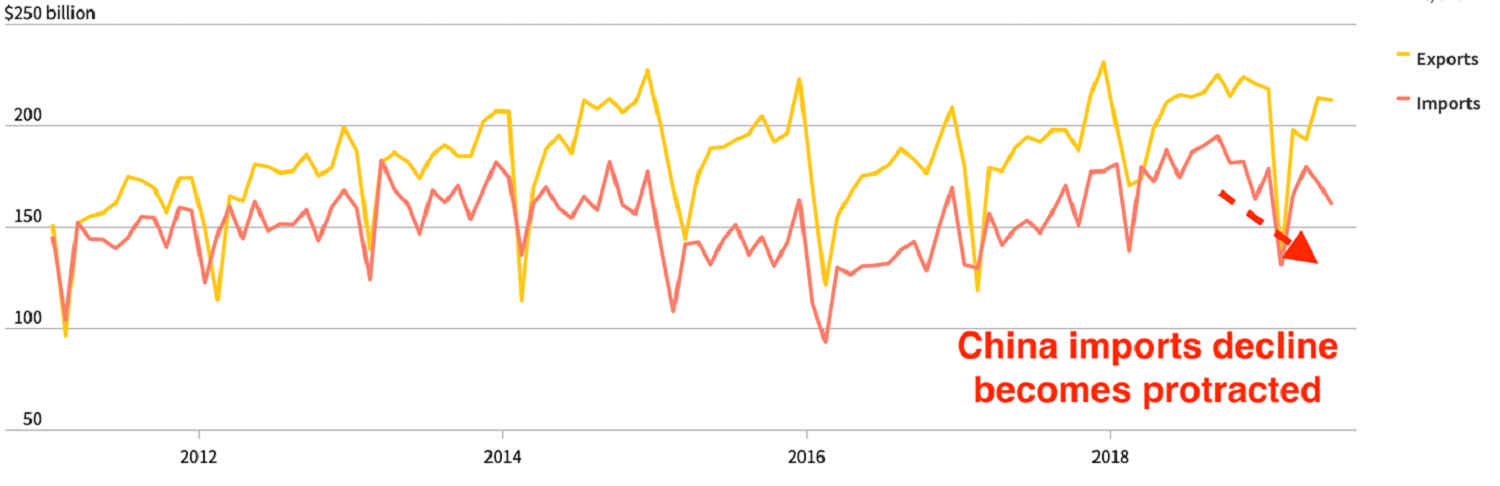

July exports rose 3.3% compared to last year, at the fastest pace since March 2019. The data topped the forecast of decline by 2.0%, after the export volume shrank by 1.3% in June. However, import volumes have been falling for the third consecutive month, since the government couldn’t isolate domestic demand from the trade shocks and weakness crept into consumption too. The main import items for China are oil, integrated circuits, and cars, so speaking about the sluggish consumption we are talking about catastrophically low sales of cars. Oil prices dismissed China's weak imports, focusing on rumors that Saudi Arabia and other oil powers could expand market support measures by further reducing production.

In July, China's imports fell 5.6% YoY, which was less than expectations of 8.3%.

The data shows that China's exports are growing at the fastest pace in ASEAN countries, then in South Korea and Europe. Again, the growing Asian economies that basically need their own production are unlikely to find untapped demand potential to boost imports from China to the extent shown in the data. Most likely, we are witnessing the implementation of a “transshipment”, which Steven Mnuchin recently blamed on Chinese exporters.

PBOC fixed USDCNY above 7 yuan per dollar for the first time since 2008. The devaluation of the renminbi is seen as one of the most effective ways to offset tariffs but has attracted criticism from Trump and the U.S. Treasury, which ultimately led to official accusations of currency manipulation by China. This could give the US the right to introduce additional countervailing duties.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.