USD Eases, Equities Rise, and Gold Surges Amid Geopolitical Tensions

The US Dollar is starting the week on a softer note, continuing the trend from last week, as equities climb and commodities trade higher. With European markets closed for a bank holiday, trading volumes in the region are expected to be lighter than usual.

From a technical perspective, there appears to be a short-term buying opportunity in the major USD pairs as the DXY has reached the lower bound of an upward-sloping ascending corridor, where it has previously seen rebounds:

Traders are keeping a close watch on the Federal Reserve's upcoming minutes from the latest FOMC meeting due on Wednesday. The market is eager for any insights into how long the Fed plans to maintain its current interest rate levels. Adding to the anticipation, five Fed officials are scheduled to speak today, potentially providing more clues about the future of monetary policy.

Gold has hit a new all-time high following reports of a helicopter crash in Iran that claimed the lives of President Ebrahim Raisi and other high-profile figures. This incident has heightened geopolitical tensions in an already volatile region, given the ongoing Israel-Hamas conflict. The increased demand for gold is also driven by diminishing expectations that the Federal Reserve will keep interest rates elevated for an extended period of time. Lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

The market's outlook on US growth potential has shifted due to softer inflation and retail sales data from April. Despite the Federal Reserve's cautious stance on cutting rates, interest rate derivatives such as overnight index swaps indicate a 65% probability that the federal funds rate will be lower by September.

Global equities are off to a strong start this Monday. Asian markets are leading the charge, with most indices approaching 1% gains. Meanwhile, US equity futures are modestly in the green, up less than 0.25%.

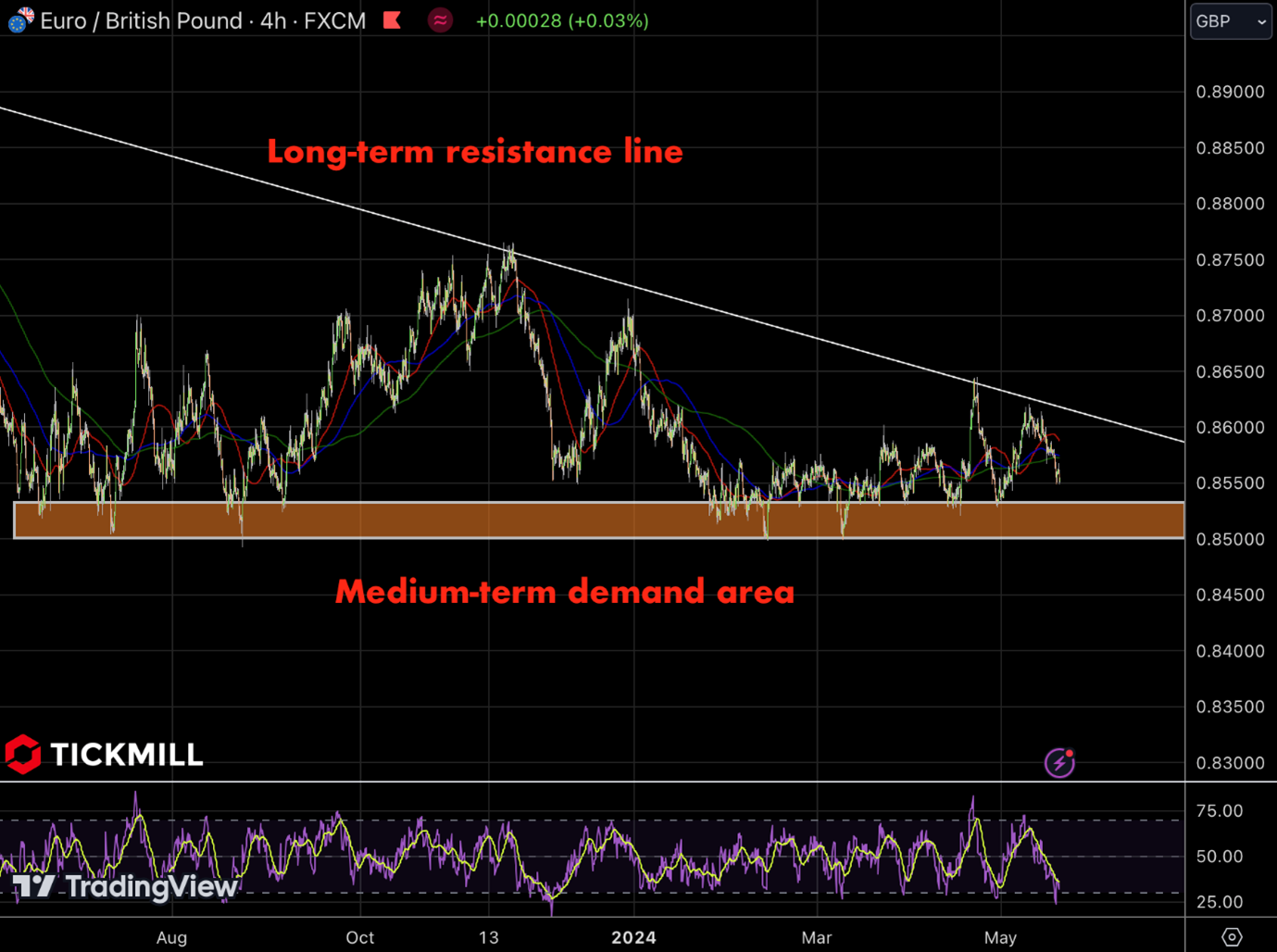

The EUR/GBP pair found temporary support around 0.8550 during Monday’s European session. However, the cross remains under pressure as investors anticipate a more aggressive rate-cutting stance from the ECB compared to the BoE. A rate cut by the ECB in June is widely expected, with policymakers confident that inflation will return to the 2% target. ECB member Martins Kazaks has suggested that June might be the starting point for rate cuts, although he warns against aggressive reductions that could rekindle inflationary pressures.

On the technical side, EUR/GBP pair is facing strong resistance from a long-term downward trendline, which has consistently capped upward movements. Currently, the price is hovering near a medium-term demand area around 0.8550, a crucial support level that has provided stability in the past. However, the repeated tests of this demand zone coupled with the downward momentum indicated by the RSI suggest increasing bearish pressure. If the pair breaks below this support, it could trigger a further decline towards the 0.8450 level or lower:

In the UK, attention shifts to the upcoming CPI data for April, set to be released on Wednesday. The Office for National Statistics is expected to report a decline in annual headline inflation to 2.1% from 3.2%. Core CPI, excluding volatile items, is forecast to drop to 3.7% from 4.2%. A significant drop in inflation could pave the way for the BoE to consider rate cuts, potentially starting as early as June or August. BoE Deputy Governor Ben Broadbent hinted at possible summer rate cuts, suggesting that less restrictive monetary policy could be on the horizon.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.